GET TOP RATED STOCK ALERTS ACTIVE TRADERS DEPEND ON

SIGN UP TODAY FOR FREE NEWS DRIVEN ALERTS

84% of Indicated and Inferred Resources within Conceptual Pit Shell

Vancouver, BC – December 15, 2020 – Aftermath Silver Ltd. (TSX-V: AAG) (OTCQB: AAGFF) the (“Company” or “Aftermath Silver”) is pleased to provide the results of a CIM compliant Mineral Resource estimate for the Challacollo silver-gold project, in Region 1 of northern Chile, summarised in Table 1.

The Mineral Resource estimate used a conceptual open pit and underground optimised shapes to constrain the estimate.

Table 1. Summary of the Mineral Resource Estimate for the Challacollo Silver-Gold Project

| Classification | Material Type | Tonnes (Kt) | Silver (g/t) | Gold (g/t) | Silver (Koz) | Gold (Koz) |

| Indicated | Open Pit | 5,597 | 170 | 0.27 | 30,639 | 49 |

| Underground | 1,043 | 134 | 0.29 | 4,510 | 10 | |

| TOTAL | 6,640 | 165 | 0.27 | 35,150 | 58 | |

| Inferred | Open Pit | 2,360 | 117 | 0.15 | 8,912 | 11 |

| Underground | 443 | 157 | 0.26 | 2,232 | 4 | |

| TOTAL | 2,803 | 124 | 0.17 | 11,144 | 15 |

Source: AMC Mining Consultants (Canada) Ltd, (2020)

Notes on the Challacollo Mineral Resource Estimate

- CIM Definition Standards (2014) were used for reporting the Mineral Resources.

- The effective date of the estimate is 30 November 2020.

- The Qualified Person is Dinara Nussipakynova, P.Geo., of AMC Mining Consultants (Canada) Ltd.

- Mineral Resources are constrained by an optimized pit shell at a long-term metal price of US$20/oz Ag with recovery of 92% Ag and metal price of US$1,400/oz Au with recovery of 75%.

- Silver equivalency formula is AgEq (g/t) = Ag (g/t) + 57.065 *Au (g/t).

- The open pit mineral resources are based on a pit optimization using the following assumptions:

- Plant feed mining costs of US$3.5/t and waste mining cost of $2.5/t.

- Processing costs of US$17/t and General and Administration costs of $2.5/t.

- Edge dilution of 7.5% and 100% mining recovery.

- 45-degree slope angles

- Cut-off grade is 35 g/t AgEq g/t.

- The underground mineral resources are reported within Datamine MSO stopes based on the following assumptions:

- Mining costs of US$35/t.

- Processing costs of US$17/t and General and Administration costs of US$2.5/t.

- Minimum width of 2.5 m

- No dilution or mining recovery.

- Cut-off grade is 93 AgEq g/t

- Bulk density used was 2.47 t/m3

- Drilling results up to 31 December 2016.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The numbers may not compute exactly due to rounding.

- Mineral Resources are depleted for historic mined out material.

Further details supporting the geological model, estimation procedure, sampling and metallurgical testwork will be available in a NI 43-101 technical report. The technical report will be posted under the Company’s profile at www.sedar.com, the report is well advanced and is expected to be filed on SEDAR in within four weeks.

Ralph Rushton, President and CEO of the Company, commented “We are extremely pleased with the results of this Mineral Resource estimate. For the first time, a significant amount of mineralisation is included from outside of the main Lolón Vein, from veins that are predominately on the hangingwall to the Lolón vein. We believe this validates our concept for the Project, approximately 84% of the Indicated and Inferred resources fall inside the conceptual pit shell. This estimate is only the first step for Aftermath Silver in reaching the Company’s ultimate vision for Challacollo, and the whole team is excited to start the program in the new year.”

Resource Estimate Details

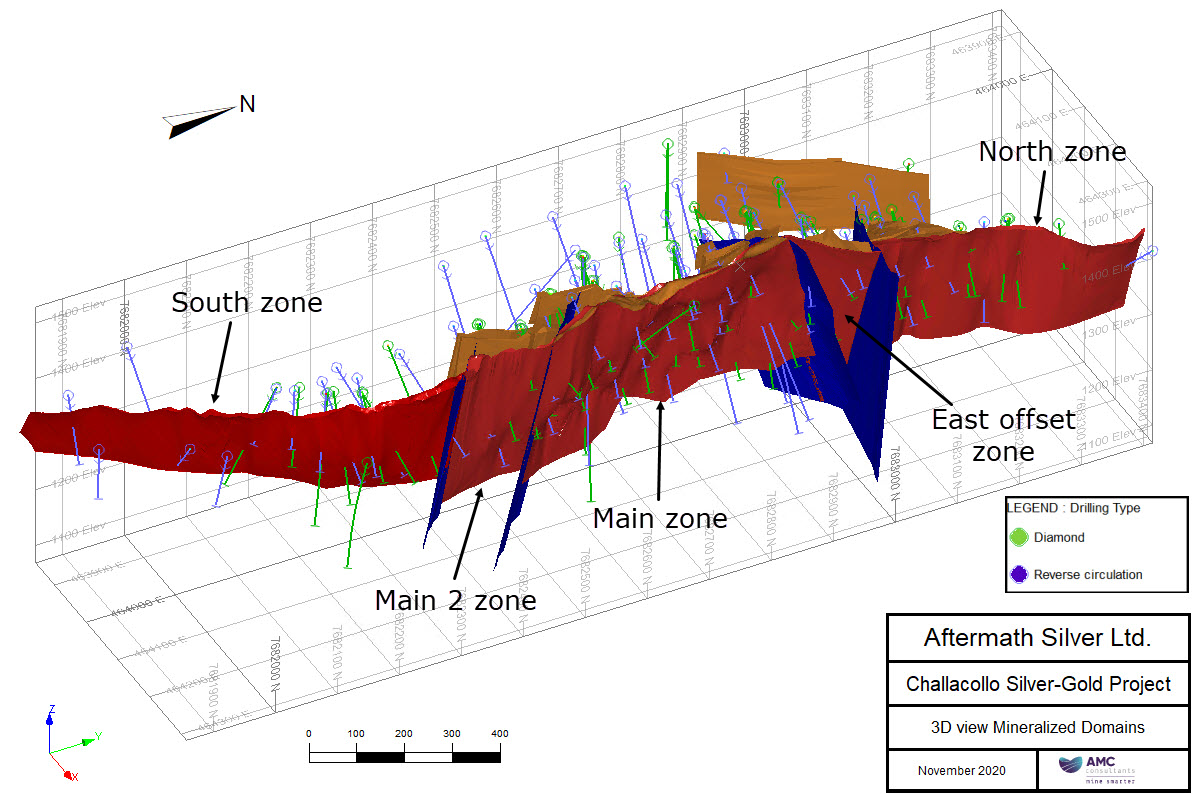

The resource estimate is based on a geological model that utilised the geological logging and assaying of drilling as well as detailed surface mapping. A mineralised domain wireframe for the Lolón Structure was constructed by Aftermath and reviewed by the independent Qualified Person (QP). The other mineralised domains were wireframed by the QP. The mineralized wireframes for the Lolón structure were based on a silver threshold of nominally 60 g/t Ag; this structure is split into the five segments South, Main 2, Main, East Offset, and North zones, separated by fault offsets, as shown in Figure 1. In addition, there are other sub parallel zones for which a 40 g/t Ag threshold was used.

A total of 112 drillholes totalling 19,213 m are located in the block model area consisting of 57 diamond and 55 reverse circulation drillholes, of which 97 drillholes intercepted the interpreted mineralization and are used in the estimate.

The analysis of probability plots of the Ag grades for the domains demonstrated the presence of high-grade outliers in the Lolón structure. Top capping was applied individually to the zones. The top cut value of 1,500 g/t Ag was selected for Lolón Main zone and the other Lolón zones which were individually treated, varied from 800 g/t Au to 190 g/t Ag. No capping was applied to the hanging wall zones.

The mean sample length is 1.38 m and the median 1 m for the entire dataset. The compositing interval was selected as 1 m. Samples were composited by domain as equal length composites with no discards.

The composites of all five zones on the Lolón structure were combined into one file with a total of 1,025 samples. Variograms were produced for Ag and Au grades based on this larger dataset. Two structure spherical variograms were modelled in Datamine.

A block model was generated in Datamine software using 4 m E x 10 m N x 5 m RL parent block size. Sub-blocking was employed and resulted in minimum cell dimensions of 0.1 m E x 1 m N x 0.25 m RL.

The grade estimation was carried out by 3 passes. The grades were estimated for each domain individually. Ordinary kriging (OK) was used for estimating the Lolón structure, but due to the small number of samples inverse distance squared (ID2) was used for the hangingwall zones.

The estimation of the Lolón zones was interpolated using the Dynamic Anisotropy feature in Datamine. Dynamic anisotropy re-orientates the search ellipsoid for each estimated block based on the local orientation of the mineralization.

The block model was validated in four ways. First, visual checks were carried out to ensure that the grades respected the capped and composited assay data. Secondly, swath plots were reviewed. Thirdly, the estimate was statistically compared to the capped assay data, with satisfactory results. Lastly, the estimates were compared to other methods namely ID2, inverse distance cubed, and a nearest neighbour estimate as applicable, also with acceptable results.

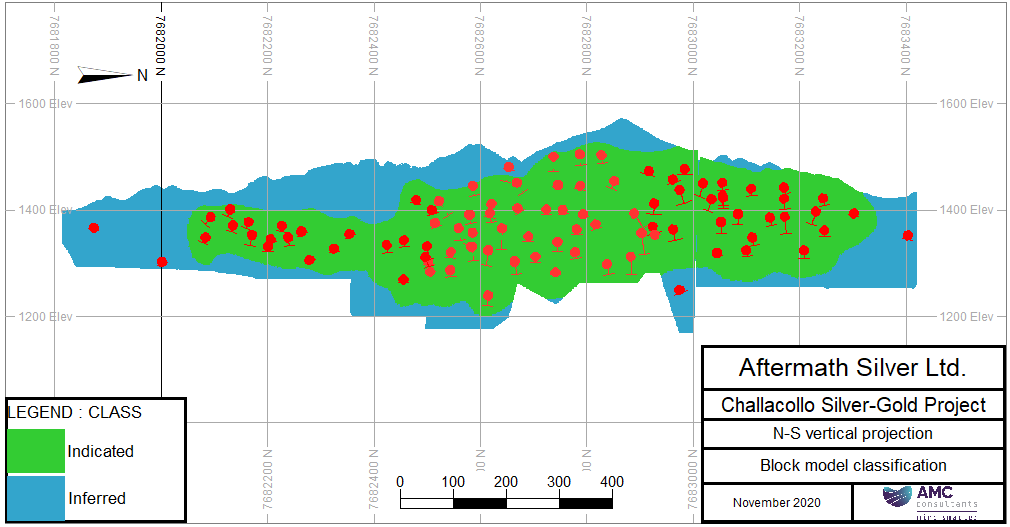

Mineral Resource classification was completed using an assessment of geological and mineralization continuity, data quality, and data density. Search passes, different from those used to estimate grade, were used as an initial guide for classification. Wireframes were then generated manually to build coherent volumes defining the different classes.

The model is depleted for historical mining activities, using surveys where available or by removing the full width of the Lolón Structure where no accurate survey was available.

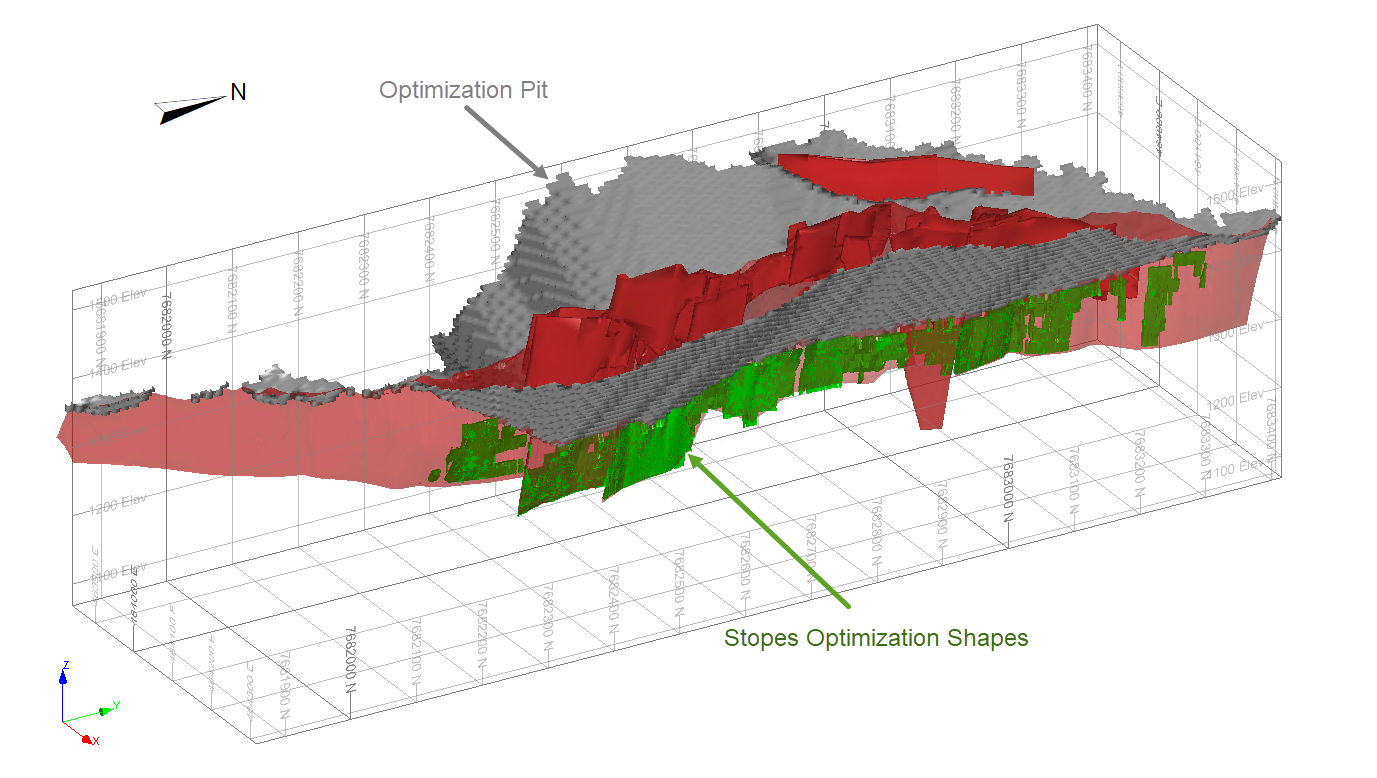

Figure shows a 3D view of the constrained open pit shell Mineral Resources (shown in red) and optimized underground Mineral Resources (shown in green). The maximum depth of the conceptual pit shell is 255 m. The underground conceptual stope shapes lie beneath the pit to a maximum vertical extent of 100 m, to the lower limits of the block model. Isolated stopes were not included in the Mineral Resource.

Data Verification

Qualified Person, Sergio Alvarado Casas, registered member of the Chilean Mining Commission (No. 004), and member of the IIMCh, of Geoinvest SAC E.I.R.L. (Chile) undertook a site visit to Challacollo in September 2020, this included verification of drill collars, storage of drill core and RC sampling.

Qualified Person, Mort Shannon, P.Geo., of AMC Mining Consultants (Canada) Ltd. considers sample preparation, analytical, and security protocols employed by Silver Standard and Mandalay to be acceptable. The QP has reviewed the Quality Assurance and Quality Control (QA/QC) procedures used by these operators including certified reference materials, blanks, duplicates, and umpire data and considers the assay database to be adequate for Mineral Resource estimation.

Qualified Person, Dinara Nussipakynova, P.Geo., of AMC Mining Consultants (Canada) Ltd., is the QP for Mineral Resources and data verification. Data verification included a review of the assay database and collar locations. The QP undertook random cross-checks of assay results in the database with original assay results on the assay certificates returned from ALS Laboratories (Canada), ALS Chemex (Chile) and ALS Mineral (Chile). This verification consisted of comparing 1,210 of the 5,757 assay results in the database to those in the certificates. This is approximately 21% of the total samples. No errors were detected. The QP considers the assay database to be acceptable for Mineral Resource estimation.

Qualified Person, Brendan Mulvihill, MAusIMM Chartered Professional (CP) Metallurgy, of GR Engineering Services is the QP for the review of the metallurgical testwork, and considers the recoveries used to be acceptable for use in the Mineral Resource estimate.

The QPs have identified no known legal, political, environmental, or other risks that could materially affect the potential development of the mineral resources.

Figure 1. 3D view of mineralization domains

Figure 2. N-S vertical section with block model classification

Figure 3. 3D view of open pit shell and underground optimized stope solids

Source: AMC Mining Consultants (Canada) Ltd, (2020)

Note: constrained open pit Mineral Resources shown in red, constrained underground Mineral Resources shown in green, the modeled extent of the Lolón Structure is shown in light red.

About Aftermath Silver Ltd

Aftermath Silver Ltd is a Canadian junior exploration company focused on silver, and aims to deliver shareholder value through the discovery, acquisition and development of quality silver projects in stable jurisdictions.

Aftermath has developed a pipeline of projects at various stages of advancement. The Companies projects have been selected based on growth and development potential.

- Berenguela Silver-Copper project. The Company has an option to acquire a 100% interest through a binding agreement with SSR Mining. The project is located in the Department of Puno, in southern central Peru. An NI 43-101 Technical Report on the property is in progress. The company is planning to advance the project through a pre-feasibility study.

- Challacollo Silver-Gold project. The Company has an option to acquire 100% interest in the Challacollo silver-gold project through a binding agreement with Mandalay Resources, see Company news release dated June 27th, 2019. The company will aggressively seek to grow the mineral resource.

- Cachinal Silver-Gold project. The Company own 80% interest, with an option to acquire the remaining 20% from SSR Mining. Located 2.5 hours south of Antofagasta. On September 16, 2020 the company released a CIM compliant Mineral Resource and accompanying NI 43-101 Technical Report (available on SEDAR and on the Companies web page).

Aftermath is well funded to advance its programs in 2021, with $16 million in the treasury.

Qualified Person

Peter Voulgaris, MAIG, MAusIMM, a consultant to the Company, is a non-independent qualified person as defined by NI 43-101. Mr. Voulgaris has reviewed the technical content of this news release, and consents to the information provided in the form and context in which it appears.

ON BEHALF OF THE BOARD OF DIRECTORS

“Ralph Rushton”

Ralph Rushton

CEO and Director

604-484-7855

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

Certain of the statements and information in this news release constitute “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to interpretation of exploration programs and drill results, predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward‐looking statements. Although the Company believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward‐looking statements. Factors that could cause actual results to differ materially from those in forward‐looking statements include, but are not limited to, changes in commodities prices; changes in expected mineral production performance; unexpected increases in capital costs; exploitation and exploration results; continued availability of capital and financing; differing results and recommendations in the Feasibility Study; and general economic, market or business conditions. In addition, forward‐looking statements are subject to various risks, including but not limited to operational risk; political risk; currency risk; capital cost inflation risk; that data is incomplete or inaccurate. The reader is referred to the Company’s filings with the Canadian securities regulators for disclosure regarding these and other risk factors, accessible through Aftermath Silver’s profile at www.sedar.com.

There is no certainty that any forward‐looking statement will come to pass and investors should not place undue reliance upon forward‐looking statements. The Company does not undertake to provide updates to any of the forward‐looking statements in this release, except as required by law.

Cautionary Note to US Investors – Mineral Resources

This News Release has been prepared in accordance with the requirements of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (”NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards, which differ from the requirements of U.S. securities laws. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian public disclosure standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and information concerning mineralization, deposits, mineral reserve and resource information contained or referred to herein may not be comparable to similar information disclosed by U.S. companies.

SOURCE: Aftermath Silver Ltd.

Toronto, Ontario – September 15, 2020 – Eric Sprott announces that today, 2176423 Ontario Ltd., a corporation that is beneficially held by him, acquired 9,200,000 common shares of Aftermath Silver Ltd., (TSXV: AAG) (OTCQB: AAGFF) pursuant to a private placement at a price of $0.65 per share for aggregated consideration of $5,980,000.

As a result of the Acquisition, Mr. Sprott now beneficially owns and controls 24,079,796 common shares and 7,439,898 common share purchase warrants (warrants) representing approximately 19.3% of the outstanding common shares on a non-diluted basis and approximately 23.8% on a partially diluted basis assuming the exercise of all such warrants. Prior to the acquisition of these Shares, Mr. Sprott beneficially owned and controlled 14,879,796 common shares and 7,439,898 warrants representing approximately 15.1% of the outstanding common shares on a non-diluted basis and approximately 21.1% on a partially diluted basis assuming the exercise of all such warrants.

The Acquisition (together with Aftermath Silver’s intervening common share issuances from treasury) resulted in a partially diluted beneficial ownership decrease of approximately 2.9% of the outstanding common shares from the date of the last early warning report and, therefore, the filing of an update to the early warning report.

The securities noted above are held for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities including on the open market or through private acquisitions or sell the securities including on the open market or through private dispositions in the future depending on market conditions, reformulation of plans and/or other relevant factors.

Aftermath Silver, is located at Suite 1500-409 Granville Street, Vancouver, British Columbia, V6C 1T2. A copy of the early warning report with respect to the foregoing will appear on the company’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR“) at www.sedar.com and may also be obtained by calling Mr. Sprott’s office at (416) 945-3294 (2176423 Ontario Ltd., 200 Bay Street, Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J1).

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/63784

Vancouver, BC – September 15, 2020 – Aftermath Silver Ltd. (TSXV: AAG) (OTCQB: AAGFF) (the “Company” or “Aftermath Silver“) is pleased to announce that it has closed its previously announced non-brokered private placement of 26,362,442 shares for gross proceeds of $17,135,587 (the “Private Placement“). Mr. Eric Sprott has increased his investment in order to maintain 19.61% of Aftermath’s issued and outstanding Common Shares.

All securities issued in connection with the Private Placement are subject to a hold period and may not be traded until January 15, 2021, except as permitted by applicable securities legislation and the rules and policies of the TSX Venture Exchange.

An aggregate amount of $494,567.44 in cash and 290,360 common shares were paid as finders’ fees in connection with the Private Placement.

The Company intends to use the net proceeds for drilling and other technical studies on the Berenguela Silver-Copper project in Peru, and the Challacollo and Cachinal Silver-Gold projects in Chile, and for general working capital purposes.

About Aftermath Silver Ltd:

Aftermath Silver is a Canadian junior exploration company. Aftermath offers investors silver-focused development opportunities in Chile and Peru, two of the world’s top mining and silver jurisdictions. Aftermath has assembled the right combination of talent, properties, strategy, risk management and marketing for investors seeking quality silver opportunities in today’s precious metals markets. Aftermath’s leadership is recognized for value generation and corresponding shareholder success.

ON BEHALF OF THE BOARD OF DIRECTORS

“Ralph Rushton”

Ralph Rushton

President & CEO

604-484-7855

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

Certain statements within this news release, other than statements of historical fact relating to Aftermath Silver, are to be considered forward-looking statements with respect to the Company’s intentions for the Cachinal Project in Chile. Forward-looking statements include statements that are predictive in nature, are reliant on future events or conditions, or include words such as “expects”, “goal”, “potential”, “anticipates”, “plans”, “believes”, “considers”, “significant”, “intends”, “targets”, “estimates”, “seeks”, attempts”, “assumes”, and other similar expressions.

The forward-looking statements are based on a number of assumptions which, while considered reasonable by Aftermath Silver Ltd, are, by their nature, subject to inherent risks and uncertainties and are not guarantees of future performance. Factors that could cause actual results to differ materially from those in forward-looking statements include: the interpretation of previous and current results, the accuracy of exploration results, the accuracy of Mineral Resource Estimates, the anticipated results of future exploration, the forgoing ability to finance these acquisitions further exploration and development, delays in the completion of exploration, the future prices of silver and gold, and other metals, and general economic, market and/or business conditions. There can be no assurances that such statements and assumptions will prove accurate and, therefore, readers of this news release are advised to rely on their own evaluation of the information contained within. In addition to the assumptions herein, these assumptions include the assumptions described in Aftermath Silver Ltd’s Management’s Discussion and Analysis for the three months ended August 31, 2019, as filed with the TSX Venture Exchange and available on SEDAR under Aftermath’s profile at www.sedar.com.

Although Aftermath Silver Ltd. has attempted to identify important risks, uncertainties and other factors that could cause actual performance, achievements, actions, events, results or conditions to differ materially from those expressed in or implied by the forward-looking statements, there may be other risks, uncertainties and other factors that cause future performance to differ from what is anticipated, estimated or intended. Unless otherwise indicated, forward-looking statements contained herein are as of the date hereof and Aftermath Silver Ltd. does not assume any obligation to update any forward-looking statements after the date on which such statements were made, except as required by applicable law.

SOURCE: Aftermath Silver

Historic 98 Million Ounces of Silver Measured & Indicated plus 28 Million Ounces of Silver Inferred

Vancouver, BC – July 28, 2020) – Aftermath Silver Ltd. (TSXV: AAG) (OTCQB: AAGFF) (the “Company” or “Aftermath Silver”) (“Aftermath Silver” or the “Company”) is pleased to announce that it has entered into a binding Letter of Intent (the “LOI”) with SSR Mining Inc. (“SSRM”) to purchase 100% of the Berenguela silver-copper project located in Puno, Peru (“Berenguela” or the “Project”) through the purchase of 100% of SSRM’s shares in the Peruvian holding company Sociedad Minera Berenguela S.A. (“SOMINBESA”).

Berenguela Silver – Copper Project Highlights

- Epithermal polymetallic carbonate-replacement deposit

- Total tenement package of 6,594 hectares

- 50 km to Juliaca, and 204 km to Arequipa, both with daily flight connections to Lima

- Located 6 km from the town Santa Lucia, with rail access to the port of Matarani

Historic 2018 JORC Mineral Resource (see below for details and cautionary statements)

- Containing:

- Silver: 98 Moz in Measured & Indicated, and an additional 28 Moz in Inferred

- Copper: 624 Mlb of in Measured & Indicated, and an additional 147 Mlb in Inferred

Historic 2018 Scoping Study (see below for details and cautionary statements)

- Open pit mining, low strip 0.96, with a mine life of 12 years at 2 million tonnes per year

- Mining inventory (Measured & Indicated) of 21.8 Mt @ 111 g/t Silver, 0.98% Copper & 7.6% Manganese

- Conventional processing flow sheet with annual average production:

- 4.85 Moz of Silver in doré;

- 13,883 tonnes of Copper in cathode;

- 96,087 tonnes of Manganese in MgSO4 mono-hydrate; and

- 5,098 tonnes of Zinc in cathode;

Transaction Summary

Aftermath Silver and SSRM have agreed to a total consideration of US$13,000,000 made in staged cash payments, C$3,000,000 in Aftermath Silver common shares, and a sliding scale net smelter returns royalty (“NSR”), as follows:

- US$1,000,000 deposit, to be paid within 48 hours of signing the LOI [(paid)];

- US$1,000,000 cash on the closing date of the proposed transaction and C$3,000,000 in Aftermath common shares, using the volume weighted average share price five (5) trading days prior to the date of signing the acquisition agreement, capped a maximum 9.9% of Aftermath’s issued and outstanding shares, with the remainder, if any, to be paid in cash;

- US$2,250,000 cash to be paid on the 12-month anniversary date of closing;

- US$2,500,000 cash to be paid on the 24-month anniversary date of closing;

- US$3,000,000 cash to be paid on the 48-month anniversary date of closing;

- Completion of a Preliminary Feasibility Study (“PFS“) and filing on SEDAR of a NI 43-101 technical report summarising the PFS, within 48 months of the anniversary date of closing;

- US$3,250,000 cash to be paid on the 72-month anniversary date of closing;

- A sliding scale net smelter returns royalty (“NSR”) on all mineral production from the Berenguela Project for the life of mine commencing at the declaration of commercial production, based on the following:

- 1.0% NSR, on all mineral production when the Silver Market Price is up to and including US$25/ounce; and

- 1.25% NSR on all mineral production when the Silver Market Price is over US$25/ounce and when the Copper Market Price is above $2.00/lb.

Closing of the acquisition is subject toAftermath Silver and SSRM having executed and delivered the acquisition agreement, SSRM having reacquired a 100% direct and indirect interest in SOMINBESA, the owner of the Project, from Valor Resources Limited (“Valor”), the approval of the TSX Venture Exchange and certain other customary closing conditions.

Ralph Rushton, President and CEO of the Company, commented “The Berenguela acquisition perfectly matches our corporate strategy of acquiring de-risked assets with immediate value creation for our shareholders. When the Berenguela acquisition is complete, Aftermath Silver will have assembled one of the largest portfolios of silver development assets. Combined with the organic growth we hope to achieve at Challacollo, we believe it positions Aftermath as one of the preeminent silver development companies.”

About the Berenguela Silver-Copper Deposit

Berenguela is located in the Department Puno, in Southern Peru, between 4150 and 4280 meters above sea level in the Western Cordillera of southern Peru. It is located 6 km north-east of the closest community of Santa Lucia, the nearest town. Berenguela is close to regional centres at Juliaca (1.5 hours drive) and Arequipa (2.5 hours drive), these cities have daily flights from Lima. A railway loading station is located at Santa Lucia, connecting to the port of Matarani on the Pacific coast. Santa Lucia is connected to the national grid at 220 Volts.

Small scale production from surface pits and underground occurred in the early 1906 through to 1958, for a total of approximately 500,000 tonnes. ASARCO optioned the project in 1965 undertaking the first large scale investigations. Several companies subsequently performed drilling and bulk sampling for metallurgical test work. SSRM (then Silver Standard) optioned the Project in 2004. Between 2004 and 2005, SSRM undertook 222 RC holes, metallurgical test work and produced a NI 43-101 technical report on the Mineral Resource in October 2005 to complete 100% ownership. Subsequently, SSRM drilled 28 diamond holes between 2010 and 2015. SSRM optioned the property in 2017 to ASX-listed Valor Resources Limited (“Valor”), who completed 69 RC holes in 2017. In April 2020, SSRM and Valor entered into a definitive agreement pursuant to which Valor has agreed to return to SSRM a 100% direct and indirect interest in SOMINBESA, the owner of the Project. A total 318 drill holes have been drilled between 2004 and 2017 for a total of 34,796 metres.

Berenguela is an epithermal polymetallic carbonate-replacement deposit. The mineralisation is present from surface to a depth of about 100 m. The deposit has a known strike length of 1.4 km and is 200 to 300 m wide, 30 to 100 m thick.

Stockwork bodies of manganese oxides (magnetic) are hosted within folded and faulted carbonates, and include massive flat lying lenses. It is interpreted that manganese oxides have replaced the dolomitic limestones in areas that have been structurally prepared through folding and faulting associated with NWN striking folds.

Associated with the manganese oxide body is an irregular cross cutting network of quartz veins. These veins contain the copper and silver minerals; malachite, azurite, covellite, chalcopyrite, chrysocolla, pyrite, acanthite, and small quantities of native silver.

In January 2018, the previous operator reported a Mineral Resource Estimate under the Joint Ore Reserves Committee (“JORC”) 2012 guideline for Berenguela.

The Company cautions that an independent Qualified Person (“QP”), as defined in National Instrument 43-101 (“NI 43-101”), has not yet completed sufficient work on behalf of Aftermath Silver to classify the estimate as a current Measured, Indicated or Inferred Mineral Resource, and Aftermath Silver is not treating the historical estimate as a current Mineral Resource. Aftermath Silver will need to validate previous work to produce a mineral resource that is current for CIM purposes. Details of the historic Mineral Resource are found in Table 1.

Table 1. Historic 2018 Mineral Resource Estimate for the Berenguela Silver-Copper Project

| Classification | Tonnes (Mt) | Silver (g/t) |

Copper (%) | Mang-anese (%) | Zinc (%) |

Silver (Koz) | Copper (Klb) |

| Measured | 7.71 | 104 | 0.99 | 8.68 | 0.34 | 25,717 | 168,040 |

| Indicated | 28.2 | 80 | 0.73 | 5.16 | 0.30 | 73,009 | 456,465 |

| Measured + Indicated | 35.9 | 85 | 0.79 | 5.91 | 0.30 | 98,725 | 624,505 |

| Inferred | 9.97 | 88 | 0.67 | 2.14 | 0.20 | 28,183 | 147,242 |

Notes on the Historic Mineral Resource Estimate

- JORC-2012 definitions were followed for Mineral Resources.

- Mineral Resources were estimated by P.Geo. Marcelo Batelochi, AusIMM Competent Person.

- Grades are estimated by the Ordinary Kriging interpolation method using capped composite samples.

- Bulk density has been estimated by Nearest Neighbour method and the average value is 2.82g/cm3.

- The historic mineral resource uses a copper equivalent cut off of 0.5%, copper equivalents (“CuEq”) were based on the formula CuEq (%) = Cu (%) + ((Ag (g/t) / 10000) in ounces x Ag price x silver recovery) / (Cu price x Cu recovery) + (Zn% x Zn price x Zn recovery) / (Cu price x Cu recovery). Assuming: Ag price $16.795/oz and Zn $3,150/t and recoveries of Ag 50%, Cu 85% and Zn 80%. Mn grades are not considered for CuEq calculations.

- Numbers may not add/multiply due to rounding.

Historic Scoping Study Summary

The previous operator undertook a scoping study on Berenguela (Salva Mining, May, 2018) to a quoted level of accuracy of ±35%. A summary of the scoping study economic highlights follows, the results have not been verified by the Company and the reader is cautioned not to rely on the economic results below:

- Open pit mining inventory (of historic Measured and Indicated Mineral Resource) of:

- 21.8Mt @ 111 g/t Silver, 0.98% Copper & 7.6% Manganese at a 1% CuEq cut off

- Conventional processing flow sheet:

- crushing, dry grind and magnetic pre-concentration;

- solvent extraction and electrowinning of Copper and manganese; and

- cyanide leaching and Merrill-Crowe precipitation of Silver doré

- Mine life 12 years at 2 Million tonnes per year using open pit methods

- Metal price assumptions: $19.10/oz Silver, $3.22/lb Copper, $500/t Manganese sulphate & $1.07 /lb Zinc

- Average overall metallurgical recoveries: 67.9% Silver, 70.8% Copper, 63.2% Manganese & 69.4% Zinc

- Average annual metal production of: 4.85 Moz of Silver, 13,883 tonnes of Copper, 96,087 tonnes of Manganese in MgSO4 mono-hydrate and 5,098 tonnes of Zinc

- Preproduction capital of US$260.3M, includes working capital, EPCM, owner’s costs and 30% contingency

- Life of mine sustaining capital of $85.2M, including closure costs

- Average operating cost US$52.62/t run of mine, all-in sustaining cash cost includes royalties

- Cumulative free cash flow $1,658M

- Pre-Tax NPV (8%) $815M and IRR 49%

- After Tax NPV (8%) $564M and IRR 35%

Aftermath Silver’s Immediate Plans

Upon closing of the proposed transaction, Aftermath will immediately commence a detailed review of the historic scoping study and define the scope of a Pre-feasibility study for Berenguela. This will involve upgrading of any Inferred Mineral Resource into Indicated Mineral Resources, the twinning of historic drill holes, acquiring fresh metallurgical samples, mine and civil geotechnical investigations and hydrology studies.

Aftermath Silver will also review the significant exploration potential around Berenguela and will drill test the most prospective targets.

Finders Fees

Finders fees commensurate with TSX-V policies will be payable to Elysium Mining Ltd (“Elysium”) in cash and shares, Elysium is a company in the business of identifying mineral project acquisitions.

About Aftermath Silver Ltd

Aftermath Silver Ltd is a Canadian junior exploration company focused on silver, and aims to deliver shareholder value through the discovery, acquisition and development of quality silver projects in stable jurisdictions. Aftermath has developed a pipeline of projects at various stages of advancement.

- Cachinal Silver-Gold project. The company currently owns 80% of the Cachinal Silver-Gold project, with an option to acquire the remaining 20% from SSRM. Cachinal has a historic Mineral Resource as shown in Table 2.

- Challacollo Silver-Gold project. In addition, the Company has an option to acquire a 100% interest in the Challacollo Silver-Gold project, located near Iquique, Region I, Chile. Challacollo has a historic Mineral Resource as shown in Table 2. Aftermath Silver’s focus on Challacollo is to define a Mineral Resource in the hangingwall and footwall of the existing historic Mineral Resource, summarised in Table 3.

Table 2. Historic Mineral Resource* Summary for the Cachinal Silver-Gold Project

| Classification | Tonnes (Mt) | Silver (g/t) | Gold (g/t) | Silver (Moz) | Gold (Koz) |

| Indicated | 5.66 | 101 | 0.13 | 18.41 | 24.03 |

| Inferred | 0.82 | 115 | 0.12 | 3.02 | 3.26 |

* Please see cautionary note below about Cachinal Historic Mineral Resources.

Table 3. Historic Mineral Resource* Summary for the Challacollo Silver-Gold Project

| Classification | Tonnes (Mt) | Silver (g/t) | Gold (g/t) | Silver (Moz) | Gold (Koz) |

| Indicated | 4.7 | 200 | 0.32 | 30.2 | 48.4 |

| Inferred | 1.6 | 134 | 0.31 | 6.9 | 15.9 |

* Please see cautionary note below about Challacollo Historic Mineral Resources.

Qualified Person

Peter Voulgaris, MAIG, MAusIMM, a consultant to the Company, is a non-independent qualified person as defined by NI 43-101. Mr. Voulgaris has reviewed the technical content of this news release, and consents to the information provided in the form and context in which it appears.

ON BEHALF OF THE BOARD OF DIRECTORS

“Ralph Rushton”

Ralph Rushton

CEO and Director

604-484-7855

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Information

Certain of the statements and information in this news release constitute “forward-looking information” within the meaning of applicable Canadian provincial securities laws. Any statements or information that express or involve discussions with respect to interpretation of exploration programs and drill results, predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategies”, “targets”, “goals”, “forecasts”, “objectives”, “budgets”, “schedules”, “potential” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward‐looking statements. Although the Company believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward‐looking statements. Factors that could cause actual results to differ materially from those in forward‐looking statements include, but are not limited to, changes in commodities prices; changes in expected mineral production performance; unexpected increases in capital costs; exploitation and exploration results; continued availability of capital and financing; differing results and recommendations in the Feasibility Study; and general economic, market or business conditions. In addition, forward‐looking statements are subject to various risks, including but not limited to operational risk; political risk; currency risk; capital cost inflation risk; that data is incomplete or inaccurate. The reader is referred to the Company’s filings with the Canadian securities regulators for disclosure regarding these and other risk factors, accessible through Aftermath Silver’s profile at www.sedar.com.

There is no certainty that any forward‐looking statement will come to pass and investors should not place undue reliance upon forward‐looking statements. The Company does not undertake to provide updates to any of the forward‐looking statements in this release, except as required by law.

Cautionary Note about Cachinal Historic Mineral Resources

This News Release quotes an Historic Mineral Resource for Cachinal. Please note, an independent “Qualified Person”, as defined in National Instrument 43-101 (“NI 43-101”), has not yet completed sufficient work on behalf of Aftermath to classify the historical estimate as a current Indicated or Inferred Mineral Resource, and Aftermath is not treating the historical estimate as a current Mineral Resource. For full details of the Cachinal Historic Mineral Resource please see the For full details of the Cachinal Historic Mineral Resource please see the NI 43-101 Technical Report dated February 9, 2010, with an effective date of April 30, 2008, titled “Mineral Resource Estimation, Cachinal Silver-Zinc-Gold Project, Region II, Chile” QP’s Cole, G., Couture, J.-F., and Keller, G.D. of SRK Consulting (Canada) Inc. Prepared for Apogee Minerals Ltd., now available on the Halo Labs Inc. SEDAR profile.

Cautionary Note about Challacollo Historic Mineral Resources

This News Release quotes an Historic Mineral Resource for Challacollo. Please note, an independent “Qualified Person”, as defined in National Instrument 43-101 (“NI 43-101”), has not yet completed sufficient work on behalf of Aftermath to classify the historical estimate as a current Indicated or Inferred Mineral Resource, and Aftermath is not treating the historical estimate as a current Mineral Resource. For full details of the Challacollo Historic Mineral Resource please see the NI 43-101 Technical Report dated March 31, 2015, with an effective date of December 31, 2014 titled “NI 43-101 Technical Report for the Challacollo Silver Project, Region 1, Chile” QPs Mroczek, M., Collins, M. and Butler, S. of Mining Plus Canada Consulting Ltd. and Tapia, J.C., of Sedgman S.A. Prepared for Mandalay Resources, available on the Mandalay Resources SEDAR profile.

Cautionary Note to US Investors – Mineral Resources

This News Release has been prepared in accordance with the requirements of Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (”NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards, which differ from the requirements of U.S. securities laws. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian public disclosure standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and information concerning mineralization, deposits, mineral reserve and resource information contained or referred to herein may not be comparable to similar information disclosed by U.S. companies.

SOURCE: Aftermath Silver Ltd.

Vancouver, BC – June 2, 2020 – Aftermath Silver Ltd. (TSXV: AAG) (OTCQB: AAGFF) (the “Company” or “Aftermath Silver”) is pleased to announce that Mr. Alastair Brownlow has been appointed as Chief Financial Officer (CFO) of the Company. Jasmine Lau, Aftermath Silver’s current CFO, resigned on June 1, 2020 due to her upcoming maternity leave.

Mr. Brownlow is a Chartered Professional Accountant and a U.S. Certified Public Accountant (Washington) specializing in resource-focused accounting and finance. Mr. Brownlow has accumulated extensive experience working as CFO of TSXV listed mineral exploration and development companies throughout the world, including exploration and production companies in South America. Mr. Brownlow also previously worked as an auditor in the British Virgin Islands focusing on financial and regulatory reporting of public and private funds and trust companies. Prior to this, Mr. Brownlow worked for a Canadian chartered professional accountant firm where he specialized in the mining industry, gaining significant accounting experience auditing mineral exploration and development companies in Canada and throughout the world. Mr. Brownlow has a Bachelor of Business Administration degree with first class honours from Simon Fraser University.

Ralph Rushton, the President of Aftermath Silver commented: “I would like to welcome Alastair to the Aftermath Silver team and I look forward to working with him as we explore and develop our portfolio of silver projects in Chile. I’d like to thank Jasmine for the hard work she’s put in to helping Aftermath Silver grow and wish her all the best during this exciting time for her family.”

About Aftermath Silver Ltd

Aftermath Silver Ltd is a Canadian junior exploration company engaged in acquiring, exploring, and developing mineral properties with an emphasis on silver in Chile. The Company is focused of growth through the discovery and acquisition of quality projects in stable jurisdictions. Aftermath continues to seek new opportunities to capitalize on the current silver environment.

ON BEHALF OF THE BOARD OF DIRECTORS

“Ralph Rushton”

Ralph Rushton

CEO and Director

604-484-7855

SOURCE: Aftermath Silver Ltd.

Aftermath Silver Ltd is a Canadian junior exploration company engaged in acquiring, discovering and developing silver properties in stable jurisdictions like Chile. We aim to grow our business by adding quality silver resources to the project portfolio, and we’re always looking for new opportunities to take advantage of the relatively low silver price.

PROJECTS

Challacollo Silver-Gold Project

As announced by news release dated August 1, 2018, the Company has entered into a non-binding Letter of Intent (the “Challacollo LOI”) with Mandalay Resources Inc. (“Mandalay”) to purchase the Challacollo silver-gold project (“Challacollo”) by the purchase of 100% of Mandalay’s shares in the Chilean holding company Minera Mandalay Challacollo Limitada (“MMC”), which currently owns 100% of the Project. Challacollo is the only asset held by MMC.

Challacollo is a low sulphidation epithermal deposit which hosts a historic Mineral Resource1 of Indicated of 4.7 million tonnes at 200 g/t silver and an Inferred of 1.6 million tonnes at 134 g/t silver, with associated gold credits (30.3 million ounces silver and 48.4 thousand ounces of gold)

Cachinal Silver-Gold Project

As announced by news release dated June 25, 2018, the Company has entered into a definitive agreement (the “Cachinal Agreement”) with Apogee Opportunities Inc. (“Apogee”) to purchase Apogee’s holding in the Cachinal De La Sierra Silver-Gold Project (“Cachinal”) through the purchase of Apogee’s shares in the Chilean holding company Minera Cachinal S.A., representing 80% ownership.

Cachinal, is a low sulphidation epithermal deposit which currently hosts a current Mineral Resource2 of Indicated of 5.7 million tonnes at 101 g/t silver and an Inferred of 0.8 million tonnes at 115 g/t silver, with associated gold credits (18.41 million ounces silver and 24.03 thousand ounces of gold).

SOURCE: https://aftermathsilver.com/