GET TOP RATED STOCK ALERTS ACTIVE TRADERS DEPEND ON

SIGN UP TODAY FOR FREE NEWS DRIVEN ALERTS

Provides Funds to Materially Advance the Kindersley Lithium Project

Conference call and webcast to be held at 10:00am (MST) on January 17, 2024 to describe the transaction

Calgary, AB – January 16, 2024 – Grounded Lithium Corp. (OTCQB: GRDAF) (TSX.V: GRD) – Grounded Lithium Corp. (“GLC” or the “Company”) is pleased to announce we entered into a definitive agreement dated January 15, 2024 with Denison Mines Corp (TSX: DML NYSE American: DNN) (“Denison”) whereby Denison has the option to earn up to a 75% working interest in the Kindersley Lithium Project (“KLP”) by funding in aggregate up to $15,150,000 comprised of both cash payments to GLC of up to $3,150,000 and funding project expenditures of up to $12,000,000 through a structured earn-in option. (the “Agreement”).

The Agreement is expected to provide more than sufficient funding for a field pilot (the “Pilot”) for the KLP which both the Company and Denison (collectively, the “Parties”) plan to advance on a priority basis. Beyond the Pilot, Denison may also provide further capital during the earn-in period to fund other activities as necessary to drive the overall KLP value such as further technical evaluations and studies, drilling, sampling and expenditures to maintain the KLP lands in good standing.

The Agreement highlights are as follows:

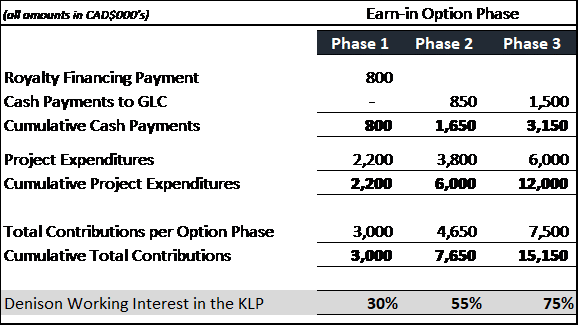

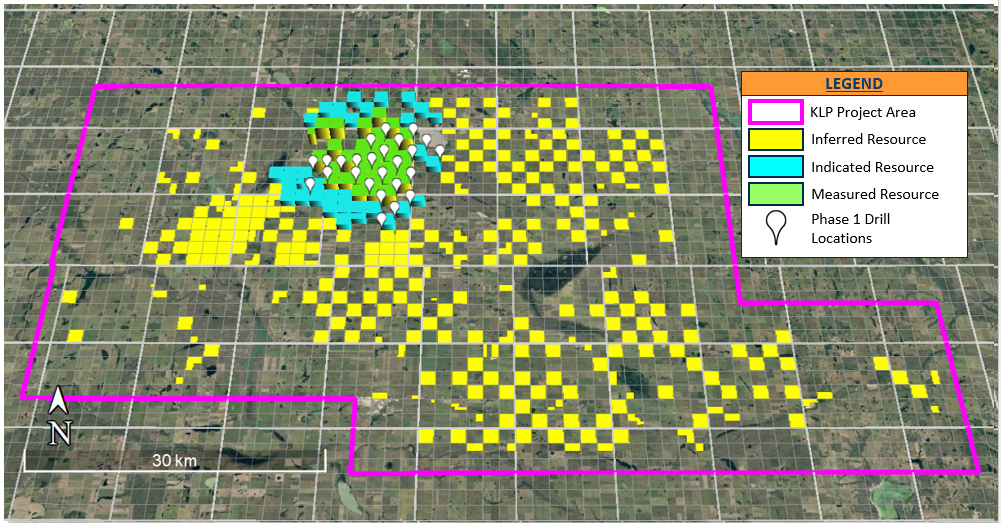

- Three distinct earn-in options (each, an “Earn-in Option”) which include a cash payment directly to the Company along with dedicated expenditures to advance the KLP, as described below. During the earn-in period, KLP expenditures will generally be funded 100% by Denison, and Denison will be entitled to an increased working interest in the KLP as it completes each Earn-in Option phase. Key economic parameters of the Agreement are summarized in the table below:

- Upon funding the total amounts of each Earn-in Option, Denison has the right to either exercise the Earn-In Option and acquire the working interest associated with that Earn-In Option phase or move on to the ensuing option phase;

- Should Denison exercise the Earn-In Option and elect to acquire a working interest in the KLP, a formal joint venture will be created to govern the Parties. The joint venture agreement will contain customary language and terms associated with an arrangement of this nature, including but not limited to, governance provisions, rights of first refusals, dilution provisions for non-participation and technical and management committees;

- The Agreement terminates on the earlier of (i) Denison electing to acquire its working interest and convert to a formal joint venture, (ii) June 30, 2028, or (iii) a date as otherwise agreed between the Parties;

- The ability exists for either Party to recommend drilling expenditures, outside of the earn-in option terms detailed above, for which the purpose is to preserve lithium rights associated with the various KLP permits; and

- Denison will become the named operator of the KLP during the Earn-In Period, however, to ensure continuity of site activities, the Parties will enter into a two-year site management contract whereby a fee will be paid to the Company to effectively manage the day-to-day site activities of the KLP; and

The Company also sold a 5% gross overriding royalty (“GORR”) on the KLP to Denison in accordance with the terms of a royalty agreement (the “Royalty Agreement”) for a cash payment of $800,000. Pursuant to the terms of the Royalty Agreement, the GORR drops to 2% upon the receipt of all approvals, inclusive of GLC shareholder approval of the Agreement. The GORR is eliminated in its entirety on the date that is fifteen (15) months after the closing of the Earn-In Agreement unless Denison elects to forfeit its rights to exercise an Earn-In Option.

GLC and Denison have established an area of mutual interest in respect of any lands acquired within 10 kilometers of any existing lands contained within the KLP that are prospective for lithium (“AMI Lands”). GLC is free to explore for, acquire and develop lands outside of the AMI Lands for its own account and we currently have developed several prospects which honour our geological model for economic lithium resource plays, while we benefit from intellectual knowledge gained from the technical work on the KLP.

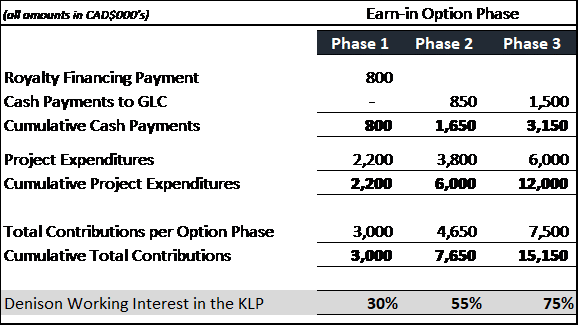

Figure 1 – KLP Area Subject to Mutual Interest

“Grounded remains steadfast in our vision to economically produce battery grade lithium with a focus on low-cost operations and this strategic investment from Denison is a major step in that regard,” stated Gregg Smith, President & CEO. “Denison has a considerable operating footprint in Saskatchewan as well as an excellent reputation within the Province, and we continue to be impressed with the diligence and professionalism of the Denison team. We look forward to working together to unlock the full value potential of the KLP for the benefit of our respective shareholders. Further, the strategic investment from Denison in both GLC and the KLP eliminates many perceived or distinct risks in our anticipated path to commercial production.”

David Cates, President and CEO of Denison commented, “Denison is excited to acquire a royalty and enter into an earn-in agreement with GLC that supports the further assessment of the KLP in Saskatchewan. Denison has developed a unique platform for the de-risking of mine development projects in the Province with its innovative and highly skilled Saskatoon-based technical, regulatory, and operations teams. Lithium is a complementary mineral to Denison’s core uranium business, with both identified as critical minerals needed to support the clean energy transition. Brine extraction also has many similarities to the In-Situ Recovery mining method that the Company has successfully validated for use at its flagship Wheeler River uranium project in northern Saskatchewan. Combining our deep local technical capabilities with the Grounded team’s experience on KLP has the potential to create an incredible environment to incubate the KLP to emerge as a premier lithium project in a top mining jurisdiction.”

“The transaction with Denison is a great outcome for both parties,” commented Greg Phaneuf, Senior Vice President Corporate Development & CFO. “Denison gains exposure to a high-potential lithium brine project in Saskatchewan with similarities to its impressive uranium project development portfolio in the Province] while Grounded receives immediate funding and partners with a strategic investor with a much lower cost of capital to advance the KLP without incurring dilution at the corporate level.”

Conference Call Details

Those interested can listen to Company officials describe the transaction with Denison by participating in the following conference call details:

Conference Call:

Participant Toll-Free Dial-In Number: 1 (888) 300-4030

Participant Toll Dial-In Number: 1 (646) 970-1443

Conference ID: 5553583

Webcast url: https://events.q4inc.com/attendee/658855672

The Company will post a playback of the conference call on the Company’s website.

About Denison Mines Corp.

Denison is a uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. The Company has an effective 95% interest in its flagship Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region of northern Saskatchewan. In mid-2023, a Feasibility Study was completed for Wheeler River’s Phoenix deposit as an ISR mining operation, and an update to the previously prepared PFS was completed for Wheeler River’s Gryphon deposit as a conventional underground mining operation. Based on the respective studies, both deposits have the potential to be competitive with the lowest cost uranium mining operations in the world. Permitting efforts for the planned Phoenix ISR operation commenced in 2019 and have advanced significantly, with licensing in progress and a draft Environmental Impact Statement submitted for regulatory and public review in October 2022.

Denison’s interests in Saskatchewan also include a 22.5% ownership interest in the McClean Lake Joint Venture, which owns several uranium deposits and the McClean Lake uranium mill, contracted to process the ore from the Cigar Lake mine under a toll milling agreement, plus a 25.17% interest in the Midwest Main and Midwest A deposits and a 67.41% interest in the THT and Huskie deposits on the Waterbury Lake property. The Midwest Main, Midwest A, THT and Huskie deposits are located within 20 kilometres of the McClean Lake mill.

Through its 50% ownership of JCU (Canada) Exploration Company, Ltd (”JCU”), Denison holds additional interests in various uranium project joint ventures in Canada, including the Millennium project (JCU, 30.099%), the Kiggavik project (JCU, 33.8118%) and Christie Lake (JCU, 34.4508%).

Denison’s exploration portfolio includes further interests in properties covering approximately 285,000 hectares in the Athabasca Basin region.

About Grounded Lithium Corp.

GLC is a publicly traded lithium brine exploration and development company that controls approximately 1.0 million metric tonnes of Measured & Indicated lithium carbonate equivalent mineral resource and approximately 3.2 million metric tonnes of Inferred lithium carbonate equivalent resource over our focused land holdings in Southwest Saskatchewan as per the Company’s updated PEA. The updated PEA, titled “NI 43-101 Technical Report: Preliminary Economic Assessment Kindersley Lithium Project – Phase 1 Update” dated November 7, 2023 and effective as of June 30, 2023, reports a Phase 1 NPV8 after-tax of US$1.0 billion with an after-tax IRR of 48.5%. GLC’s multi-faceted business model involves the consolidation, delineation, exploitation and ultimately development of our opportunity base to fulfill our vision to build a best-in-class, environmentally responsible, Canadian lithium producer supporting the global energy transition shift. U.S. investors can find current financial disclosure and Real-Time Level 2 quotes for the Company on https://www.otcmarkets.com/.

Qualified Person

Scientific and technical information contained in this press release has been prepared under the supervision of Doug Ashton, P.Eng., Alexey Romanov, P. Geo., Meghan Klein, P. Eng., Dean Quirk, P.Eng., Jeffrey Weiss, P.Eng., Chad Hitchings., P.L. Eng., and Michael Munteanu, P.Eng., each of whom is a qualified person within the meaning of NI 43-101.

For more information, please contact:

Gregg Smith, President & CEO Greg Phaneuf, SVP Corporate Development & CFO

gregg.smith@groundedlithium.com greg.phaneuf@groundedlithium.com

Phone: 587.319.6220

Forward-Looking Statements

This press release may contain forward-looking statements and forward-looking information within the meaning of applicable Canadian securities laws. The opinions, forecasts, projections and statements about future events of results, are forward looking information, forward-looking statements or financial outlooks (collectively, “forward-looking statements“) under the meaning of applicable Canadian securities laws. These statements are made as of the date of this press release and the fact that this press release remains available does not constitute a representation by GLC that the Company believes these forward-looking statements continue to be true as of any subsequent date. Although GLC believes that the assumptions underlying, and expectations reflected in, these forward-looking statements are reasonable, it can give no assurance that these assumptions and expectations will prove to be correct. Such statements include, but are not limited to, statements pertaining to the advancement of the Pilot and the timing thereof, GLC’s expectation of the funding required for the Pilot; Denison’s funding to the Company, the timing and amount thereof and the use of proceeds from such funding; shareholder approval of the Agreement activities necessary to drive the overall KLP value; the entering into of the joint venture agreement if at all and the timing and terms thereof; the impact of the Agreement on the shareholders of the Company; prospective lands outside of the AOI Lands and the viability for economic lithium resource plays; and GLC’s vision of becoming a best-in-class, environmentally responsible, Canadian lithium producer supporting the global energy transition.

Among the important factors, risks, uncertainties and assumptions that could cause actual results to differ materially from those indicated by such forward-looking statements are: GLC’s expectation that our operations will be in Western Canada, unexpected problems can arise due to technical difficulties and operational difficulties which impact the production, transport or sale of our products; geographic and weather conditions can impact the production; the risk that current global economic and credit conditions may impact commodity prices and consumption more than GLC currently predicts; the failure to obtain financing on reasonable terms; the risk that unexpected delays and difficulties in developing currently owned properties may occur; the failure of drilling to result in commercial projects; unexpected delays due to the limited availability of drilling equipment and personnel; and the other risk factors detailed from time to time in GLC’s periodic reports. GLC’s forward-looking statements are expressly qualified in their entirety by this cautionary statement.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Source: Grounded Lithium Corp.

Calgary, AB – November 22, 2023 – Grounded Lithium Corp. (TSXV: GRD) (OTCQB: GRDAF) (” GLC ” or the ” Company “) announces our financial and operating results for the three month period and nine month period ended September 30, 2023 . Selected financial and operational information is set out below and should be read in conjunction with the Company’s September 30, 2023 financial statements and the related management’s discussion and analysis, which are available for review at www.sedarplus.ca or the Company’s website at www.groundedlithium.com .

Third Quarter 2023 Financial and Operational Highlights

- On July 26, 2023 , the Company announced the economic results of our maiden preliminary economic assessment (” PEA “). These results represent arguably top decile results for a lithium from brine operation on a per tonne basis. At a realized sales price of US$25,000 per tonne of lithium hydroxide monohydrate (” LHM “), the after-tax internal rate of return on the first 11,000 tonne LHM per year phase of the Kindersley Lithium Project (” KLP “) equates to 48.5% while the after-tax net present value using an 8% discount rate is CAD$1.3 billion , or US$1.0 billion . The strong economics directly speak to the extensive geological analysis conducted at the inception of the Company – resource plays with the lowest cost structure should rank at or near the top compared to similar operations; and

- At the end of the quarter, the Company closed a $765,000 non-brokered private placement, with a large percentage subscribed for by insiders of the Company. Proceeds from the offering are being allocated to general corporate purposes. The offering was a unit offering comprised of one Class A Common Share (” Common Share “) at a price of $0.11 together with a ½ warrant, where a full warrant can be exercised into a Common Share at a price of $0.18 for a period of two years.

|

(CAD$, except per share amounts and common shares outstanding) |

||||||

|

Three Months Ended Sept 30, |

Nine Months Ended Sept 30, |

|||||

|

2023 |

2022 |

2023 |

2022 |

|||

|

FINANCIAL RESULTS |

||||||

|

Net comprehensive loss |

783,927 |

3,539,319 |

3,410,678 |

4,732,315 |

||

|

Per share – basic and diluted |

0.01 |

0.09 |

0.05 |

0.15 |

||

|

Cash flow used in operating activities |

549,952 |

833,496 |

2,688,376 |

1,869,033 |

||

|

Per share – basic and diluted |

0.01 |

0.02 |

0.04 |

0.06 |

||

|

Funds flow used in operations |

542,677 |

704,651 |

2,700,693 |

1,765,219 |

||

|

Per share – basic and diluted |

0.01 |

0.02 |

0.04 |

0.06 |

||

|

Capital expenditures |

||||||

|

Capital expenditures |

999 |

1,062,102 |

451,846 |

1,740,318 |

||

|

Liquidity |

||||||

|

Working capital surplus |

385,560 |

2,394,958 |

385,560 |

2,394,958 |

||

|

Common shares outstanding |

||||||

|

Weighted average – basic and diluted |

70,034,345 |

40,308,155 |

69,436,671 |

31,728,257 |

||

|

Outstanding, end of period |

76,613,873 |

56,872,750 |

76,613,873 |

56,872,750 |

||

Operational and Corporate Update

The Company’s go-forward business plan is robust however relies on external sources of capital to progress. The Company continues to evaluate a number of alternative strategies to allow us to execute on our stated business goals. In addition to traditional methods of raising capital in which insiders will continue to participate, we actively pursue strategies which include:

- Seeking funds under various government programs which could defray the cost of both drilling and field pilot operations; and

- Seeking funding and partnerships with one or more strategic partners. A strategic partner provides multiple benefits including experience in either responsible resource development or technologies related to our emerging industry, an interest in realizing the robust value identified in our PEA, and/or a desire to support energy transition. The Company maintains current dialogue with a number of qualifying strategic partners.

About Grounded Lithium Corp.

GLC is a publicly traded lithium brine exploration and development company that controls approximately 1.0 million metric tonnes of Measured & Indicated lithium carbonate equivalent mineral resource and approximately 3.2 million metric tonnes of Inferred lithium carbonate equivalent resource over our focused land holdings in Southwest Saskatchewan as per the Company’s updated PEA. The updated PEA, titled ” NI 43-101 Technical Report: Preliminary Economic Assessment Kindersley Lithium Project – Phase 1 Update ” dated November 7, 2023 and effective as of June 30, 2023 , reports a Phase 1 NPV 8 after-tax of US$1.0 billion with an after-tax IRR of 48.5%. GLC’s multi-faceted business model involves the consolidation, delineation, exploitation and ultimately development of our opportunity base to fulfill our vision to build a best-in-class, environmentally responsible, Canadian lithium producer supporting the global energy transition shift. U.S. investors can find current financial disclosure and Real-Time Level 2 quotes for the Company on https://www.otcmarkets.com/ .

Qualified Person

Scientific and technical information contained in this press release has been prepared under the supervision of Doug Ashton , P.Eng., Alexey Romanov , P. Geo., Meghan Klein , P. Eng., Dean Quirk , P.Eng., Jeffrey Weiss , P.Eng., Chad Hitchings ., P.L. Eng., and Michael Munteanu , P.Eng., each of whom is a qualified person within the meaning of NI 43-101.

Forward-Looking Statements

This press release may contain forward-looking statements and forward-looking information within the meaning of applicable Canadian securities laws. The opinions, forecasts, projections and statements about future events of results, are forward looking information, forward-looking statements or financial outlooks (collectively, ” forward-looking statements “) under the meaning of applicable Canadian securities laws. These statements are made as of the date of this press release and the fact that this press release remains available does not constitute a representation by GLC that the Company believes these forward-looking statements continue to be true as of any subsequent date. Although GLC believes that the assumptions underlying, and expectations reflected in, these forward-looking statements are reasonable, it can give no assurance that these assumptions and expectations will prove to be correct. Such statements include, but are not limited to, statements regarding the internal rates of return and net present values of the KLP, the KLP ranking as a top decile project, the future price of lithium, seeking funding under government programs, seeking funding and partnership opportunities, and GLC’s vision of becoming a best-in-class, environmentally responsible, Canadian lithium producer supporting the global energy transition.

Among the important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are: GLC’s expectation that our operations will be in Western Canada , unexpected problems can arise due to technical difficulties and operational difficulties which impact the production, transport or sale of our products; geographic and weather conditions can impact production; the risk that current global economic and credit conditions may impact commodity prices and consumption more than GLC currently predicts; the failure to obtain financing on reasonable terms; volatility in the trading price of the common shares of the Company; the risk that unexpected delays and difficulties in developing currently owned properties may occur; the failure of drilling to result in commercial projects; unexpected delays due to the limited availability of drilling equipment and personnel; and the other risk factors detailed from time to time in GLC’s periodic reports. GLC’s forward-looking statements are expressly qualified in their entirety by this cautionary statement.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE Grounded Lithium Corp

Sign Up for FREE

Stock Alerts from

to be the first to know when this emerging company issues Breaking News!

Grounded Lithium is focused on responsibly generating value for its stakeholders by producing battery metals required to fuel the global energy transition

Grounded Lithium (TSXV: GRD) is a publicly traded, Alberta-headquartered lithium resource company focused on supplying lithium into the rapidly developing electricity-powered economy. Within the accelerating energy transition industry, lithium is a critical metal in the manufacturing of Electric Vehicle batteries. We focus on lithium extraction from the production of subsurface brines, where Western Canada’s potential remains undeveloped.

The Grounded Lithium team is dedicated to generating value through a balanced model of exploration, production, and strategic acquisitions of formations bearing lithium-rich brines in Western Canada.

Contributing to a Cleaner Future

We are committed to reducing environmental impacts by applying technologies to increase efficiencies, reduce emissions, eliminate tailings ponds and freshwater consumption.

Direct Lithium Extraction delivers improved social and environmental license

Environmentally Friendly

– Much lower environmental impact (less land disturbance, minimal water consumption and emissions, no tailings) compared to solar evaporation ponds and conventional hardrock mining

– Shallow depth with thick reservoir minimizes energy and environmental footprint to access sufficient brine volumes

Social License

– Full carbon footprint of energy from batteries versus traditional energy sources of supply still being assessed but lithium from brine has potential to dramatically reduce carbon footprint for battery manufacturing as compared to alternative sources of battery metals

– This process/source speaks directly to global movement

– Using modular DLE plants minimizes capital costs, reduces permitting risks and shortens construction timeline. Also faster production with higher recoveries compared to solar evaporation ponds. World gets more for less!

Governance

– Canada’s reputation and expertise is being an ethical and environmentally conscious energy producer can extend into the lithium from brine industry.

– Canada’s federal and provincial energy regulators have done an excellent job of balancing often competing demands. Results in an efficient and responsible industry – who better than Canada to be part of the global movement?

Kindersley Lithium Project Phase 1 Preliminary Economic Assessment

Grounded PEA – Leading Lithium from Brine Project

Robust Project Economics – 11,000 tonne/yr lithium hydroxide monohydrate (“LHM”) Phase 1

Grounded’s Kindersley Lithium Project competes with all other lithium companies’ economics (hard rock, Latin America lithium triangle and lithium from brine companies in Canada) Project continues to be de-risked. Sets stage for future critical project milestones

Disclaimer

FN Media Group LLC (FNMG) owns and operates FinancialNewsMedia.com (FNM) which is a third party publisher that disseminates electronic information through multiple online media channels. FNMG’s intended purposes are to deliver market updates and news alerts issued from private and publicly trading companies as well as providing coverage and increased awareness for companies that issue press to the public via online newswires. FNMG and its affiliated companies are a news dissemination and financial marketing solutions provider and are NOT a registered broker/dealer/analyst/adviser, holds no investment licenses and may NOT sell, offer to sell or offer to buy any security. FNMG’s market updates, news alerts and corporate profiles are NOT a solicitation or recommendation to buy, sell or hold securities. The material in this release is intended to be strictly informational and is NEVER to be construed or interpreted as research material. All readers are strongly urged to perform research and due diligence on their own and consult a licensed financial professional before considering any level of investing in stocks. The companies that are discussed in this release may or may not have approved the statements made in this release. Information in this release is derived from a variety of sources that may or may not include the referenced company’s publicly disseminated information. The accuracy or completeness of the information is not warranted and is only as reliable as the sources from which it was obtained. While this information is believed to be reliable, such reliability cannot be guaranteed. FNMG disclaims any and all liability as to the completeness or accuracy of the information contained and any omissions of material fact in this release. This release may contain technical inaccuracies or typographical errors. It is strongly recommended that any purchase or sale decision be discussed with a financial adviser, or a broker-dealer, or a member of any financial regulatory bodies. Investment in the securities of the companies discussed in this release is highly speculative and carries a high degree of risk. FNMG is not liable for any investment decisions by its readers or subscribers. Investors are cautioned that they may lose all or a portion of their investment when investing in stocks. This release is not without bias, and is considered a conflict of interest if compensation has been received by FNMG for its dissemination. To comply with Section 17(b) of the Securities Act of 1933, FNMG shall always disclose any compensation it has received, or expects to receive in the future, for the dissemination of the information found herein on behalf of one or more of the companies mentioned in this release. For current services performed FNMG has been compensated forty five hundred dollars for Grounded Lithium Corp. current news coverage by a non-affiliated third party. FNMG HOLDS NO SHARES OF Grounded Lithium Corp.

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and FNMG undertakes no obligation to update such statements.