GET TOP RATED STOCK ALERTS ACTIVE TRADERS DEPEND ON

SIGN UP TODAY FOR FREE NEWS DRIVEN ALERTS

HIGHLIGHTS:

- US$217 million (Cdn$290 million) after-tax Net Present Value at 8% discount rate and Internal Rate of Return of 28.0%;

- PEA based on a production rate of 5,000 tonnes of lithium carbonate per year;

- Processing based on simple and proven solar evaporation technology;

- Expected mine life of 30 years with a 3 year ramp up period starting 2021;

- Fully loaded operating cost of US$3,122 per tonne of lithium carbonate;

- Total capital expenditure of US$93 million.

Vancouver, BC – April 29, 2019: NRG METALS INC. (“NRG” or the “Company”) (TSX-V:NGZ) (OTCQB:NRGMD) is pleased to announce positive results from an independent Preliminary Economic Assessment (PEA) for its Hombre Muerto North Lithium Project near Salta, Argentina. The PEA was prepared by Knight Piesold Consulting (“KP“) and JDS Energy and Mining (“JDS“), both of Vancouver, in accordance with the standards set out in National Instrument 43-101 Standards of disclosure for Mineral Projects (NI 43-101), and, CIM’s Best Practice Guidelines for Mineral Processing (BPGMP). The PEA is preliminary in nature, and there is no certainty that the PEA will be realized.

Company President and C.E.O Adrian F.C. Hobkirk is quoted: “We are very pleased that NRG has advanced the HMN Project from discovery to PEA in just under twelve months. The PEA results highlight attractive economics associated with the project, including a smaller environmental footprint and manageable CAPEX. We look forward to taking the HMN Lithium Project to the next stage of development as quickly as possible “.

PRELIMINARY ECONOMIC ASSESSMENT HIGHLIGHTS

| After-tax Net Present Value (“ NPV ”) 8% discount rate | $ 217 million |

| After-tax Internal Rate of Return (“IRR”) | 28.0% |

| CAPEX Capital Expenditures | $ 93.3 million |

| OPEX Cash Operating Costs (per metric tonne of lithium carbonate) | $ 3,112 |

| Average Annual Production (lithium carbonate ) | 5,000 |

| Mine Life | 30 years |

| Payback Period (from commencement of production ) | 2 years 5 months |

The Preliminary Economic Assessment is preliminary in nature, there is no certainty that the Preliminary Economic Assessment will be realized. The economic analysis is based upon mineral resources that are measured and indicated, but are not mineral reserves, and have not demonstrated economic viability.

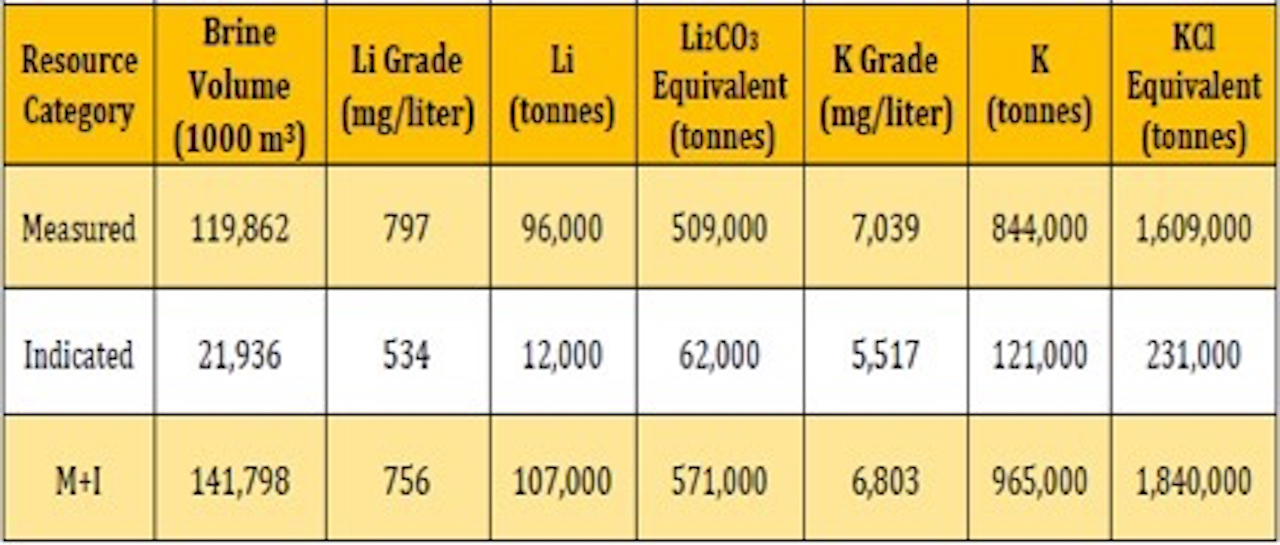

Resource Estimate

The resource estimate was prepared in accordance with C.I.M. requirements/definitions and uses best practice methods specific to brine resources, including a reliance on core drilling and sampling methods that yield depth-specific chemistry and effective (drainable) porosity measurements. The resource estimation was completed by independent qualified person Mr. Michael Rosko, M.Sc., C.P.G. of the international hydrogeology firm E.L. Montgomery & Associates (M&A), which was announced in a news release dated October 2, 2018, and is summarized as follows:

Table 1. Hombre Muerto North Lithium Brine Resource Statement

Tonnages are rounded off to the nearest 1,000. Cutoff grade: 500 mg/L lithium, but no laboratory results were less than the cutoff grade. The conversion used to calculate the equivalents from their metal ions is based on the molar weight for the elements added to generate the equivalent. The equations are Li x 5.3228 = lithium carbonate equivalent and K x 1.907 = potassium chloride equivalent. The reader is cautioned that mineral resources are not mineral reserves and do not have demonstrated economic viability.

The resource is defined over a 3.9 square kilometer footprint using results from core drilling and depth-specific packer sampling. In addition, the brine was also sampled during short term pumping tests. The new Measured and Indicated Resource was derived from two polygons surrounding core holes drilled to depths of 401 and 281 meters (m). Large diameter rotary holes were drilled adjacent to both core holes, each to a depth of about 400 m. The spacing between the two pairs of core/rotary holes is approximately 2.1 kilometers.

CAPITAL COSTS

| Description | $ US Million |

| Evaporation Ponds | 22.8 |

| Plant Facilities and Equipment | 31.5 |

| Infrastructure and Other | 14.5 |

| Direct Costs Subtotal | 68.2 |

| Indirect Costs

Total Direct and Indirect Costs |

11.4

79.6 |

| Contingency @ 17% | 13.3 |

| Total Initial Capital Costs | 93.4 |

Capital costs ( CAPEX ) have been updated with quotations from current suppliers working in project construction and development in the Puna region of Argentina. CAPEX estimates include an Indirect Cost of 16.6% of Direct Costs, and a contingency of 17% of Total Costs.

OPERATING COSTS

| Description | US$M/Year |

| Pond Chemicals | 8.74 |

| Salt Removal and Transport | 0.78 |

| Energy | 1.08 |

| Transportation | 0.31 |

| Maintenance | 1.20 |

| Equipment Operation | 0.23 |

| Manpower | 2.16 |

| Catering and Camp Costs | 0.36 |

| Total Direct Costs | 14.86 |

| Indirect Costs | |

| General and Administrative Local | 0.70 |

| Total Production Costs | 15.56 |

Project Location and Environmental Permitting

The Project is located at the northern portion of the Salar del Hombre Muerto, at the boundary zone of the Catamarca and Salta provinces, 170 km southeast of the city of Salta. The project area comprises a collection of properties or concessions acquired under purchase options from the existing owner. The properties are held as “minas” (full mining licenses not subject to further area reduction requirements) by Mr. Jorge Moreno, a private borate producer focused on the exploration, exploitation and marketing of ulexite. The Project comprises six properties distributed over the Salar for a total of 3,237 hectares. All properties are subject to a mining license for borates. The area of the Property is not subject to any known environmental liabilities.

Lithium Pricing

Lithium prices were based on an average of three years historic pricing and two years forward projections for battery grade lithium. The three-year historic price (to April 2019) is $11,770 /t. Contemporary publicly available reports have published a range of forward pricing that varies between $10,700 to $14,750 /t for the next two years. The median price of $13,400 /t was selected as the forward projected price for each of the next two years. This resulted in a project price assumption of $12,420 /t, which was used as the basis of the study. A range of +/- 20% was evaluated to test the project’s sensitivity to price assumptions.

Recovery and Processing

The PEA models the extraction of the brine containing the lithium resource by means of multiple extraction wells.

The brine will be pumped to a series of pre-concentration and concentration evaporation ponds. Evaporation will increase the lithium content and precipitate or “salt out” species such as Na, K, and Cl. Lime will be added to the pre-concentrated brine to remove bulk impurities such as sulphate as gypsum, which will be physically separated. The final concentrated solution will be stored in lithium surge evaporation ponds then pumped to a hydrometallurgical processing plant to purify the concentrated brine and recover the final product.

The production of lithium carbonate involves the following steps:

- Boron removal using solvent extraction;

- Polishing of the boron-free raffinate in order to remove impurities such as residual calcium and magnesium, among others, using sodium carbonate (soda ash) solution, Na2CO3;

- Lithium carbonate (Li2CO3) precipitation (“carbonation”) using sodium carbonate solution;

- Lithium carbonate purification by re-dissolution with carbon dioxide and re-precipitation by desorption;

- Lithium carbonate drying, conditioning and packaging.

It was deemed that the quality of the hydrometallurgical plant-concentrated feed-brine was superior in terms of key impurity to lithium ratios. For this reason, stages such as bulk sulphate polishing (using calcium or barium chloride) were excluded from the process. The need of scavenging precipitation for magnesium using caustic soda was also deemed redundant at this point in time. Instead, a purification circuit was included to ensure adequate purity of the final product, targeted as battery-grade lithium carbonate (99.5% Li2CO3).

Qualified Person Statements

Richard Goodwin, P.Eng., Project Manager for JDS Energy and Mining, Inc., is independent of NRG Metals Inc.. and a ‘Qualified Person’ as defined under Canadian National Instrument 43-101. Mr. Goodwin is a mining engineer and Study manager with over 30 years of experience managing mining operation and projects in various commodities such as base metals, precious metals, PGMs, and diamonds in various domestic and international locations. Mr. Goodwin is responsible for the PEA results, participated directly in the production of this press release, and directly related information in this press release, and approves of the technical and scientific disclosure contained herein.

Alex Mezei, P.Eng, is a ‘Qualified Person’ as defined under Canadian National Instrument 43-101, is responsible for the processing and recovery assumptions used in the preparation of the PEA, which are disclosed in this news release. Mr. Mezei is a Consulting Metallurgist with extensive experience in base, precious, rare and light metals, including lithium, cobalt, graphite, etc. Mr. Mezei is independent of NRG Metals Inc.

The P.E.A. is the first step in moving the HMN Project towards potential development. The process developed for the site is based on conventional, proven technology for brine operations. The project is located with easy access to energy, and on a salar of development activity. Galaxy Resources Ltd. recently sold the land surrounding the HMN Lithium Project to Korean conglomerate POSCO for $ US 280 million and are continuing to develop their remaining portion of the salar, referred to as the Sal da Vida Project. The project is located in a jurisdiction that is mining friendly (Salta Province), and the Government of Argentina recently announced reducing the corporate tax rate for mining companies to 25% in 2020.

The final report is expected to be completed within the next 45 days and filed on SEDAR. Pending completion of the report, the Company intends to rapidly advance the HMN Lithium Project to a full feasibility study which will include upgrading the current resource to a reserve status. Pilot test work to develop the basic engineering will be performed with the intent of producing a Battery Grade Lithium Carbonate (99.5% Li2CO3 purity).

On behalf of the board of directors of NRG Metals Inc.

Adrian F. C. Hobkirk

President and Chief Executive Officer

Investors / Shareholders Call 855-415-8100 or direct to Adrian Hobkirk 714-316-3272 ahobkirk@nrgmetalsinc.com

The TSX Venture Exchange has not reviewed the content of this news release and therefore does not accept responsibility or liability for the adequacy or accuracy of the contents of this news release.

This news release contains certain “forward- looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward- looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. We seek safe harbor.

SOURCE: NRG METALS INC.

February 6, 2019 / Vancouver, BC / NRG Metals Inc. (“NRG” or the “Company”) (TSX-V: NGZ) (OTCQB: NRGMF) (Frankfurt: OGPN) is pleased provide an update on progress with a Preliminary Economic Analysis of the Hombre Muerto North Lithium Project, located in Salta Province, Argentina. The evaluation is being conducted by Knight Piésold Consulting (KP) and JDS Energy & Mining (JDS).

The analyses are currently focused on process engineering optimizations. Simultaneously, design work and evaluation of site infrastructure is ongoing, including the overall general arrangement with optimal location for potential pilot and production plant sites and the ponds. Material quantities and costs are being prepared and preliminary economic numbers are being developed for the P.E.A.

The HMN Project is strategically located in the Hombre Muerto Salar, an area of active lithium production by FMC at the Fenix lithium mine, some 12 kilometers south of the project area. The project is surrounded by ground now owned by POSCO, a Korean based lithium producer, as a result of its US$ 280 million purchase of the area from Galaxy Resources Ltd, an Australian based producer. Galaxy is also moving their portion of the Hombre Muerto Salar, the Sal de Vida Project, to lithium production.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F. C. Hobkirk,

President and C.E.O.

T: Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk 714.316.3272

E: ahobkirk@nrgmetalsinc.com

W: www.nrgmetalsinc.com

The TSX Venture Exchange has not reviewed the content of this news release and therefore does not accept responsibility or liability for the adequacy or accuracy of the contents of this news release.

This news release contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward looking statements. The reader is cautioned not to place undue reliance on forward-looking statements. We seek safe harbor.

Source: NRG Metals Inc.

January 31, 2019 / Vancouver, BC / NRG Metals Inc. (“NRG” or the “Company”) (TSX-V: NGZ) (OTCQB: NRGMF) (Frankfurt: OGPN) is pleased to announce it is working with Eastern Shore Microbes (E.S.M.) of Virginia, USA, to evaluate the potential for enhancing evaporation characteristics if lithium brine at the Hombre Muerto North Lithium Project (H.M.N.) located in Salta and Catamarca Provinces, Argentina.

E.S.M. is developing Halophillic Evaporative Applications Technology (H.E.A.T.) The process has been utilized to evaporate and clean brines from curing cattle hides and E.S.M. is currently using their collection of over 1300 microbes to adapt the technology to potentially enhance and shorten the production cycle of lithium from brines. Testing will be conducted over the coming months on brine samples from the HMN project at the E.S.M. laboratory in Belle Haven, Virginia.

E.S.M. is headed by Dr. Russell Vreeland. Dr. Vreeland is an expert in the microbial eco logy of saline environments. He is the co-discoverer of the world’s oldest known bacteria, the 250 million year old Virgibacillus strains, extracted from ancient salt crystals found deep in a salt mine outside Carlsbad NM. He has also isolated living microbes from salt cores in Brazil and the oldest know DNA from 412 million year old salt from a Detroit Mine.

The Company is also in discussions with two developers of alternative extraction technologies. NRG is committed to evaluating all aspects of potential lithium production including those that may allow for a shortened production cycle.

NRG recently filed a report titled “Initial Measured Lithium and Potassium Resource Estimate Hombre Muerto North Project, Salta and Catamarca Provinces, Argentina.” The report was completed in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, on behalf of the Company by independent consultants Montgomery and Associates, of Santiago Chile. The report identifies 571,000 tonnes of Lithium Carbonate Equivalent at a grade of 756 parts per million lithium in the combined Measured and Indicated categories, with a low magnesium to lithium ratio of 2.6 to 1.0 (October 3, 2108 press release) that will be used in the completion of the PEA.

The HMN Project is strategically located in the Hombre Muerto Salar, an area of active lithium production by FMC at the Fenix lithium mine, some 12 kilometers south of the project area. The project is surrounded by ground now owned by POSCO, a Korean based lithium producer, as a result of its US$ 280 million purchase of the area from Galaxy Resources Ltd, an Australian based producer. Galaxy is also moving their portion of the Hombre Muerto Salar, the Sal de Vida Project, to lithium production.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F. C. Hobkirk,

President and C.E.O.

T: Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk 714.316.3272

E: ahobkirk@nrgmetalsinc.com

W: www.nrgmetalsinc.com

The TSX Venture Exchange has not reviewed the content of this news release and therefore does not accept responsibility or liability for the adequacy or accuracy of the contents of this news release.

This news release contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward looking statements. The reader is cautioned not to place undue reliance on forward-looking statements. We seek safe harbor.

Source: NRG Metals Inc.

January 24, 2019 / Vancouver, BC / NRG Metals Inc. (“NRG” or the “Company”) (TSX-V: NGZ) (OTCQB: NRGMF) (Frankfurt: OGPN) is pleased to announce that it has selected Knight Piésold Consulting (KP) and JDS Energy & Mining (JDS) to prepare a National Instrument 43-101 Preliminary Economic Assessment (PEA) on its flagship Hombre Muerto Norte (HMN) Lithium Project, located in Salta Province, Argentina.

The HMN Project is strategically located in the Hombre Muerto Salar, an area of active lithium production. The development strategy for HMN focuses on production of 5,000 tonnes per year of lithium carbonate, with the potential for expansion. A site visit was completed in December 2018 and the project evaluation and report are progressing in a timely manner. The report is expected to be completed during Q1 2019.

KP is a global consulting firm that provides specialized services to the mining, power, water resources, infrastructure, and oil and gas industries. The company focuses on creating value at every stage of a project through quality driven, sustainable, and cost-effective solutions. Established in South Africa in 1921, KP has expanded their reach into a global network of over 800 professionals based in offices in North and South America, Europe, Africa, Australia, and Asia. KP has extensive experience working in Argentina, with offices in Mendoza, San Juan and Neuquen.

JDS is an engineering, project, and construction management firm composed of a diverse set of skilled and highly experienced mining and construction professionals. With a proven record of providing clients with fit-for-purpose solutions and value delivery, JDS has acquired a reputation for delivering and executing project plans on budget, on time, and most importantly, safely. The JDS team prides itself on delivering project concepts from inception to full operations, providing clients with technical engineering support, onsite operations services and EPCM.

NRG recently filed a report titled “Initial Measured Lithium and Potassium Resource Estimate Hombre Muerto North Project, Salta and Catamarca Provinces, Argentina.” The report was completed in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, on behalf of the Company by independent consultants Montgomery and Associates, of Santiago Chile. The report identifies 571,000 tonnes of Lithium Carbonate Equivalent at a grade of 756 parts per million lithium in the combined Measured and Indicated categories, with a low magnesium to lithium ratio of 2.6 to 1.0 (October 3, 2108 press release) that will be used in the completion of the PEA.

The HMN Project is strategically located in the Hombre Muerto Salar, an area of active lithium production by FMC at the Fenix lithium mine, some 12 kilometers south of the project area. The project is surrounded by ground now owned by POSCO, a Korean based lithium producer, as a result of its US$ 280 million purchase of the area from Galaxy Resources Ltd, an Australian based producer. Galaxy is also moving their portion of the Hombre Muerto Salar, the Sal de Vida Project, to lithium production.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F. C. Hobkirk,

President and C.E.O.

T: Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk 714.316.3272

E: ahobkirk@nrgmetalsinc.com

W: www.nrgmetalsinc.com

The TSX Venture Exchange has not reviewed the content of this news release and therefore does not accept responsibility or liability for the adequacy or accuracy of the contents of this news release.

This news release contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward looking statements. The reader is cautioned not to place undue reliance on forward-looking statements. We seek safe harbor.

Source: NRG Metals Inc.

HIGHLIGHTS

- 756 parts per million Li contained within 571,000 tonnes in the Measured Indicated Categories

- Low magnesium to lithium ratio of 2.6 to 1.0

- Second well pumps at 20 liters per second limited only by pump size

October 3, 2018, Vancouver, BC – NRG Metals Inc. (“NRG” or the “Company”) (TSX-V: NGZ) (OTCQB: NRGMF) (Frankfurt: OGPN) is pleased to provide additional information regarding the maiden lithium (“Li”) and potassium (“K”) resource statement for its Hombre Muerto Norte lithium brine project in the Salta province of Argentina. The average grade of lithium for the 571,000 tonne combined Measured and Indicated resource ( 509,000 measured and 62,000 indicated ) is 756 mg/liter lithium, with a low lithium to magnesium ratio of 2.6 to one.

We provided the NI 43-101 resource statement in Table 1 of our October 2, 2018 press release, and we have reproduced Table 1 below with the inclusion of grade data for lithium and potassium. We refer the reader to our October 2, 2018 press release for detailed information about the resource estimate.

Table 1. Hombre Muerto North Lithium Brine Resource Statement

| Resource Category |

Brine Volume (1000 m3) | Li Grade

(mg/liter) |

Li

(tonnes) |

Li2CO3 Equivalent (tonnes) |

K Grade (mg/liter) | K (tonnes) |

KCl Equivalent (tonnes) |

| Measured | 119,862 | 797 | 96,000 | 509,000 | 7,039 | 844,000 | 1,609,000 |

| Indicated | 21,936 | 534 | 12,000 | 62,000 | 5,517 | 121,000 | 231,000 |

| M+I | 141,798 | 756 | 107,000 | 571,000 | 6,803 | 965,000 | 1,840,000 |

Tonnages are rounded off to the nearest 1,000. Cutoff grade: 500 mg/L lithium, but no laboratory results were less than the cutoff grade. The conversion used to calculate the equivalents from their metal ions is based on the molar weight for the elements added to generate the equivalent. The equations are Li x 5.3228 = lithium carbonate equivalent and K x 1.907 = potassium chloride equivalent.

The reader is cautioned that mineral resources are not mineral reserves and do not have demonstrated economic viability.

As we reported in a press release dated September 21, initial pumping tests from our first pumping test well (TWW18-01) located on the eastern side of the property indicated an average pumping rate of 25 liters per second of brine. We have completed pumping tests on the second pumping test well (TWW18-02), located approximately 2.1 kilometers west of the first pumping well, and we are pleased to report that the initial results from the second pumping well indicated an average pumping rate of 20 liters per second of brine. Both tests were conducted over a period of 72 hours. The capacity of the pump used for the pumping tests for both holes was limited, and we expect that the pumping rates will be exceeded with a larger pump.

Adrian Hobkirk, President and CEO of NRG, commented, “The grades we are seeing at the Hombre Muerto Project are some of the highest reported grades for any of the lithium-bearing brine deposits in Argentina. The combination of high grades, excellent chemistry and good pumping rates are very positive indicators that we hope will allow us to advance the project through feasibility studies to production should the economic viability and technical feasibility of the project be established.”

Qualified Person

The resource evaluation work was completed by Mr. Michael Rosko, M.Sc., C.P.G. of E. L. Montgomery and Associates of Santiago, Chile (“M&A”). Mr. Rosko is a Registered Geologist (C.P.G.) in Arizona, California, and Texas, a Registered Member of the Society for Mining, Metallurgy and Exploration, and is a qualified person (QP) as defined by NI 43-101. Mr. Rosko and hydrogeologists from M&A have been on site multiple times during the various phases of drilling and sampling operations; Mr. Rosko has extensive experience in salar environments and has been a QP on many lithium brine projects. Mr. Rosko and M&A are completely independent of NRG. Mr. Rosko has reviewed and approved the content of this news release.

On behalf of the board of directors of NRG Metals Inc.,

Adrian F. C. Hobkirk, President and C.E.O.

Investors / Shareholders Call 855-415-8100 or direct to Adrian Hobkirk 714-316-3272 ahobkirk@nrgmetalsinc.com.

The TSX Venture Exchange has not reviewed the content of this news release and therefore does not accept responsibility or liability for the adequacy or accuracy of the contents of this news release.

This news release contains certain “forward- looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward- looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. We seek safe harbor.

SOURCE: NRG Metals Inc.

Vancouver, BC – October 2, 2018 – NRG Metals Inc. (“NRG” or the “Company”) (TSX-V: NGZ) (OTCQB: NRGMF) (Frankfurt: OGPN) is pleased to report a maiden lithium (“Li”) and potassium (“K”) resource statement for its Hombre Muerto Norte lithium brine project in the Salta province of Argentina. The NI 43-101 resource statement, detailed in Table 1 below, includes 509,000 tonnes (metric tons) of lithium carbonate (“Li2CO3”) equivalent (“LCE”) and 1,609,000 tonnes of potash (“KCl”) equivalent in the Measured and Indicated Resource categories, with an additional 62,000 tonnes of LCE and 231,000 tonnes KCl in the Indicated Resource category.

Adrian Hobkirk, President and CEO of NRG, commented, “We are very excited to see a robust and high-grade 43-101 resource estimate from our hydrogeological consultants. “The Company now has a high-quality defined resource estimate with positive chemical characteristics that will hopefully allow us to advance the project through feasibility studies to production should the economic viability and technical feasibility of the project be established.”

Table 1. Hombre Muerto North Lithium Brine Resource Statement

| Resource Category |

Li (tonnes) | Li2CO3 Equivalent (tonnes) |

K (tonnes) |

KCl Equivalent (tonnes) | |

| Measured | 96,000 | 509,000 | 844,000 | 1,609,000 | |

| Indicated | 12,000 | 62,000 | 121,000 | 231,000 | |

| M+I | 108,000 | 571,000 | 965,000 | 1,840,000 | |

Tonnages are rounded off to the nearest 1,000. Cutoff grade: 500 mg/L lithium, but no laboratory results were less than the cutoff grade.

The conversion used to calculate the equivalents from their metal ions is based on the molar weight for the elements added to generate the equivalent. The equations are Li x 5.3228 = lithium carbonate equivalent and K x 1.907 = potassium chloride equivalent.

The reader is cautioned that mineral resources are not mineral reserves and do not have demonstrated economic viability.

The resource estimate was prepared in accordance with the requirements of National Instrument 43-101 and uses best practice methods specific to brine resources, including a reliance on core drilling and sampling methods that yield depth-specific chemistry and effective (drainable) porosity measurements. The resource estimation was completed by independent qualified person Mr. Michael Rosko, M.Sc., C.P.G. of the international hydrogeology firm E.L. Montgomery & Associates (M&A).

The resource is defined over a 3.9 square kilometer footprint using results from core drilling and depth-specific packer sampling. In addition, the brine was also sampled during short-term pumping tests. The new Measured and Indicated Resource was derived from two polygons surrounding core holes drilled to depths of 401 and 281 meters (m). Large-diameter rotary holes were drilled to adjacent to both core holes, each to a depth of about 400 m. The spacing between the two pairs of core/rotary holes is approximately 2.1 kilometers.

The chemistry of the Hombre Muerto North brine is judged to be very favorable. Brine density and the ratios of magnesium and sulfate to lithium for the combined measured and indicated resource are given below:

- Density of the brine from depth-specific samples at the core holes ranged from 1.19 to 1.23 grams per cubic centimeter (g/cm3)

- Average Magnesium/Lithium ratio is 2.6 to 1

- Average Sulfate/Lithium ratio is 11.7 to 1

Based on the geologic model, approximately 33% of the resource is hosted by sand and silty sand units, 28% by interbedded halite, sand and silty sand and 39% sandy conglomerate.

The total contained lithium and potassium values are based on measurements of effective (drainable) porosity distributed throughout the aquifer volume that defines this resource. This method of porosity determination is designed to estimate the portion of the total porosity that can theoretically be drained by pumping; however, these estimates may differ from total extractable quantities. The drainable porosity is different for each hydrogeologic unit, but the average ranges from about 8 to 11% based on laboratory results.

Resource Estimation Methodology

A total of 627.5 m of drilling from two holes were evaluated for this resource estimate calculation. A total 20 drainable porosity results and 35 depth-specific brine sample analyses were used in the computations, not including QA/QC samples or composite samples obtained during pumping tests. The average spacing of vertical samples for both drainable porosity and chemistry was variable with an average of approximately 31 m for drainable porosity samples and 18 m for depth-specific brine samples. The first core hole was terminated at a depth of 401 m due to drill limitations and the second hole was terminated at a depth of 281 m due to difficult drilling conditions; the hydrogeologic basement was not encountered. The total thickness of the basin, and the total thickness of saturated sediments, is unknown. Based on well drilling and geophysical measurements, additional brine-bearing aquifer material is believed to exist below 400 m in most of the concession area.

The consultants chose to estimate the resource using a drill-hole centered polygonal technique. Hydro-stratigraphic units have variable thickness and were determined by the consultants based on observed lithology and anticipated similar hydraulic properties. The values for drainable porosity and grade (lithium and potassium values) for each hydro-stratigraphic unit were derived from direct measured values from the well. The unit thicknesses combined with the areas yield a volume of total saturated aquifer. The saturated volume combined with the drainable porosity values, represent the amount of fluid theoretically available from the formation, and subsequently yield the drainable volume of brine. Applying the average lithium and potassium grades for each unit provides the estimated resource for each block, which are then summed for each hydro-stratigraphic polygon unit. Total lithium and potassium volumes are then represented as lithium carbonate and potassium chloride equivalents.

The primary analytical laboratories for the data used in this resource are Alex Stewart (NORLAB) in Jujuy, Argentina. The laboratory is accredited to ISO 9001:2008 and ISO14001:2004 for their geochemical and environmental labs for the preparation and analysis of numerous sample types, including brines.

The porosity determinations were made by Geosystems Analysis (GSA) of Tucson, Arizona. GSA has abundant experience since 1994 in reservoir description, production enhancement and reservoir management services and has provided services to various other lithium projects located in Argentina and globally.

Qualified Person

The resource evaluation work was completed by Mr. Michael Rosko, M.Sc., C.P.G. of E. L. Montgomery and Associates of Santiago, Chile (“M&A”). Mr. Rosko is a Registered Geologist (C.P.G.) in Arizona, California, and Texas, a Registered Member of the Society for Mining, Metallurgy and Exploration, and is a qualified person (QP) as defined by NI 43-101. Mr. Rosko and hydrogeologists from M&A have been on site multiple times during the various phases of drilling and sampling operations; Mr. Rosko has extensive experience in salar environments and has been a QP on many lithium brine projects. Mr. Rosko and M&A are completely independent of NRG. Mr. Rosko has reviewed and approved the content of this news release.

A Technical Report prepared under the guidelines of NI 43-101 standards describing the resource estimation will be filed on SEDAR within 45 days of this release.

On behalf of the board of directors of NRG Metals Inc.,

Adrian F. C. Hobkirk, President and C.E.O.

Investors / Shareholders Call 855-415-8100 or direct to Adrian Hobkirk 714-316-3272 ahobkirk@nrgmetalsinc.com.

The TSX Venture Exchange has not reviewed the content of this news release and therefore does not accept responsibility or liability for the adequacy or accuracy of the contents of this news release.

This news release contains certain “forward- looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward- looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. We seek safe harbor.

Source: NRG Metals Inc.

VANCOUVER, September 25, 2018 /PRNewswire/ — NRG Metals Inc. (“NRG” or the “Company”) (TSX-V: NGZ) (OTCQB: NRGMF) (Frankfurt: OGPN) The Company is pleased to announce that it has completed the third installment of it’s purchase option for the Hombre Muerto North Lithium Project (” HMN Project “), located in Salta Province, Argentina. A payment of $ US 250,000 and one million common shares have been made to the vendor as per the contract terms. The vendor has also become an insider of the Company as defined by Canadian securities regulations. The Company has now completed an extensive evaluation of the HMN Project, and intends to announce a maiden resource estimate in the immediate future through the release of an independent NI43-101 technical report.

The HMN Project is strategically located in the Hombre Muerto Salar, an area of lithium production by FMC at the Fenix Lithium Mine, some 12 kilometers south of the project area. The project is surrounded by ground now owned by POSCO, a Korean based conglomerate, as a result of their $ US 280 million purchase of the area from Galaxy Resources Ltd, an Australian based producer. Galaxy is also moving their portion of the Hombre Muerto Salar, the Sal de Vida Project, to lithium production.

Salar Escondido Update

The Company has completed a technical review of exploration results to date at the Salar Escondido Project, located in Catamarca Province, Argentina. Two holes have been attempted at this large project area, and drilling has proven to be very challenging. The presence of lithium in highly permeable host rocks was confirmed in both holes, but there was considerable variation in lithium grades and Mg/Li ratios. No representative sample to target depth has been obtained to date, and only a small portion of the project area has been drill tested.

The project is comprised of five underlying agreements. One has been terminated, relinquishing approximately 3,000 hectares of the 29,000 hectare total. As a completion of an option commitment on part of the Luz Maria claim group, the Company is issuing 420,000 shares to the underlying owner. Management are in discussions regarding the project, and anticipate further developments in the near future.

Consulting Agreements

The Company has entered into two consulting agreements with Market IQ Media Group Incorporated (“Market IQ”) and VibraSlim Sales Inc. (“Vibraslim’). Each of the consultants were retained to provide digital marketing primarily using Google ads, digital media, corporate advisory, branding and strategic business services to the Company over a four-month period for consideration of $400,000 to Market IQ and $100,000 to VibraSlim. The Company prepaid the total amount of $500,000 to these two entities using cash on hand. Market IQ is located in Vancouver B.C. and owned by Brady Middleditch. VibraSlim is located in Vancouver B.C. and owned by Chris Jackson.

Subsequent to the entry into the consulting agreements, MarketIQ and VibraSlim subscribed for 2,000,000 units of the Company in the above-mentioned private placement for total subscription amount of $500,000. The Company has received full payment for the private placement units from these two entities by cheque.

The TSX Venture Exchange has not reviewed the content of this news release and therefore does not accept responsibility or liability for the adequacy or accuracy of the contents of this news release.

This news release contains certain “forward- looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward- looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. The transaction described in this news release is subject to a variety of conditions and risks which include but are not limited to: regulatory approval, shareholder approval, market conditions, legal due diligence for claim validity, financing, political risk, security risks at the property locations and other risks. As such, the reader is cautioned that there can be no guarantee that this transaction will complete as described in this news release. We seek safe harbor.

Contact:

Adrian F.C.Hobkirk

President and Chief Executive Officer

Investors / Shareholders Call 855-415-8100 or direct to Adrian Hobkirk 714-316-3272 ahobkirk@nrgmetalsinc.com

SOURCE NRG Metals Inc.

HIGHLIGHTS

- NRG’s second drill hole at the Hombre Muerto North project has been completed to a depth of 280.8 m, and the sample results demonstrate that excellent lithium values are present in the lower portion of the hole.

- Based on these encouraging results, as well as the excellent results from the pumping well located approximately 2.1 kilometers to the east, NRG has decided to drill a second pumping well adjacent to the second core hole. The target depth of this hole is 400 m.

VANCOUVER, British Columbia, Aug. 23, 2018 /PRNewswire/ — NRG Metals Inc. (“NRG” or the “Company”) (TSX-V: NGZ) (OTCQB: NRGMF) (Frankfurt: OGPN) is pleased to report additional assays from the second diamond drill hole at the Hombre Muerto North lithium project. The samples were taken from depths ranging from 91.0 to 230.5 m below surface, and these assays range from 779 to 507 mg/L lithium with low Mg to Li ratios ranging from 2.3 to 3.0. The average for the entire hole is 638 mg/L Lithium with a Mg to Li ratio of 2.65 to 1.0. The assay results for the additional samples are shown in the following table.

Host rocks are mainly poorly-consolidated sandstone from surface to 77 m, followed by a layer of compact halite from 77 to 139 m, poorly-consolidated sandstone from 139 to 166 m, and then intercalated halite and sandstone to 230.5 meters. The sample interval is not regular because it was difficult to collect samples due to caving of the hole. Nevertheless, these results confirm that brine containing high lithium grades is present from the surface to a depth of at least 230 m, the depth of the deepest sample.

Based upon these encouraging results, management decided to drill a second pumping well adjacent to this core hole. Equipment has been moved into place, and the contractor has commenced drilling to an anticipated target depth of 400 meters.

Jose de Castro, COO of NRG Metals Inc., commented, “We are extremely enthusiastic about the diamond drilling results, as well as the results from the pumping well. These results demonstrate the presence of high-grade lithium bearing brine across the breadth of our Tramo property. We look forward to completing the second pumping well and to fast tracking the project to production.”

The sampling was conducted with double packer equipment over 1.0- to 1.5-m intervals, and the final sample from 228.5 to 230.5 m was collected using a bailer sampling device. Onsite QA/QC for the sampling was directed by Cristian Avila of Montgomery and Associates of Santiago, Chile under the supervision of Mike Rosko, also of Montgomery and Associates, a Qualified Person under NI 43-101. The samples were assayed by the Alex Stewart Laboratory in Jujuy, Argentina, which is the preeminent laboratory for lithium brine analysis in northern Argentina. Alex Stewart employed Inductively Coupled Plasma Optical Emission Spectrometry (“ICP-OES”) as the analytical technique for the primary constituents of interest, including those shown in the table. Alex Stewart maintains a strict internal QA/QC program employing multiple standards, re-analyses by AA and calculation of ionic balances. NRG inserted one blank sample and one blind duplicate samples in the sample batch; all QA/QC results corroborate the analyses reported in this press release. In addition to the packer brine samples, sealed core samples have been collected, and these samples will be sent to a laboratory in the United States for brine release testing.

The project is located in the province of Salta, Argentina at the northern end of the prolific Hombre Muerto Salar, adjacent to FMC’s producing Fenix mine and the Sal de Vida development stage project being developed by Galaxy Resources Ltd.

About the Company

NRG Metals Inc. is an exploration stage company focused on the advancement of lithium brine projects in Argentina. NRG Metals Inc. currently has approximately 132 million shares issued and outstanding, and trades on the TSX Venture Exchange under symbol NGZ, on the OTC QB Market under symbol NRGMF, and on the Frankfurt Stock Exchange under symbol OGPN.

Technical Disclosure

The preparation of this press release was supervised by Mr. Michael J. Rosko, a registered professional geologist in the states of Arizona (25065), California (5236), and Texas (6359), and a registered member of Society for Mining, Metallurgy, and Exploration (#4064687) and a Qualified Person as defined under National Instrument 43-101 with over 30 years of experience, with 10 years of direct experience with lithium brine deposits. Mr. Rosko approves the scientific and technical disclosure contained in this press release.

The TSX Venture Exchange has not reviewed the content of this news release and therefore does not accept responsibility or liability for the adequacy or accuracy of the contents of this news release.

This news release contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward-looking statements. The reader is cautioned not to place undue reliance on forward-looking statements. We seek safe harbor.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F.C. Hobkirk

President and C.E.O.

Media Contact:

Investors / Shareholders

T:+1-855-415-8100

Adrian Hobkirk

T: +1-714-316-272

E: ahobkirk@nrgmetalsinc.com

SOURCE NRG Metals Inc.

Maiden Resource Estimate Expected Shortly

VANCOUVER, British Columbia, September 21, 2018 /PRNewswire/ — NRG Metals Inc. (“NRG” or the “Company”) (TSX-V: NGZ) (OTCQB: NRGMF) (Frankfurt: OGPN) The Company is pleased to announce the completion of a second pumping well at the Hombre Muerto North Lithium Project, Salta, Argentina. The well, designated TWW18-02, was drilled to the target depth of 400 meters, and it is located immediately adjacent to core hole TH18-02, which was described in the company’s press releases dated July 10, 2018 and August 23, 2018. Pumping tests will commence shortly.

Pumping well TWW18-02 was drilled adjacent to core hole TH18-02 on the western side of the Tramo concession. The core hole was drilled to a depth of 281 meters, and the arithmetic average of single packer, double packer and one bailer sample from surface to a depth of 230.5 meters was 638 mg/L with a low Mg to Li ratio of 2.65 to one. Host rocks were mainly poorly-consolidated sandstone from surface to 77 m, followed by compact halite from 77 to 139 m, poorly-consolidated sandstone from 139 to 166 m and then intercalated halite and sandstone to the bottom of the hole. The results from the pumping well were consistent with the core hole.

As we reported in our press release dated June 28, 2018, the arithmetic average of all samples (single packer) for TH18-01 from the surface to a depth of 401 meters was 900 mg/L with a low magnesium to lithium ratio of 3.0 to one. Host rocks were almost entirely poorly-consolidated sandstone and conglomerate. Pumping well TWW18-01 was drilled adjacent to core hole TH18-01, and the results from the pumping well were consistent with the core hole. Initial pumping tests from TWW18-01 indicated an average pumping rate of 25 liters per second of brine, but the capacity of the pump was limited, and we expect that this rate will be exceeded with a larger pump. TH18-01 and TWW18-01 are located on the eastern side the Tramo concession approximately 2.1 kilometers from hole TH18-02 and TWW18-02.

Two bulk samples of brine have been collected from pumping well TH18-01 for technical evaluation. A 200 liter sample has been shipped to the Company’s strategic partner Chengdu Chemphys Chemical Industry Co., Ltd, (“Chemphys”), located in Chengdu, China. Chemphys, along with Sunresin New Materials Co. Ltd. , Xi’an, located in Shaanxi, China, are evaluating the brine for new recovery applications. A large bulk sample has also been collected via tanker truck by Alex Stewart Laboratories, located in Jujuy, Argentina, to evaluate and optimize magnesium removal.

NRG’s technical advisor, Montgomery and Associates of Santiago, Chile, is preparing a maiden resource estimate compliant to National Instrument 43-101, as part of a technical report for the Hombre Muerto North project, which will be completed and announced shortly.

The preparation of this press release was supervised by Mr. William Feyerabend, a Certified Professional Geologist and a Qualified Person under NI 43-101. Mr. Feyerabend approves of the technical and scientific disclosure contained in this press release.

The TSX Venture Exchange has not reviewed the content of this news release and therefore does not accept responsibility or liability for the adequacy or accuracy of the contents of this news release.

This news release contains certain “forward- looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward- looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. The transaction described in this news release is subject to a variety of conditions and risks which include but are not limited to: regulatory approval, shareholder approval, market conditions, legal due diligence for claim validity, financing, political risk, security risks at the property locations and other risks. As such, the reader is cautioned that there can be no guarantee that this transaction will complete as described in this news release. We seek safe harbor.

On behalf of the board of directors of NRG Metals Inc.,

Adrian F. C. Hobkirk, President and C.E.O.

Investors / Shareholders Call +1-855-415-8100 / Direct to Adrian Hobkirk +1-714-316-3272 ahobkirk@nrgmetalsinc.com

SOURCE NRG Metals Inc.

Sign Up for FREE

Stock Alerts from

to be the first to know when this emerging company issues Breaking News!

NRG Metals Inc. is an exploration stage company focused on the advancement of lithium brine projects in Argentina. It is currently drilling the 29,000 hectare (71660 acre) Salar Escondido Lithium Project, in Catamarca province where the company recently completed a 400 meter rotary hole, as described in the Company’s press release dated May 8, 2018. The diameter of the hole is currently being enlarged by reaming to install casing so that it can be sampled.

In addition to the Salar Escondido lithium project, the Company is currently drilling at its 3,287 hectare (8,100 acre) Hombre Muerto Norte lithium project (“HMN”) in Salta province and just added a second drill rig to the project as described in the Company’s development stage project, as described in the Company’s press release dated May 14, 2018. A NI 43-101 report for HMN was filed on SEDAR in October 2017. The HMN project is located at the northern end of the prolific Hombre Muerto Salar, adjacent to FMC’s producing Fenix  mine and Galaxy Resources’ Sal de Vida development stage project.

mine and Galaxy Resources’ Sal de Vida development stage project.

The Company currently has working capital of CAD$4.0 million dollars. The Company plans to use its working capital to fund the ongoing exploration drill programs at the Salar Escondido and HMN Projects.

The Company currently has approximately 132 million shares issued and outstanding, and trades on the TSX Venture Exchange under the symbol NGZ, on the OTCQB Market under the symbol, NRGMF, and on the Frankfurt Stock Exchange under the symbol, OGPN.

COMPANY HIGHLIGHTS

- Experienced Lithium Brine Junior

- Two Drill Projects underway in Lithium Triangle, Argentina

- Sizeable Properties adjacent to leading Lithium-Brine producers

- World Class Management Team

- Partnered with high-purity Lithium battery producer in China – Chemphys – www.chemphys.com

- C$4.0 M in working capital, no debt, C$36 M market cap

- NRG Metals listed as TOP 10 PERFOMER in Mining in 2018

TSX Venture 50 Ranking – www.tmxmoney.com

BOARD OF DIRECTORS

Adrian F.C. Hobkirk

PRESIDENT & CHIEF EXECUTIVE OFFICER, DIRECTOR

Mr. Hobkirk has 26 years of experience in the mining and venture capital industry, beginning with Norgold Resources in 1990, which was ultimately purchased by BEMA Gold. Mr. Hobkirk has been involved in Guyana for over twenty years and founded the company to develop the Groete Gold Copper Deposit in 2006. He has worked in many countries including Canada, Mongolia, Venezuela, Guyana, Chile, Colombia, the United States and Mexico. He has been involved in mineral exploration and technology ventures, and has extensive public company experience. He holds a BA in Economics from Simon Fraser University and is the largest single individual shareholder of the Company.

José Gustavo de Castro

DIRECTOR & CHIEF OPERATING OFFICER

Mr. de Castro is a chemical engineer with extensive experience in the evaluation and development of lithium projects. From 2010 to 2015, he was country manager of Orocobre Ltd. for Argentina, during which time he grew the company from 10 employees to over 800 during construction and 200 in operation. His accomplishments during this period include the exploration and development of the $US300 million Olaroz Salar lithium project to commercial production. In addition, he supervised the exploration of the Salinas Grandes salar, and was responsible for the development of a new process patent for lithium carbonate battery grade production. Prior to Orocobre, he served as Assistant Superintendent at the lithium division of FMC Corp., which operates South America’s largest lithium project at the Hombre Muerto salar. He holds an M.B.A. degree from the Institute for Executive Development, Antofagasta, Chile. He graduated as a chemical engineer from the University of Salta, Argentina, and graduated in the C.E.O. program at Kellogg School in Northwestern University in Chicago.

Alison Dai

DIRECTOR

Ms. Dai has 7 years of experience in the lithium industry and is responsible for business development and is a director for Chengdu Chemphys Chemical Industry Co., Ltd. In her role at Chemphys, Ms. Dai has been involved in developing strategic partnerships, international markets and procurement. Prior to joining Chemphys, Ms. Dai was an investment banking analyst at J.P. Morgan Australia in the mining and metals team. Ms. Dai holds a double degree in Bachelor of Laws and Bachelor of Commerce from the University of Western Australia.

Allen V. Ambrose

DIRECTOR

Mr. Ambrose has nearly three decades of experience in the mining industry, including work with large companies as well as junior exploration companies. He was a director of Minera Andes from November 1995 until its combination with McEwen Mining in January 2012. Mr. Ambrose also served as President and Chief Executive Officer of Minera Andes from 1995 until June 2008. Mr. Ambrose has extensive experience in all phases of exploration, project evaluation and project management, and has worked as a geologic consultant in the US, Venezuela, and Argentina. As a consultant, he was a co-discoverer of a Venezuelan auriferous massive sulfide deposit acquired by Gold Reserve Corporation and known generally as the Brisas deposit. He holds a BS in Geology from Eastern Washington University.

Gordon K. Neal

DIRECTOR

Gordon Neal has more than 35 years experience in governance, corporate finance and investor relations. He founded Neal McInerney Investor Relations in 1991. Through marketing more than $4 billion in debt and equity financings, the company grew to be the second largest full service Investor Relations firm in Canada with offices in Vancouver, Toronto and Los Angeles. Clients included; BCE, Nortel, Bell Canada International, Bell Mobility, Clearnet, Intrawest, Canaccord Capital, BMO Nesbitt Burns, and Blackberry (RIM). Mr. Neal was VP Corporate Development at MAG Silver Corp. where he provided capital market strategies and solutions to the board. He is currently VP Corporate Development for Silvercorp Metals Inc.. Mr. Neal has served on the board of Falco Resources, Balmoral Resources, Americas Petrogas, Rockgate Capital, and Xiana Mining. Mr. Neal has raised more than $500 million for resources companies since 2004. Mr. Neal graduated from Dalhousie University with a B.Sc. in Biochemistry. 1977. He has also served as a member of the Dalhousie University Senate and Board of Governors.

Christoper P. Cherry

DIRECTOR & CHIEF FINANCIAL OFFICER

Mr. Cherry has over 14 years of corporate accounting and audit experience. Mr. Cherry has extensive corporate experience and has held senior-level positions for several public mining companies, including director, CFO and secretary. Mr. Cherry has been a chartered accountant since February, 2009, and a certified general accountant since 2004. In his former experience as an auditor, he held positions with KPMG and Davidson and Co. LLP in Vancouver, where he gained experience as an auditor for junior public companies and as an initial public offering specialist. Mr. Cherry served as CFO of the Company in 2012 and 2013, and has extensive knowledge of business in Guyana.

Fernando E. Villarroel

DIRECTOR & PROJECT MANAGER

Mr. Villaroel has 12 years of experience in the mining industry in Argentina with a focus on Lithium process development. From 2009 to 2013 he worked with Lithium Americas Corp. (Minera Exar S.A.) as Project Manager which included construction management and commissioning of the initial pilot evaporation facilities and laboratory at the Cauchari Olaroz Lithium Project. He has also acted as a consultant to Neo Lithium and International Lithium Inc. He holds a degree in Industrial Engineering and has specialized training in Data Modeling & Analysis for Business and Engineering from M.I.T.

Jan Urata

CORPORATE SECRETARY

Ms. Urata brings over 20 years experience in public company corporate finance and securities related matters including her years as a paralegal at McMillan. She also serves as Corporate Secretary of other TSX Venture issuers.

PROJECTS

Salar Escondido Lithium Project in Argentina

Drilling is underway the Salar Escondido lithium project (formerly called Carachi Pampa) in Catamarca province, Argentina. The Salar Escondido project comprises mining concessions totaling approximately 29,180  hectares (72,100 acres) located 280 km southeast of the provincial capital of Catamarca. The project area is strategically located within the Lithium Triangle, in close proximity to one of the largest known lithium deposits in Argentina, and within the Puna Region, an elevated plateau which lies on the eastern side of the Andes Mountains. This region contains a number of highly mineralized salars including the lithium producing salars Hombre Muerto.

hectares (72,100 acres) located 280 km southeast of the provincial capital of Catamarca. The project area is strategically located within the Lithium Triangle, in close proximity to one of the largest known lithium deposits in Argentina, and within the Puna Region, an elevated plateau which lies on the eastern side of the Andes Mountains. This region contains a number of highly mineralized salars including the lithium producing salars Hombre Muerto.

Salar Escondido is a large basin, roughly 20 by 40 kilometers in size, which is mostly covered by a series of overlapping alluvial fans. NRG’s technical team believes that a large salar with an area of at least 700 km2 developed in the basin about 2 million years ago.

After the salar was formed, it was buried by coalescing alluvial fans, and it is thus considered to be a “paleo-salar.” Hence the name Salar Escondido, which means “hidden salar” in Spanish.

Only a small portion of the original brine salar is presently exposed at surface in a small saline lake in the southwest portion of the basin. The brine in the lake contains anomalous lithium values.

During 2017, NRG’s drilling confirmed the presence of a buried brine zone beneath the alluvial cover on the surface of the basin. Brine was intersected at a depth of 140 m, and as reported in the Company’s press release dated December 7, 2017, sampling from 183 to 198 mreturned an average grade of 229 mg Li/liter in a porous, weakly consolidated sandstone horizon. A Vertical Electrical Sounding (“VES”) geophysical survey conducted by the Company suggests that the brine zone occurs at an even shallower depth where the upcoming hole will be drilled.

Hombre Muerto North Project in Argentina

Located in Salta and Catamarca Provinces, Argentina. The property package of 3,287 hectares is comprised of the Alba Sabrina, Tramo, Natalia Maria, Gaston Enrique, Viamonte and Norma Edit concessions, all located in the Salar del Hombre Muerto in northwestern Argentina.

Highlights of the Hombre Muerto North Lithium Project Include:

- Project has been significantly de-risked.

- Exceptional Li Samples; 300 – 400 meter average 918 mg/l Li with a low Mg to Li ratio.

- Excellent Pump Test Results – produced 26 liters per second of lithium brine in 72-hours.

- Geophysical data indicates zones of low resistivity, interpreted to be potential lithium-bearing zones that are open at depth.

- Adjacent to Galaxy Resources’ Sal de Vida lithium development project sold in May 2018 to Posco for $280 Million.

- Drilling on a second core hole located 2.1 kilometers to the west of the first hole is advancing.

- Highly qualified, Argentina-based team of professionals experienced with lithium exploration, development, through to lithium production.

Quotes taken from previous New Releases…

August 9th – José de Castro, Chief Operating Officer of NRG Metals Inc., commented,

“we are very pleased with the results of the pumping test at Hombre Muerto North. These results have removed a significant part of the risk associated with developing a lithium operation. We are seeing exceptionally high grades in clastic host rocks with good permeability, and the brine chemistry is very favorable. The Hombre Muerto North brine is unsaturated and has low sulfate and magnesium ratios. Brine with these characteristics has the potential to evaporate more quickly while using less pond area than would be the case for a typical saturated brine and will require lower consumption of chemical reagents potentially resulting in diminished capital and operating costs.”

July 10th – Adrian Hobkirk, CEO of NRG Metals Inc., commented,

“We are encouraged to find high lithium grades in the first part of the second hole, and these results demonstrate the presence of lithium bearing brine across our Tramo property. We will have a more complete picture once this hole is completed and when we have the results of the pumping test from the large diameter hole completed adjacent to the first core hole.”

Adrian Hobkirk, CEO of NRG Metals, commented:

“We are very excited to be able to lock-up this project in the preeminent lithium brine production and development area in Argentina. NRG has a highly qualified, Argentina-based team of professionals experienced with lithium exploration, development, through to lithium production.”

Source: https://www.nrgmetalsinc.com/