GET TOP RATED STOCK ALERTS ACTIVE TRADERS DEPEND ON

SIGN UP TODAY FOR FREE NEWS DRIVEN ALERTS

Vancouver, BC – May 4, 2021 – QMC Quantum Minerals Corp., (TSX.V: QMC) (FSE: 3LQ) (OTC PINK: QMCQF) (“QMC” or “the Company) will be incorporating the results of a litho-geochemical soil survey in the upcoming NI 43-101 report, being prepared by SGS Canada.

Highlights:

- Strong lithium soil geochemical anomaly 1,100m long by 100m on the east widening to 350m at the west.

- Potential for additional tonnage.

- Several areas reported over 1,000 ppm Li.

- Chip samples in the area are 2.47% Li2O at Mapetre and 4.16% Li2O at Central.

- Magnitude of lithium anomaly cannot be accounted for by the known pegmatites in the area.

- Lithium market moving into deficit with material shortages emerging.

Balraj Mann, CEO, commented, “Macquarie Group recently stated the lithium market is moving to a deficit in 2022 with material shortages emerging in 2025. Lithium hydroxide prices are expected to top $16,000 per tonne. Moreover, as the amount of cobalt in batteries is reduced, the lithium component within must be increased.”

The historic assessment report (Manitoba Mines Branch: #92681) documents a litho-geochemical soil survey that was conducted by TANCO for the purpose of delineating buried, undiscovered tantalum-bearing pegmatite structures that may occur south of Cat Lake between the known Central Pegmatite on the west and the Mapetre Pegmatite to the east. Two survey grids were laid out. The larger grid (Grid “A” below), established on a 150 x 500-foot grid pattern, confirmed that a very intense, widespread lithium geochemical soil anomaly is situated between the Central and Mapetre Dikes covering an east/west distance of approximately 1100 metres with a width of 100 metres at the east end, widening to approximately 350 metres at the west end. TANCO reports lithium results within this anomaly to be up to 630 ppm Li.

The second grid (Grid “B”) established a tighter, 150 x 150-foot grid pattern over the western portion of the Grid “A” anomaly. The purpose of Grid “B” was to again identify additional pegmatite mineralization in extensions of, or parallel structures to the Central Dike. Results of the lithium soil geochemistry were highly anomalous as several areas reported over 1,000 ppm lithium concentrations with a widespread lithium anomaly showing > 300ppm Li and remaining open ended to the east.

In the assessment report, TANCO geologists state that the “breath and length of this lithium anomaly is such that it cannot be accounted for by the known pegmatites in the area”. TANCO geologists strongly recommended that the company explore both these target areas with additional drill programs; however, at the time, tantalum was TANCO’s metal of choice and the company had no interest in producing lithium. The assessment report was prepared by D.L. Trueman, P. Eng. for the Tantalum Mining Corporation of Canada Limited (“TANCO”) and was dated 1979.

QMC’s exploration work programs have confirmed the presence of significant mineralization within the Mapetre and Central pegmatite dikes. QMC crews identified large crystals of spodumene mineralization on the Mapetre where a 1.5-metre-long chip sample assayed 2.47% Li2O. Chip samples from the Central assay returns were from 1.42% to 4.16% Li2O. QMC also had TANCO drill core assayed for lithium. The best Mapetre Dike intersection was 0.32% Li2O over 16.61 metres, including 0.52% Li2O over 8.69 metres. The best intersection from the Central Dike was 1.28% over 3.81 metres, including 2.97% Li2O over 1.22 metres. Two additional sample intervals from drill holes on the Central Dike re-assayed 1.50% Li2O over 1.52 metres and 1.04% Li2O over 1.52 metres.

The Company has entered into a month-to-month marketing and consulting contract with Toronto-based marketing firm, North Equities Corp. North Equities specializes in various social media platforms and will be able to facilitate greater awareness and widespread dissemination of the Company’s news. The Company will pay North Equities $3,500 per month. North Equities currently owns 200,000 shares of the Company along with 200,000 warrants exercisable at $0.16 per share.

Qualified Person

The technical content of this news release has been reviewed and approved by Bruce E. Goad, P. Geo., a qualified person as defined by National Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the acquisition, exploration and development of resource properties. Its objective is to acquire, locate and develop economic deposits within the company’s precious, base, rare metal resource properties of merit. The Company’s current properties include the Irgon Lithium Mine Project and two VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew Lake District Project. Currently, all of the Company’s properties are located in Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

604-601-2018

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: QMC QUANTUM MINERALS CORP.

Vancouver, British Columbia – April 13, 2021 – QMC Quantum Minerals Corp., (TSX.V: QMC) (FSE: 3LQ) (OTC PINK: QMCQF) (“QMC” or “the Company”) is pleased to announce that it has received the 2021 work permit for QMC’s 100% owned Irgon Lithium Mine Project. Balraj Mann, C.E.O. commented: “With the recent announcement of U.S. President Joe Biden’s proposal for $1.9-trillion in stimulus spending, of which $174-billion is ear-marked for investment in the electric vehicle (EV) market, QMC is situated to be an important part of the EV supply chain. Not only will we have lithium (extracted from the Irgon Lithium Mine Project) for batteries, our Namew Lake District project can potentially supply copper-nickel for the proposed network of 500,000 EV charging stations across the United States.”

The proposed 2021 work program will include stripping of overburden, prospecting, surface sampling, channel sampling and obtaining a bulk sample. The work will focus on:

- extending known mineralization along strike of all currently identified dikes on the property including the Irgon dike.

- the two parallel structures identified in SGS’s 2020 mobile metal ion (“MMI”) orientation survey to the north and south of the Irgon Dike. The survey generated strong MMI geochemical responses indicating underlying lithium-bearing pegmatite occurrences parallel to the Irgon Dike.

- preparing areas within our claims for additional MMI sampling surveys as recommended by SGS.

The planned work program will begin shortly. Potential strike extensions of the five significant spodumene and rare metal-bearing (Li, Nb, Ta, (+/_Cs)), zoned, granitic pegmatite dikes (Irgon, Irgon West, Mapetre, North and Central Dikes) that have currently been identified on the property will be evaluated and several additional and untested exploration targets, including an historical lithium soil geochemical anomaly that strikes generally east west and is approximately 1100m long and up to 350m wide (identified between the Central and Mapetre Dikes) will be tested. Proposed geochemical surveys will assist in defining strike extensions of existing targets and will also potentially identify additional mineralization in known lithium geochemically anomalous areas.

The Irgon Lithium Mine Project

Between 1953-1954, the Lithium Corporation of Canada Limited drilled 25 holes into the Irgon Dike and subsequently reported a historical lithium mineral resource estimate of 1.2 million tons grading 1.51% Li20 over a strike length of 365 meters and to a depth of 213 meters (Northern Miner, Vol. 41, no.19, Aug. 4, 1955, p.3). This historical mineral resource is documented in a 1956 Assessment Report by B. B. Bannatyne for the Lithium Corporation of Canada Ltd. (Manitoba Assessment Report No. 94932). This historical lithium mineral resource estimate is believed to be based on reasonable assumptions, and neither the company nor the QP has any reason to contest the document’s relevance and reliability. Historic metallurgical tests reported an 87% recovery from which a concentrate averaging 5.9% Li2O was obtained.

The mineral resource cited above is presented as a historical estimate and uses historical terminology which does not conform to current NI43-101 standards. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. Although the historical estimates are believed to be based on reasonable assumptions, they were calculated prior to the implementation of National Instrument 43-101. These historical estimates do not meet current standards as defined under sections 1.2 and 1.3 of NI 43-101; consequently, the issuer is not treating the historical estimate as current mineral resources or mineral reserves.

During this historical 1950-era work program, a complete mining plant was installed onsite, designed to process 500 tons of ore per day, and a three-compartment shaft was sunk to a depth of 74 meters. On the 61-metre level, lateral development was extended off the shaft for a total of 366 meters of drifting, from which seven crosscuts transected the dike.

Namew Lake District Project

Situated in the renowned Flin Flon and Snow Lake districts of Manitoba known for its world-class VMS deposits, the company land package covers 55,000 acres. The project is 11km east of Hudbay Minerals’ (HBM-TSX) Namew Lake Mine which has produced 2.57 million tons of nickel, copper, palladium, and platinum. The Namew Lake Project is also in the vicinity of the currently producing 777 and Lalor mines, in addition to being proximal to the past-producing Reed Lake Mine. In addition to being in close proximity to these other deposits, the company’s district sized Namew Lake Project displays similar underlying geology to the aforementioned mines. The company has recently identified 41 large, strong, untested geophysical targets through a versatile time domain electromagnetic (VTEM) system survey.

Qualified Person

The technical content of this news release has been reviewed and approved by Bruce E. Goad, P. Geo., a qualified person as defined by National Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the acquisition, exploration and development of resource properties. Its objective is to acquire, locate and develop economic deposits within the company’s precious, base, rare metal resource properties of merit. The Company’s current properties include the Irgon Lithium Mine Project and two VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew Lake District Project. Currently, all of the Company’s properties are located in Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

604-601-2018

To keep up with the current info on QMC Quantum Minerals Corp, be sure to join our Telegram chat room: http://t.me/quantummineralscorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: QMC Quantum Minerals Corp

Vancouver, BC – March 22, 2021 – QMC Quantum Minerals Corp., (TSX.V: QMC) (FSE: 3LQ) (OTC PINK: QMCQF) (“QMC” or “the Company”) has appointed Daniel Leroux, M.Sc., P. Geo, as a technical advisor to assist the Company with the focus of increasing the resource at Irgon Lithium Mine Project and bringing it to production in Manitoba. Similarly, Mr. Leroux will also help QMC to develop the Namew Lake District project containing nickel, copper, and gold. Mr. Leroux was the former Global Business Manager – Geological Services for SGS and managed staff and consultants that worked on many significant world-wide lithium pegmatite projects including Sigma Lithium (Brazil) and Nemaska Lithium (Quebec).

Daniel Leroux commented: “I am excited join the QMC team as a technical advisor and help them advance their Irgon Lithium Project towards production. With a project which has the Irgon pegmatite dike system as well as several additional lithium pegmatite dikes swarms identified to date and nearby infrastructure in place, unlike many other projects, the Irgon Project could be a low-cost producer. QMC will be an important part of the Canadian Government’s recently announced 31 minerals considered critical for the sustainable economic success of Canada (March 11, 2021).”

Balraj Mann commented: “We are excited to have Daniel joining the team with his expertise. Access to his global network of experts and service providers will help move the Company’s Irgon Lithium Mine Project towards production. QMC will be an important part of the supply chain due to its close proximity to EV and battery manufacturing plants. The Irgon Lithium Mine’s pegmatite dikes additionally contain cesium, niobium, tantalum, and other rare-earth metals.”

Mr. Leroux is a bilingual (French-English) economic geologist with over 25+ years of diversified geological, project generation, mining, mineral processing, project management, corporate and executive experience with both major and junior mining companies and with geological and mining consultancy firms. Mr. Leroux is currently the CEO and Vice President Exploration of Zodiac Gold Inc. a Canadian based private mineral exploration and development company with gold projects located in Liberia. From 2003 to 2015, he was the co-owner and Vice President of A.C.A. Howe International Limited (A.C.A. Howe), a geological and mining consulting firm established in 1960 that operated offices in Toronto, Canada and London, UK until the Canadian operation was acquired by CSA Global in 2016. A.C.A Howe was instrumental in the discovery of the Bernic Lake (Cabot/Sinomine) tantalum mine in the early 1960’s. From 2011 to 2013, Daniel was the Vice President Exploration and in 2014, the President of RDX Minerals Inc. a private Canadian-based junior mining company. From 1988-1990, Daniel worked for Inco Exploration and Technical Services (now Vale) and with Placer Dome in 1991.

Mr. Leroux holds both a B.Sc. degree (Geology) and a Master of Science in Mineral Exploration degree from Laurentian University. He is a registered member of the Association of Professional Geoscientists of Ontario (“APGO”), the Association of Professional Engineers and Geoscientists of Saskatchewan (“APEGS”) and l ‘Ordre des géologues du Québec (“OGQ”).

Options

The board of directors has authorized the grant of 500,000 incentive stock options to certain consultants at an exercise price of 35 cents per option. The options are exercisable on or before March 22, 2026. The stock option grant is subject to acceptance by the TSX Venture Exchange.

About the Company

QMC is a British Columbia based company engaged in the acquisition, exploration and development of resource properties. Its objective is to locate and develop economic precious, base, rare metal resource properties of merit. The Company’s properties include the Irgon Lithium Mine Project and two VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew Lake District Project. Currently, all of the Company’s properties are located in Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

604-601-2018

To keep up with the current info on QMC Quantum Minerals Corp, be sure to join our Telegram chat room: http://t.me/quantummineralscorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: QMC QUANTUM MINERALS CORP.

Vancouver, BC – March 15, 2021- QMC Quantum Minerals Corp., (TSX.V: QMC) (FSE: 3LQ) (OTC PINK: QMCQF) (“QMC” or “the Company”) has closed its previously announced financing for gross proceeds of $2.1-million through the issuance of 7.5-million units at $0.28 per unit, where each unit will consist of one common share and one common share purchase warrant exercisable at $0.37 per warrant for a period of 24 months, in the event that the closing price of the Company’s shares as quoted on the TSXV exceeds $0.50 per share for ten consecutive trading days, the Company may accelerate the expiry date of the warrants by giving notice to the holders, within five days of such event, thereof, and in such case, the warrants will expire on the 30th day after the date on which such notice is given by the Company.

Balraj Mann, CEO, commented: “Canada continues to solidify its electric vehicle manufacturing presence with General Motors (GM) joining Ford and Fiat Chrysler, announcing its plan to produce GM’s BrightDrop EV 6000 light commercial vehicle at its CAMI plant in Ingersoll, Ontario. This will be Canada’s first large-scale electric delivery vehicle manufacturing plant; FedEx has placed the first order for the EV 6000 and will take delivery of the first EV units by the end of the year. The EV manufacturing hub of Canada now has investments totaling approximately $6 billion which will significantly increase over the next few years. With QMC’s close proximity to North America’s EV Hub (Ontario, Michigan and Ohio), we are strategically positioned to be a key supplier in the electric vehicles battery supply chain.”

As per Multilateral Instrument 61-101, two insiders subscribed for an aggregate of 300,000 units. In connection with the private placement, the Company paid finder’s fees to arm’s length third parties consisting of $11,200 cash. All shares to be issued pursuant to the financing will be subject to a four-month plus a day hold period under applicable securities laws in Canada. The Company intends to use the net proceeds from the private placement for working capital, advancing its mineral properties, and general corporate purposes.

About the Company

QMC is a British Columbia based company engaged in the acquisition, exploration and development of resource properties. Its objective is to locate and develop economic precious, base, rare metal resource properties of merit. The Company’s properties include the Irgon Lithium Mine Project and two VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew Lake District Project. Currently, all of the Company’s properties are located in Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

604-601-2018

To keep up with the current info on QMC Quantum Minerals Corp, be sure to join our Telegram chat room: http://t.me/quantummineralscorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Source: QMC Quantum Minerals Corp,

Vancouver, BC – February 22, 2021 – QMC Quantum Minerals Corp., (TSX.V: QMC) (FSE: 3LQ) (OTCPK: QMCQF) (“QMC” or “the Company”), further to its February 12, 2021 news release, the Company has received conditional approval from the TSX Venture Exchange for its a non-brokered private placement for $2.1 million. The private placement will consist of issuing 7.5-million units at $0.28 per unit, where each unit will consist of one common share and one common share purchase warrant exercisable at $0.37 per warrant for a period of 24 months. In the event that the closing price of the Company’s shares as quoted on the TSXV exceeds $0.50 per share for ten consecutive trading days, the Company may accelerate the expiry date of the warrants by giving notice to the holders, within five days of such event, thereof, and in such case, the warrants will expire on the 30th day after the date on which such notice is given by the Company.

Balraj Mann states: “We are now seeing the rapid transition to electric vehicles. Just last week, Land Rover Jaguar announced its Jaguar brand vehicles will be all-electric by 2025 joining the list of manufactures who have determined this is the future. QMC has the potential to supply not only lithium, but nickel, copper, gold and various rare-earth metals to the markets. We are in close proximity to the new EV car plants of southern Ontario (Fiat-Chrysler, Ford, GM), Michigan (GM, Rivian) and Ohio (Lordstown,), as well as the battery-manufacturers: Samsung SDI with a plant in Michigan and LG Energy Solution with plants in both Michigan and Ohio. QMC can and will be an important part of the supply chain.”

All securities issued pursuant to this private placement will be subject to a four-month hold. The private placement is subject to final acceptance by the TSX Venture Exchange.

Finders’ fees may be paid by the company in conjunction with the completion of the private placement in accordance with TSX Venture Exchange policies.

The Company reserves the right to accept, reject or partially fill any subscriptions received up to the aggregate amount permitted by the TSX-V.

Certain insiders are expected to participate in the private placement. The participation of such directors and officers in the offering will constitute a related party transaction for the purposes of Multilateral Instrument 61-101 (Protection of Minority Security Holders in Special Transactions). The company will be exempt from the requirements to obtain a formal valuation or minority shareholder approval in connection with the offering in reliance on sections 5.5(a) and 5.7(1)(a) of MI 61-101.

The Company intends to use the net proceeds from the private placement for working capital, advancing its mineral properties, and general corporate purposes.

FOR ADDITIONAL INFORMATION PLEASE GO TO https://wallstnow.com/2021/01/29/gold-silver-copper-investors-knowledge-resource

About the Company

QMC is a British Columbia-based company engaged in the business of acquisition, exploration and development of resource properties. Its objective is to locate and develop precious, base and rare metal resource properties of merit. The Company’s properties include the Irgon Lithium Mine Project and two VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew Lake District Project. Currently, all of the company’s properties are located in Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

604-601-2018

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: QMC Quantum Minerals Corp.,

Vancouver, BC – November 3, 2020 – QMC Quantum Minerals Corp., (TSX.V: QMC) (FSE: 3LQ) (OTC PINK: QMCQF) (“QMC” or “the Company”) begins developing a proposed work program for its Namew Lake District volcanic massive sulphide (“VMS”) property in Manitoba.

Highlights

- World-class Flin Flon-Snow Lake mining region, host to 11 mines including Hudbay Minerals Inc.’s (“HBM”) new deposit, the Lalor Mine

- 41 strong geophysical targets identified, the largest one being 1.5km long

- District scale project with similar geology to the nearby HudBay’s Lalor (27.1Mt) and 777 (21.9Mt) mines

The Company will focus the upcoming exploration program on testing the stronger of 41 geophysical targets currently identified on the property. Twenty-two of these targets have been classified by Garth Kirkham, P. Geo (2013) as priority targets with potential to host deposit-scale VMS mineralization. This NI43-101 report is available on SEDAR. To date, positive results of limited drilling collared on the property have suggested that existing geophysical surveys are an excellent exploration indicator of subsurface sulphide mineralization.

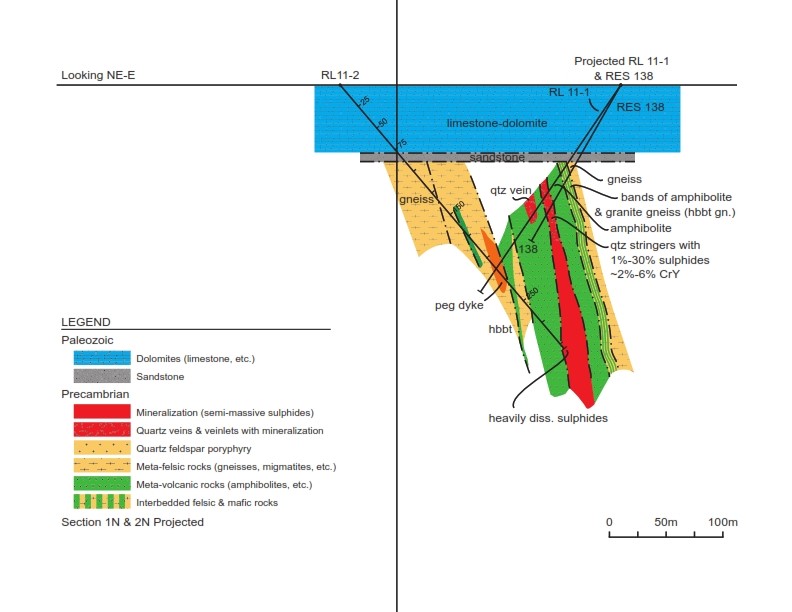

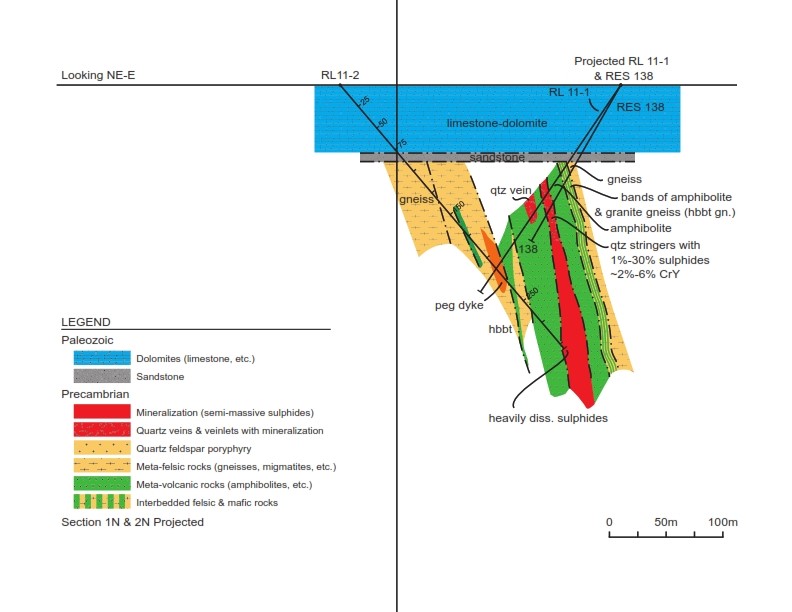

QMC has previously drilled one of these targets, on the 1,500m long conductor and intersected mineralization at the top of the conductor. Two drill holes (RL 12-5 and RL 11-2) intersected significant visible chalcopyrite mineralization (Figure 1). Drill hole RL 12-5 cut a 10m thick, semi-massive sulphide intersection grading 0.48% Cu (including 0.80% Cu over 1m). Drill hole RL 11-2 was terminated in massive sulphide at a vertical depth of 193 metres. Assays returned grades of 0.26% copper over a 0.3m wide, semi-massive sulphide intersection which contained approximately 20% iron sulphides. Further, deeper drilling may develop a larger zone of additional significant VMS mineralization. The Company postulates that the top conductor intersected by drilling may be the top of the first lens alternating between copper and gold much like the Lalor Mine which has similar geology.

At the Lalor Mine, and typically all VMS deposits, mineralization forms as concordant lenses of massive to semi-massive sulphide mineralization. Over time these systems can have several periods of sulphide accumulation forming several localized lenses of mineralization. This accumulation of several distinct base metal and gold rich lenses has been identified at the Lalor Mine. Identification of these favourable horizons can provide a significant pathfinder to additional mineralized zones within the property and may also guide discovery of new zones of mineralization regionally.

Characteristically, VMS deposits have a very predictable positioning of the metals, both horizontally and vertically within the deposit. Gold concentrations generally are elevated in the central copper-rich zones. These are typically copper +/- gold rich zones in or adjacent to hydrothermally altered zones that develop within fractures. Generally iron sulphides (pyrite and pyrrhotite) occur with the base metal sulphides.

Figure 1 Cross section of Drill Hole 11-2

Qualified Person

The technical content of this news release has been reviewed and approved by Bruce E. Goad, P. Geo., a qualified person as defined by National Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the business of acquisition, exploration and development of resource properties. Its objective is to locate and develop economic precious, base, rare metal resource properties of merit. The Company’s properties include the Irgon Lithium Mine Project and two VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew Lake District Project. Currently, all of the company’s properties are located in Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

604-601-2018

To keep up with the current info on QMC Quantum Minerals Corp, be sure to join our Telegram chat room: http://t.me/quantummineralscorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: QMC QUANTUM MINERALS CORP.

Vancouver, BC – October 20, 2020 – QMC Quantum Minerals Corp., (TSX.V: QMC) (FSE: 3LQ) (OTC PINK: QMCQF) (“QMC” or “the Company”) is extremely pleased with the recent $3.3B CDN funding announcement to build Electric Vehicles (“EV”) and batteries within Canada as the company is ideally positioned to source the required metals.

HIGHLIGHTS:

- $1.8 Billion Federal and Provincial Funding for Oakville EV plant

- $1.5 Billion Fiat Chrysler investment in Windsor EV plant

- Critical elements: lithium, copper, zinc, nickel

- Historical resource of 1.2M tons of 1.51% lithium oxide

- Extensive potential of copper, nickel, gold, and zinc with 41 deposit potential targets

QMC is in an extremely favourable position to gain significantly through the announcement on October 8th by the Federal Government of Canada and the Province of Ontario that they would provide a total investment commitment of $590 million CDN into the $1.8-billion CDN retooling of Ford Motor’s Oakville Ontario assembly plant making it the hub of EV production in Canada. This investment and retooling will make Ford Motor’s Canadian production facility the largest electric vehicle assembly plant in North America. This project will build five new electric vehicle models and the batteries that will power these vehicles.

Fiat Chrysler followed up a week later announcing a $1.5-billion investment in their Windsor assembly plant. The investment would outfit the factory with the state-of-the-art equipment that will enable the assembly of plug-in hybrids and battery-powered vehicles with at least one new model in 2025. The plant will add up to 2,000 jobs to the Windsor plant.

To produce these vehicles specialized raw materials will be required. In addition to typical commodities required to manufacture vehicles, EVs require four additional critical elements: lithium, copper, zinc, and nickel which QMC is moving towards becoming a producer of ALL of these commodities (plus potentially gaining platinum, palladium, silver and gold credits) through the ongoing development of its Irgon Lithium (Spodumene) Mine Project and Namew Lake District (Volcanic Massive Sulphide (“VMS”) Projects.

Namew Lake District Project

Situated in the renowned Flin Flon and Snow Lake districts of Manitoba known for its world-class VMS deposits, the company land package covers 55,000 acres. The project is contiguous to the western side of Hudbay Minerals’ (HBM-TSX) Namew Lake Mine which has produced 2.57 million tons of nickel, copper, palladium, and platinum. The Namew Lake Project is also in the vicinity of the currently producing 777 and Lalor mines, in addition to being proximal to the past-producing Reed Lake Mine. In addition to being in close proximity to these other deposits, the company’s district sized Namew Lake Project displays similar underlying geology to the aforementioned mines. The project hosts 41 deposit sized targets outlined in a versatile time domain electromagnetic (VTEM) system survey.

The Irgon Lithium Mine Project

Between 1953-1954, the Lithium Corporation of Canada Limited drilled 25 holes into the Irgon Dike and subsequently reported a historical resource estimate of 1.2 million tons grading 1.51% Li20 over a strike length of 365 meters and to a depth of 213 meters (Northern Miner, Vol. 41, no.19, Aug. 4, 1955, p.3). This historical resource is documented in a 1956 Assessment Report by B. B. Bannatyne for the Lithium Corporation of Canada Ltd. (Manitoba Assessment Report No. 94932). This historical estimate is believed to be based on reasonable assumptions, and neither the company nor the QP has any reason to contest the document’s relevance and reliability. The detailed channel sampling and a subsequent drill program will be required to update this historical resource to current NI 43-101 standards. Historic metallurgical tests reported an 87% recovery from which a concentrate averaging 5.9% Li2O was obtained.

During this historical 1950-era work program, a complete mining plant was installed onsite, designed to process 500 tons of ore per day, and a three-compartment shaft was sunk to a depth of 74 meters. On the 61-metre level, lateral development was extended off the shaft for a total of 366 meters of drifting, from which seven crosscuts transected the dike.

The Company has had recent discussions with Sinomine Group, Co., Ltd. (“Sinomine”) to process spodumene material from the Irgon Lithium Mine Property at their TANCO plant. The TANCO plant is easily accessible, located approximately 20km directly south of the Irgon Lithium Mine Property via Highway 314. The TANCO management have provided the Company with an estimate to prepare samples (crushing and grinding), floatation testing, assaying and analysis for preliminary metallurgical evaluation. The testing will provide the Company with a lithium concentrate, in the past the TANCO circuitry was able to achieve lithium concentrate levels up 7.25% Li2O to Dow Corning. The Company expects to achieve at least 6% Li2O in this round of testing.

The mineral reserve cited above is presented as a historical estimate and uses historical terminology which does not conform to current NI43-101 standards. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. Although the historical estimates are believed to be based on reasonable assumptions, they were calculated prior to the implementation of National Instrument 43-101. These historical estimates do not meet current standards as defined under sections 1.2 and 1.3 of NI 43-101; consequently, the issuer is not treating the historical estimate as current mineral resources or mineral reserves.

Qualified Person

The technical content of this news release has been reviewed and approved by Bruce E. Goad, P. Geo., a qualified person as defined by National Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the business of acquisition, exploration and development of resource properties. Its objective is to locate and develop economic precious, base, rare metal resource properties of merit. The Company’s properties include the Irgon Lithium Mine Project and two VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew Lake District Project. Currently, all of the company’s properties are located in Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

604-601-2018

To keep up with the current info on QMC Quantum Minerals Corp, be sure to join our Telegram chat room: http://t.me/quantummineralscorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: QMC Quantum Minerals Corp

Vancouver, BC – October 6, 2020 – QMC Quantum Minerals Corp., (TSX.V: QMC) (FSE: 3LQ) (OTC PINK: QMCQF) (“QMC” or “the Company”) is pleased to announce an update on its Rocky Lake volcanic massive sulphide (“VMS”) property.

Highlights:

- District scale project with similar geology to the nearby Lalor (27Mt) and 777 (22Mt) mines

- Previous drilling on Rocky Lake Property intersected significant VMS mineralization

- Previous QMC drilling returned 10m of 0.48% copper (including 0.80% over 1m)

The Rocky Lake VMS discovery within the company’s Namew Lake Project was discovered by HudBay Minerals Inc. (“HBM”) in 1987 through an airborne survey. This survey identified a 5km long conductor and was followed up with ground EM surveys that outlined a 1,500m conductor. Historic HBM drilling on the property intersected 10.3m of mineralization grading 0.38% Cu (including 4.3m @ 0.67% Cu). This intersection included high-grade sections (up to 3.0% Cu across 0.3m). Subsequent EM surveys, commissioned by QMC, suggest that some of the strongest portions of the HBM electromagnetic anomaly have yet to be tested. On re-interpretation of the HBM drilling, the data suggest that the HBM drill program was carried out on the footwall side of a potential mineralized body, thereby missing the main target. Copper mineralization intersected in the HBM drilling is present as stringers which is currently interpreted as representing footwall stringer mineralization adding credence to the interpretation that the main massive sulphide mineralized body may well have been missed.

Additional geophysical surveys undertaken for QMC over the conductor and subsequent detailed re-interpretation of data suggest the conductor is seated at a depth of 200m and is at least 1,000m long. QMC believes that its recent drilling confirmed the top of the conductor as two drill holes (RL 12-5 and RL 11-2) intersected significant visible chalcopyrite mineralization. Drill hole RL 12-5 cut a 10m thick, semi-massive sulphide intersection grading 0.48% Cu (including 0.80% Cu over 1m). Drill hole RL 11-2 was terminated in massive sulphide at a vertical depth of 193 metres. Assays returned grades of 0.26% copper over a 0.3m wide, semi-massive sulphide intersection which contained approximately 20% iron sulphides. The company anticipates that proposed additional deeper and step-out drilling along the conductor could expand the mineralized section and develop a larger zone of significant VMS mineralization.

The company’s Namew Lake Project covers over 55,000 acres and is contiguous to the western side of Hudbay Minerals’ (HBM-TSX) Namew Lake Mine which has produced 2.57 million tonnes of copper, nickel, gold, silver, palladium, and platinum. The Namew Lake Project is also in the vicinity of the currently producing 777 and Lalor mines, in addition to being proximal to the past-producing Reed Lake Mine. In addition to being in close proximity to these other deposits, the company’s district sized Namew Lake Project displays similar underlying geology to the aforementioned mines.

Total resources for HBM’s Lalor and 777 deposits are as follows:

| Mine | Resource | Copper | Zinc | Gold | Silver |

| 777 | 21.9M tonnes | 2.6% | 4.4% | 2.1 g/t | 26.9 g/t |

| Lalor | 27.1M tonnes | 0.7% | 5.1% | 2.8 g/t | 27.3 g/t |

Includes past production, current reserves and resources.

Qualified Person

The technical content of this news release has been reviewed and approved by Bruce E. Goad, P. Geo., a qualified person as defined by National Instrument 43-101.

FOR MORE COMPELLING QMC DETAILS ALSO VISIT: https://wallstnow.com/2020/09/22/undiscovered-juniorresource-company-stumbles-upon-potentially-massive-gold-deposit-missed-bymining-giant/

About the Company

QMC is a British Columbia based company engaged in the business of acquisition, exploration and development of resource properties. Its objective is to locate and develop economic precious, base, rare metal resource properties of merit. The Company’s properties include the Irgon Lithium Mine Project and two VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew Lake District Project. Currently, all of the company’s properties are located in Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

604-601-2018

To keep up with the current info on QMC Quantum Minerals Corp, be sure to join our Telegram chat room: http://t.me/quantummineralscorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Source: QMC Quantum Minerals Corp

Vancouver, BC – September 22, 2020 – QMC Quantum Minerals Corp., (TSX-V: QMC) (OTCPK: QMCQF) (FSE: 3LQ) (“QMC” or “the Company”), is pleased to announce an update on its Rocky Lake and Rocky-Namew volcanic massive sulphide (“VMS”) properties.

Highlights

- World-Class Flin Flon-Snow Lake region home to 11 mines, including Hudbay Minerals Inc.’s (“HBM”) Lalor Mine and 31 VMS deposits.

- 41 identified gold-copper-zinc targets;

- Drilling confirmed a 1,000 metre long target with visible chalcopyrite in drill core;

- Easily accessible to excellent infrastructure;

The Company has initiated planning of the proposed 2021 work program on its 100% owned VMS properties located in the mineral-rich Flin Flon-Snow Lake Area of Central Manitoba. These properties, the Rocky Lake and the Rocky-Namew, are known collectively as the Namew Lake District Project.

To date, QMC has completed a significant amount of work on the project, including Geotech’s Versatile Time Domain Electromagnetic (“VTEM”) system survey which outlined 41 targets. Detailed re-interpretation of the VTEM data by Maxwell Modelling on the main Rocky Lake massive sulphide target showed the presence of a deep-seated conductor (target). This conductor is at least 1,000 metres long and at a depth of 200 metres.

Four drill holes tested the conductor with two drill holes confirming the top of the conductor, intersecting massive sulphide mineralization at a vertical depth of 193 metres. The drill holes confirmed the presence of massive sulphide mineralization with visible chalcopyrite. Based on the results, it is reasonable to assume that there could be potential for a deposit scale mineralization. A NI 43-101 technical report entitled Rocky Lake Volcanogenic Massive Sulphide (VMS) Project and dated March 20, 2013, can be found under QMC’s profile on SEDAR website at www.sedar.com.

The project is located immediately west of Provincial Highway 10, 65km northwest of the town of The Pas and 40km south of the mining center and former smelter at Flin Flon. The property is accessible year-round by 4-wheel drive and by all-terrain vehicles, and the Hudson’s Bay rail line is east of the property. Important infrastructure including access, goods, services and supplies are readily available.

Hudson Bay Mining and Smelting/Outokumpu Oy’s former Namew Lake Nickel-Copper Mine is located 11 km northwest of the Namew Lake District Project. Prior to its closure, this mine produced 2.57 million tonnes grading 0.63% Cu and 1.79% Ni, and 0.1 g/t Au, 4.1 g/t Ag, 0.5 g/t Pd, and 0.6 g/t Pt.

The Flin Flon-Snow Lake region has been an extremely productive mining camp, having produced numerous VMS deposits since the initial copper production began at the Mandy Mine in 1916. The Flin Flon Greenstone Belt hosts 11 mines and 31 developed VMS deposits, many of which host exceptionally high gold (Au) content. Included within these deposits are the Flin Flon Mine (62.5Mt @ 2.7g Au/t) and the Lalor Mine (9.9Mt @ 5.7 g Au/t in the Au zone).

HBM’s Lalor mine is located east of Flin Flon, in the Snow Lake area of Manitoba and north east of the Rocky Namew Project reported reserves of 19.4Mt grading 3.15% zinc, 4.22g/t gold, 0.85% copper and 27.55g/t silver (reference: HBM news release of March 30, 2020).

Qualified Person

The technical content of this news release has been reviewed and approved by Bruce E. Goad, P. Geo., a qualified person as defined by National Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the business of acquisition, exploration and development of resource properties. Its objective is to locate and develop economic precious, base, rare metal resource properties of merit. The Company’s properties include the Irgon Lithium Mine Project and two VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew Lake District Project. Currently, all of the company’s properties are located in Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

To keep up with the current info on QMC Quantum Minerals Corp, be sure to join our Telegram chat room: http://t.me/quantummineralscorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Source: QMC QUANTUM MINERALS CORP.

NetworkNewsWire Editorial Coverage

New York NY – October 16, 2018 – Growing demand for powerful batteries, coupled with attempts to break China’s hold on the market, are leading to growth for Canadian lithium explorers.

- Lithium is essential for batteries used in personal electronics and electric vehicles.

- The recent rise of electric cars, together with faster than expected production of other electric vehicles, is creating a huge rise in demand.

- The market’s current top global suppliers are China and Chile.

- Emerging companies in Canada are starting work on alternative sources of lithium that could reduce reliance on these two countries.

One of the companies setting up new Canadian mines is QMC Quantum Minerals Corp. (OTC:QMCQF) (TSX.V:QMC) (FSE:3LQ) (QMCQF Profile), which is using existing infrastructure in Manitoba to quickly get production up and running. Albemarle Corp. (NYSE:ALB), the world’s largest lithium manufacturer, has seen a surge in production that has almost doubled its earnings. Nemaska Lithium, Inc. (OTC:NMKEF) (TSX:NMX) is setting up mining and processing facilities in Canada as well as establishing supply agreements for when that work is completed. Sociedad Quimica y Minera S.A. (NYSE:SQM) is diversifying its lithium production, adding mining to brine extraction operations. All of this is driven by the work of companies such as Tesla, Inc. (NASDAQ:TSLA), whose electric cars are responsible for much of the demand.

To view an infographic of this editorial, click here.

The Changing Lithium Market

In the past 20 years, lithium has become one of the most sought-after commodities in the world. Lithium-ion batteries, which are used in everything from smartphones to electric trucks, are increasingly ubiquitous. Lithium is essential to their production, and as a result, demand for the mineral has soared. Mining companies around the world are rushing to set up lithium extraction facilities to get the precious metal to market.

This urgent need is leading to unexpected shifts in global markets. China, already a strong player in the lithium market, is attempting to corner its production. Previously neglected mines are being revived as sources of lithium. Countries that previously weren’t players in the market are emerging as potentially significant lithium producers. One of those countries is Canada.

Driving Up Demand

Recent years have seen a surge in lithium companies. Whether this growth is by established players or by the emergence of companies such as QMC Quantum Minerals Corp. (OTC:QMCQF) (TSX.V:QMC) (FSE:3LQ), one factor appear to be driving this — electric batteries.

Most of the chargeable batteries now used in personal electronic devices are lithium based. Mobile phones, tablets and laptops all rely on lithium to stay charged, sparking a surge in demand since the turn of the millennium. This demand is now being driven to stratospheric levels by another source — electric vehicles.

All electric cars use lithium batteries, and the vehicles require far more of the mineral than do smartphones. A Tesla Model S might need a hundred pounds of lithium in its batteries compared to a phone, which needs only a few grams. Becoming ever more common, electric cars are increasingly seen on the roads as environmentally conscious consumers try to get away from fossil fuels. Major manufacturers such as Volkswagen and BMW are spending millions on developing electric cars, all of which need the lithium that QMC and others can produce.

Production of electric trucks and buses are coming more quickly than expected, causing demand for lithium to further outstrip supply. With recent mandates by several cities, governments and car manufacturers, such as Volvo and Volkswagen, the demand for lithium continues to surpass production. Navistar has developed electric dump trucks while BYD (Lithium Battery Company) is producing electric buses.

Global lithium production is already at 600,000 tons per year and demand is expected to grow by another 600,000 to 800,000 tons over the next decade. Prices have risen 30 percent over the past few years and are likely to continue their ascent. This increase is great news for QMC. As the owner of a 1.2 million-ton lithium oxide deposit in Manitoba, which the company regards as a historical resource, QMC appears to be in a position to profit from this growth. As an emerging company, QMC may be especially appealing to investors, who can buy its shares for a fraction of those in more established mining companies.

Competing with Chinese Lithium

The fact that QMC’s deposit is in Canada is particularly important at this stage in the development of the lithium industry.

The two largest lithium producers in the world are currently in China and Chile, with Australia coming in third. China controls 30 percent of lithium production and is making moves to gain control of more. Chinese manufacturers recently tried to buy a large stake in one of Chile’s major lithium producers, only to be blocked by the Chilean government until the two parties could reach an agreement that granted the Chinese 24 percent of the company. As a major manufacturer of electric cars, this important move supports one of China’s growth industries; however, it’s also a strategic move, ensuring that China has access to supplies of a resource with significant uses in infrastructure and military equipment.

China’s focus on controlling lithium has created two strong reasons for other countries to develop their lithium deposits. On the one hand, there is the possibility of these countries benefitting from Chinese investment, attracting the money that Beijing businesses are throwing at the lithium supply problem. In addition, there’s the desire to reduce reliance on Chinese lithium and provide additional options — and independence — to electric vehicle manufacturing around the world.

Manitoba, where QMC has its lithium claims, is rich with potential for lithium exploitation. Recognized as one of the world’s best mining districts, it has previously been a rich source of other minerals. Many of these deposits, such as those being explored on QMC’s Irgon Lithium Mine Project Property, were discovered decades ago but never exploited, as lithium wasn’t a profitable resource at the time. Now the old mining records are being dusted off, and work is commencing in these neglected claims.

Extracting Canada’s Mineral Wealth

QMC’s lithium operations show how companies outside of China and Chile can compete with the big players, despite working on a smaller scale.

QMC’s Irgon Lithium Mine Project is based around Cat Lake within the prolific Cat Lake-Winnipeg River rare-element pegmatite field of S.E. Manitoba. This year, the company acquired 18 new claims, taking its total in the area up to 22. The lithium sources include the former Irgon Mine, possibly the best and richest lithium deposit in the whole of Manitoba. The quality of lithium ore in the area is also particularly rich – 1.51 percent lithium oxide, one of the higher grades of any company’s deposits in the country.

The region’s old mining industry also provides opportunities. Past surveys have put QMC ahead of the game in mapping out and analyzing the available lithium. Existing infrastructure for power and access can be reused, speeding up the establishment of mines. QMC’s project is road accessible with skilled workers readily available in the area.

The methods of mineral extraction used on these sites will be faster than those widely used in China and Chile. There, lithium is extracted from brines, with areas flooded, and the water evaporated to extract the minerals. In its Manitoba claims, QMC can simply mine and process the rock. This means a much faster turnaround time to set up extraction and see the results. Between its mining methods and the existing infrastructure, QMC is in a good position to quickly start extracting large quantities of high-quality lithium ore. Bottom line, QMC is poised to jump into the Lithium production market and could prove to be a big player.

Lithium Production across the Americas

The lithium industry’s importance in both North and South America is reflected in the growing number of companies and their wealth in the sector.

The biggest lithium manufacturer in the world, Albemarle Corp. (NYSE:ALB) has benefited enormously from the changes of the past few years. While it also produces bromine and catalysts for the chemical industry, lithium is now its most important resource. It produced 29 percent of the world’s lithium in 2017, thanks to its heavy investment in the Chilean lithium industry. This has led to stellar financial performance. During the second quarter of 2018, it saw a 16 percent rise in net sales on the same period for the previous year, producing a 197 percent increase in earnings.

Quebec-based company Nemaska Lithium, Inc. (OTC:NMKEF) (TSX:NMX) is working to set up lithium mining and processing facilities in Canada, with an aim of catering to the car market. Like QMC, it will be extracting lithium from mineral-rich ores. As of this month, work is on schedule to get the mine and processing plant up and running. Based on this, the company expects to start producing concentrate in the second half of 2019 and lithium salts in 2020. It already has a supply agreement with green battery manufacturer Northvolt, ensuring a market for some of its product.

Like Albemarle, Sociedad Quimica y Minera S.A. (NYSE:SQM) produces lithium from Chilean brine sources. As demand for lithium grows, SQM’s operations do as well. It is moving into lithium rock extraction, with mining at Mount Holland expected to begin in 2021. As the producer of 23 percent of the world’s lithium in 2017, it’s second only to Albemarle as a lithium producer while also manufacturing other industrial and agricultural chemicals.

One of the most prominent companies driving the demand for lithium is Tesla, Inc. (NASDAQ:TSLA). Famous for its work in electric and self-driving cars, Tesla has seen huge growth in demand for its vehicles, leading to a 40 percent rise in vehicle production in the first quarter of 2018.

Rapid growth in the electric vehicle market is leading to great demand for lithium batteries. Lithium producers that can quickly bring new sources online could profit tremendously from this surge.

For more information about QMC, please visit QMC Quantum Minerals Corp. (OTC:QMCQF) (TSX.V:QMC) (FSE: 3LQ).

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content distribution company that provides (1) access to a network of wire services via NetworkWire to reach all target markets, industries and demographics in the most effective manner possible, (2) article and editorial syndication to 5,000+ news outlets (3), enhanced press release services to ensure maximum impact, (4) social media distribution via the Investor Brand Network (IBN) to nearly 2 million followers, (5) a full array of corporate communications solutions, and (6) a total news coverage solution with NNW Prime. As a multifaceted organization with an extensive team of contributing journalists and writers, NNW is uniquely positioned to best serve private and public companies that desire to reach a wide audience of investors, consumers, journalists and the general public. By cutting through the overload of information in today’s market, NNW brings its clients unparalleled visibility, recognition and brand awareness. NNW is where news, content and information converge. For more information, please visit https://www.NetworkNewsWire.com.

Please see full terms of use and disclaimers on the NetworkNewsWire website applicable to all content provided by NNW, wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article and content set forth above. References to any issuer other than the profiled issuer are intended solely to identify industry participants and do not constitute an endorsement of any issuer and do not constitute a comparison to the profiled issuer. FN Media Group (FNM) is a third-party publisher and news dissemination service provider, which disseminates electronic information through multiple online media channels. FNM is NOT affiliated with NNW or any company mentioned herein. The commentary, views and opinions expressed in this release by NNW are solely those of NNW and are not shared by and do not reflect in any manner the views or opinions of FNM. Readers of this Article and content agree that they cannot and will not seek to hold liable NNW and FNM for any investment decisions by their readers or subscribers. NNW and FNM and their respective affiliated companies are a news dissemination and financial marketing solutions provider and are NOT registered broker-dealers/analysts/investment advisers, hold no investment licenses and may NOT sell, offer to sell or offer to buy any security.

The Article and content related to the profiled company represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in the Article and the content has been obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. None of the Author, NNW, FNM, or any of their respective affiliates, guarantee the accuracy or completeness of any such information. This Article and content are not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action; readers are strongly urged to speak with their own investment advisor and review all of the profiled issuer’s filings made with the Securities and Exchange Commission before making any investment decisions and should understand the risks associated with an investment in the profiled issuer’s securities, including, but not limited to, the complete loss of your investment.

NNW & FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and NNW and FNM undertake no obligation to update such statements.

NetworkNewsWire (NNW) is affiliated with the Investor Brand Network (IBN).

About IBN

Over the past 10+ years we have consistently introduced new network brands, each specifically designed to fulfil the unique needs of our growing client base and services. Today, we continue to expand our branded network of highly influential properties, leveraging the knowledge and energy of specialized teams of experts to serve our increasingly diversified list of clients.

Please feel free to visit the Investor Brand Network (IBN) www.InvestorBrandNetwork.com

Corporate Communications Contact:

NetworkNewsWire (NNW)

New York, New York

212.418.1217 Office

Media Contact:

FN Media Group, LLC

+1-(954)345-0611

Source: NetworkNewsWire

NetworkNewsWire Editorial Coverage

New York NY – October 2, 2018 – Despite short-term gyrations, the outlook for lithium continues to shine. Electric mobility is still only in its infancy. Revolutionizing how we commute and power our lives, the inevitable tsunami of electric vehicles and burgeoning demand for energy grid storage are driving lithium demand for the foreseeable future.

- The electric revolution is still in its infancy.

- Lithium demand expected to triple in next seven years.

- Lithium stocks could surge with demand.

- Junior miners offer big upside potential.

Anticipation of an exponential increase of electric vehicles coupled with expanding demand for lithium-ion (L-ion) batteries drove the lithium mining sector to reach all-time highs last year. Lithium  shares swooned at the beginning of 2018 on a negative oversupply forecast by Morgan Stanley analysts. That forecast has since been widely debunked by a broad range of lithium industry experts and given only a 1 percent chance of happening. As the world inexorably advances into the new electric power paradigm, the lithium sector should experience an excellent decade and produce outsized returns. Demand for raw battery materials continues to grow at an unprecedented pace, and lithium miners could easily rack up further gains and reach new highs. With large upside potential, evermore attention is turning to junior miners such as QMC Quantum Minerals Corp. (OTC:QMCQF) (TSX-V:QMC) (FSE:3LQ). The company is intent on building shareholder value through the acquisition, exploration and development of natural resource properties that contain either high-quality lithium or silver, gold, nickel, copper and zinc opportunities. Historically validated, QMC’s 100 percent-owned flagship project, the Irgon Mine Project,holds a potential motherlode of lithium. In addition, major lithium producers such as Albemarle Corporation (NYSE:ALB) and Sociedad Quimica y Minera S.A. (NYSE:SQM) plan production increases, and Nemaska Lithium, Inc. (OTC:NMKEF) (TSX:NMX) is also in the hunt to supply companies such as Tesla, Inc. (NASDAQ:TSLA) and myriad other end users seeking a secure supply chain.

shares swooned at the beginning of 2018 on a negative oversupply forecast by Morgan Stanley analysts. That forecast has since been widely debunked by a broad range of lithium industry experts and given only a 1 percent chance of happening. As the world inexorably advances into the new electric power paradigm, the lithium sector should experience an excellent decade and produce outsized returns. Demand for raw battery materials continues to grow at an unprecedented pace, and lithium miners could easily rack up further gains and reach new highs. With large upside potential, evermore attention is turning to junior miners such as QMC Quantum Minerals Corp. (OTC:QMCQF) (TSX-V:QMC) (FSE:3LQ). The company is intent on building shareholder value through the acquisition, exploration and development of natural resource properties that contain either high-quality lithium or silver, gold, nickel, copper and zinc opportunities. Historically validated, QMC’s 100 percent-owned flagship project, the Irgon Mine Project,holds a potential motherlode of lithium. In addition, major lithium producers such as Albemarle Corporation (NYSE:ALB) and Sociedad Quimica y Minera S.A. (NYSE:SQM) plan production increases, and Nemaska Lithium, Inc. (OTC:NMKEF) (TSX:NMX) is also in the hunt to supply companies such as Tesla, Inc. (NASDAQ:TSLA) and myriad other end users seeking a secure supply chain.

To view an infographic of this editorial, click here.

Lithium Demand May Exceed Expectations

Reflecting the scale of the impending energy revolution, respected independent commodity forecaster Roskill tripled its demand forecast for lithium through 2026. Two years ago, Roskill forecast demand would increase to 328,000 metric tons of lithium carbonate equivalent by 2026; now the commodities expert has revised the outlook and expects demand to explode to more than 1 million metric tons by then. However, lithium supply expectations fall far short of forecasts. In 2018, the total lithium production will total only around 280,000 metric tons of lithium carbonate equivalent — a far cry from what’s needed.

A wild card in the quest for lithium feedstocks is China, which already controls 55 percent of global lithium-ion battery production. China plans to deliver about 3.5 times more gigawatt-hours of battery cells a year than the Tesla Gigafactory and is expected to command 65 percent of all production by 2021. China also has been pushing hard for clean energy and intends to flood highways with 5 million electric vehicles by 2020. As electric autos and energy storage solutions surge, indications are that lithium may soon become the most important energy commodity in the world.

Juniors Should Shine

Many believe that the majors just won’t be able to produce enough lithium to meet global demand. Select junior miners are likely to be the beneficiaries and could produce exceptional returns. QMC Quantum Minerals Corp. (OTCPK:QMCQF) (TSX.V: QMC) (FSE: 3LQ) is in the sweet spot to capitalize on the enormous opportunity ahead. Documented by the previous owner, QMC’s flagship project, the Irgon Lithium Mine, is directly centered on a site rich with lithium-indicated resources. In the 1950s, the Lithium Corporation of Canada Ltd. drilled 25 holes into the Irgon Dike and reported a historical resource estimate of 1.2 million tons grading 1.51 percent Li2O over a strike length of 365 meters and to a depth of 213 meters. The mine was closed in the late 1950s due to a lack of demand for lithium at the time; things certainly have changed since then. QMC is currently updating the historical resource data to meet current NI43-101 reporting standards through a detailed channel sampling and subsequent drill program. An interactive 3-D model displaying historical data derived from past drilling and underground work shows that exploration and underground development has taken place only on the central portion of the dike, which means there’s a significant opportunity to quickly increase tonnage along strike. QMC recently issued an update on its promising drill program.

Once these assets are confirmed to current standards, it’s likely they will have a dramatic impact on QMC’s balance sheet. The results so far have been exceptionally promising since they currently reflect historic assays. Channel sampling on the Irgon Dike has returned 1.73 percent Li2O over 14 meters. In addition,regional results obtained from sampling of other dikes in the area returned three chip samples with concentrations over 1.90 percent lithium-oxide, including one that assayed 2.62 percent. These positive results, in conjunction with the well-developed mining infrastructure already in place, may position QMC to quickly leverage the assets and capitalize on the global demand for lithium.

Location, Location, Location

QMC’s Irgon Lithium Mine Project is strategically located in the prolific Cat Lake-Winnipeg River rare-element pegmatite field of southeastern Manitoba, Canada. This area is rich in spodumene-bearing pegmatite occurrences, also known as the source for hard-rock lithium mineralization, that often contain large amounts of lithium and other rare-element-bearing minerals. Once surveys and sampling have been completed, hard-rock pegmatite deposits are much faster to mine than salt brines, and production is more reliable. QMC is already ahead of the curve with all the previous work done and should be able to move forward to mining the riches quickly. The region’s abundant mineral resources are further substantiated by the mining activities of neighboring specialty materials behemoth Cabot Corp. through its Tantalum Mining Corporation of Canada (TANCO) rare-element pegmatite deposit.

QMC Quantum Minerals has already invested two years in the exploration of its Irgon Lithium Project. Normally it takes three to five years to develop, but due to the extensive previous exploration and development work done on the site decades ago, QMC expects to start operations much sooner than anyone thought possible and is rapidly moving toward bringing the property online for production. QMC has expanded its Irgon Lithium Mine Project holdingsby 650 percent, raising the project’s contiguous footprint to 11,325 acres as it aggressively moves the Irgon Mine Project forward to production.

Like the Irgon Lithium Mine Project, QMC’s 100 percent-owned Namew Lake District Property is also exceptionally well located. The 23,000-hectare property encompasses the Rocky Lake Discovery in the Flin Flon Belt, a world-class mining district in Northwestern Manitoba. QMC’s geophysical and drill programs at the Rocky Lake Project identified significant geophysical conductors, and assays from the drill holes showed evidence of gold, copper and zinc mineralization. This project represents a massive resource with strong future potential, but with lithium in such demand, QMC is focused on bringing the Irgon Property into production first.

Utility Storage Solutions

Lithium demand could skyrocket even higher than anticipated. A Wall Street Journal article revealed an enormous but seldom recognized lithium demand driver. Multiple states and municipalities in conjunction with utilities across the country are revamping antiquated electric grids and utilizing high-density Li-ion energy storage batteries to make the grid more efficient. Utility companies are increasingly storing energy in neighborhood battery junction boxes during off-peak, using it during peak demand and avoiding expensive peak demand electricity.

Leading global electricity industry expert GTM Research published a report on the state of the U.S. energy storage market. The study projects that in just three years, deployments of stored energy in residential, nonresidential and utility systems will grow to more than 10 times greater than current levels. Such a drastic increase in deployment is expected to lead to an energy storage market worth $2.8 billion.

If there are any doubts about lithium demand, look at any lithium mining company — every single one is trying to rapidly expand production. The lithium boom has just begun, and it won’t end any time soon. Strategically positioned portfolios in the lithium sector should excel well into the future.

Buyers and Suppliers

To lock in lithium supplies, Tesla, Inc. (NASDAQ:TSLA) just signed a deal with China’s top lithium producer to satisfy its thirst for the raw material. Tesla uses the metal as a key component to manufacture batteries for its electric cars and other energy storage products. The company is rapidly expanding output of its Model S and building a lithium-ion battery factory in Nevada.

Albemarle Corporation (NYSE:ALB) is among the world’s largest lithium producers and a leader in specialty chemicals. Albemarle’s lithium business segment mines lithium and converts it into different forms along the value chain. The company operates one of the only operating lithium brines in North America as well as a brine in Chile. ALB plans to expand production in 2019 under an Australian joint venture.

Chile-based Sociedad Quimica y Minera S.A. (NYSE:SQM) is an intriguing player in the global scramble to secure greater supplies of lithium. SQM announced plans to expand lithium carbonate capacity to 63,000 metric tons by year end. The Chilean government blocked China’s aggressive bid for over 30 percent ownership of SQM last year but reached an agreement in May allowing China’s Tianqi Lithium to buy a 24 percent stake, which could grant China control of about 60 percent of the world’s lithium supply.

Nemaska Lithium, Inc. (OTC:NMKEF) (TSX:NMX) is developing spodumene hard-rock lithium deposits in Canada and is pursuing patent protection for its proprietary process to produce lithium hydroxide and lithium carbonate. The company just signed a five-year supply agreement with Northvolt, an European battery maker. Nemaska recently obtained $75 million in funding to finance its Whabouchi Mine.

For more information about QMC, please visit QMC Quantum Minerals Corp. (OTCPK:QMCQF) (TSX.V:QMC) (FSE:3LQ)

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content distribution company that provides (1) access to a network of wire services via NetworkWire to reach all target markets, industries and demographics in the most effective manner possible, (2) article and editorial syndication to 5,000+ news outlets (3), enhanced press release services to ensure maximum impact, (4) social media distribution via the Investor Brand Network (IBN) to nearly 2 million followers, (5) a full array of corporate communications solutions, and (6) a total news coverage solution with NNW Prime. As a multifaceted organization with an extensive team of contributing journalists and writers, NNW is uniquely positioned to best serve private and public companies that desire to reach a wide audience of investors, consumers, journalists and the general public. By cutting through the overload of information in today’s market, NNW brings its clients unparalleled visibility, recognition and brand awareness. NNW is where news, content and information converge. For more information, please visit https://www.NetworkNewsWire.com.

Please see full terms of use and disclaimers on the NetworkNewsWire website applicable to all content provided by NNW, wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article and content set forth above. References to any issuer other than the profiled issuer are intended solely to identify industry participants and do not constitute an endorsement of any issuer and do not constitute a comparison to the profiled issuer. FN Media Group (FNM) is a third-party publisher and news dissemination service provider, which disseminates electronic information through multiple online media channels. FNM is NOT affiliated with NNW or any company mentioned herein. The commentary, views and opinions expressed in this release by NNW are solely those of NNW and are not shared by and do not reflect in any manner the views or opinions of FNM. Readers of this Article and content agree that they cannot and will not seek to hold liable NNW and FNM for any investment decisions by their readers or subscribers. NNW and FNM and their respective affiliated companies are a news dissemination and financial marketing solutions provider and are NOT registered broker-dealers/analysts/investment advisers, hold no investment licenses and may NOT sell, offer to sell or offer to buy any security.

The Article and content related to the profiled company represent the personal and subjective views of the Author, and are subject to change at any time without notice. The information provided in the Article and the content has been obtained from sources which the Author believes to be reliable. However, the Author has not independently verified or otherwise investigated all such information. None of the Author, NNW, FNM, or any of their respective affiliates, guarantee the accuracy or completeness of any such information. This Article and content are not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action; readers are strongly urged to speak with their own investment advisor and review all of the profiled issuer’s filings made with the Securities and Exchange Commission before making any investment decisions and should understand the risks associated with an investment in the profiled issuer’s securities, including, but not limited to, the complete loss of your investment.

NNW & FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and NNW and FNM undertake no obligation to update such statements.

NetworkNewsWire (NNW) is affiliated with the Investor Brand Network (IBN).

About IBN

Over the past 10+ years we have consistently introduced new network brands, each specifically designed to fulfil the unique needs of our growing client base and services. Today, we continue to expand our branded network of highly influential properties, leveraging the knowledge and energy of specialized teams of experts to serve our increasingly diversified list of clients.

Please feel free to visit the Investor Brand Network (IBN) www.InvestorBrandNetwork.com

Corporate Communications Contact:

NetworkNewsWire (NNW)

New York, New York

212.418.1217 Office

Media Contact:

FN Media Group, LLC

+1-(954)345-0611

SOURCE: NetworkNewsWire

VANCOUVER, British Columbia, Sept. 17, 2018 — QMC Quantum Minerals Corp., (TSX.V: QMC) (FSE: 3LQ) (OTC PINK: QMCQF) (“QMC” or “the Company”) is pleased to provide an update on its company’s 100% owned Irgon Lithium Mine Project located within the prolific Cat Lake-Winnipeg River rare-element pegmatite field of S.E. Manitoba, which also hosts Cabot Corporation’s nearby Tantalum Mining Corporation of Canada (“TANCO”) rare-element pegmatite.