Drilling Continues to Intercept Wide Intervals of High-Grade Gold Extending Mineralization Along Strike from Discovery Hole

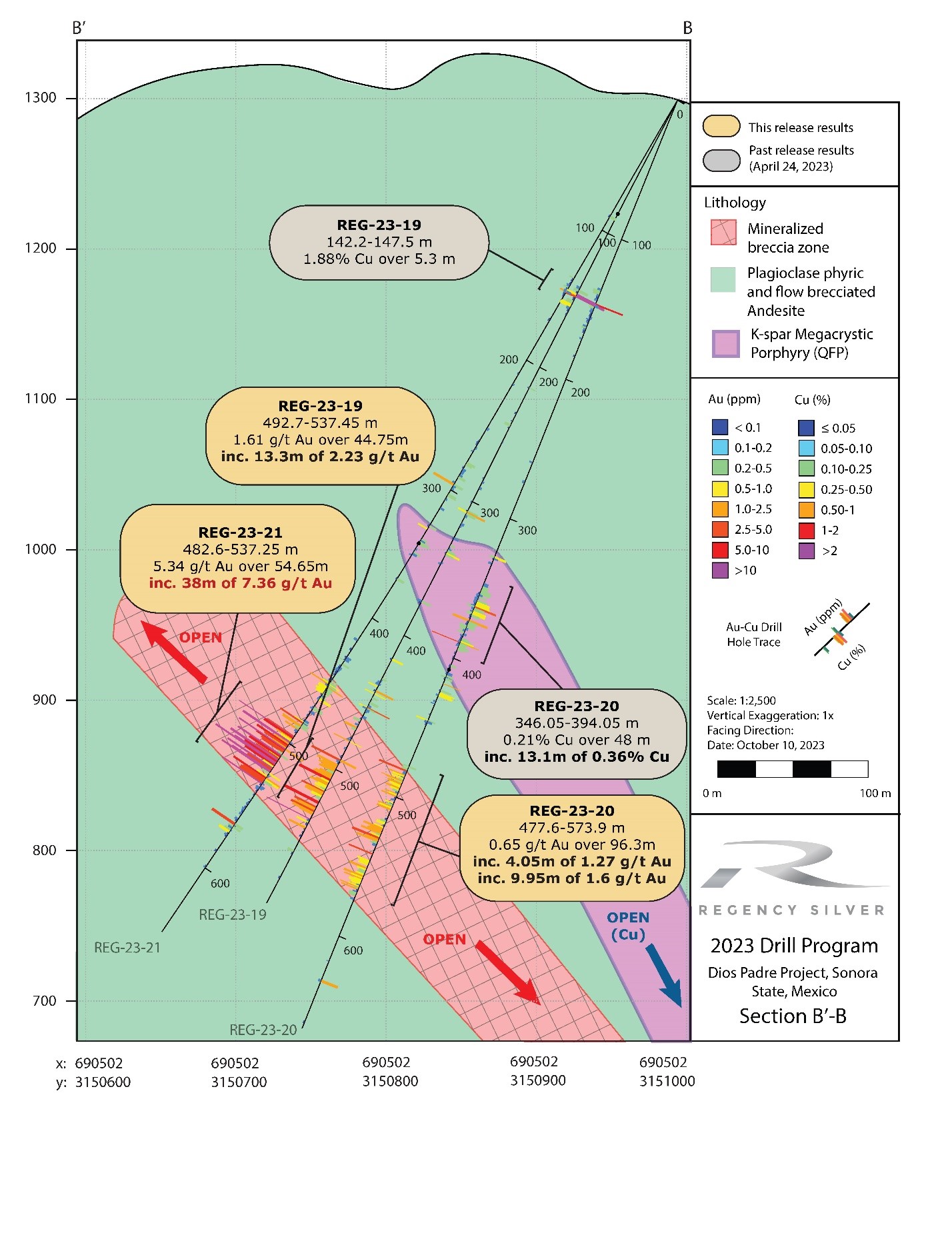

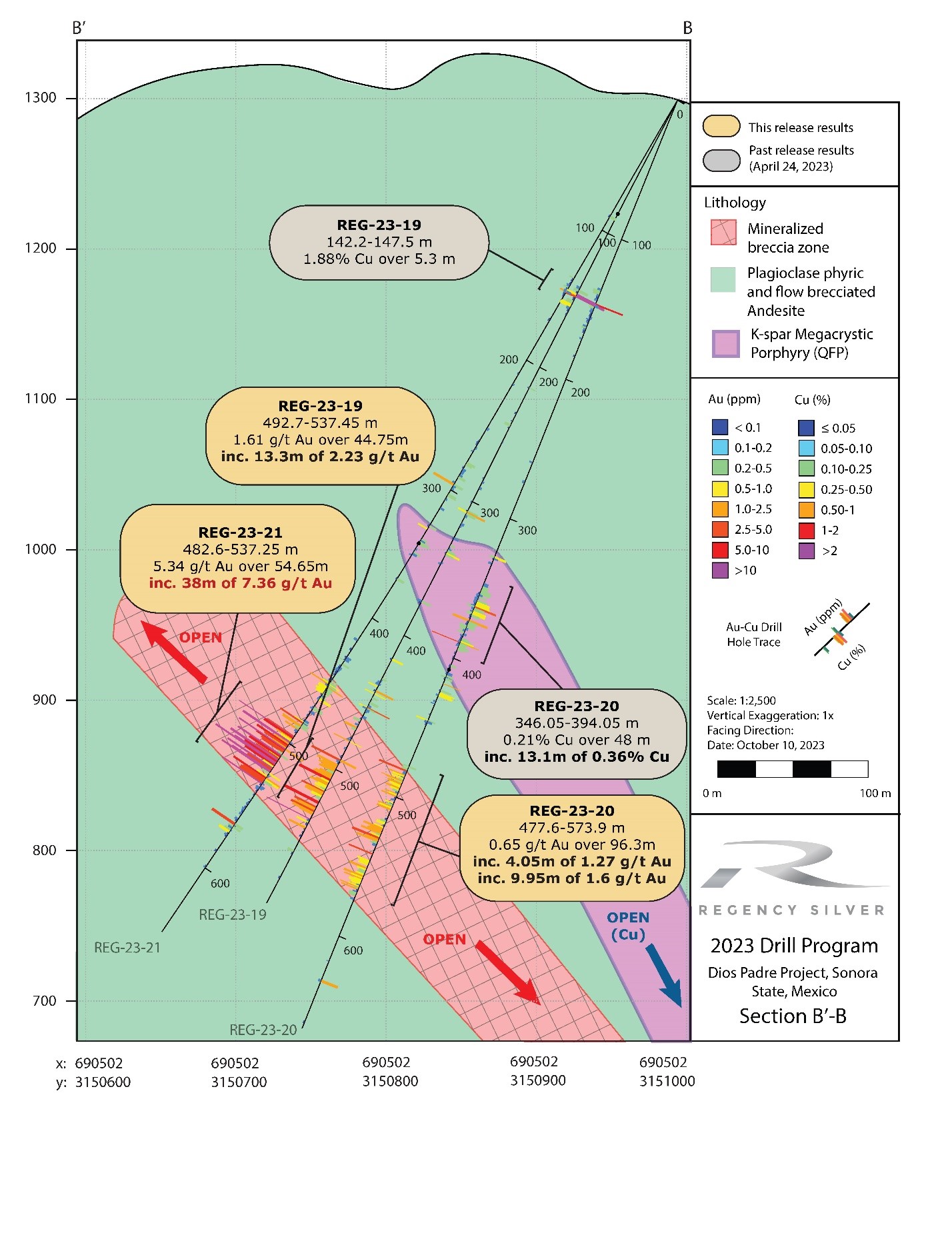

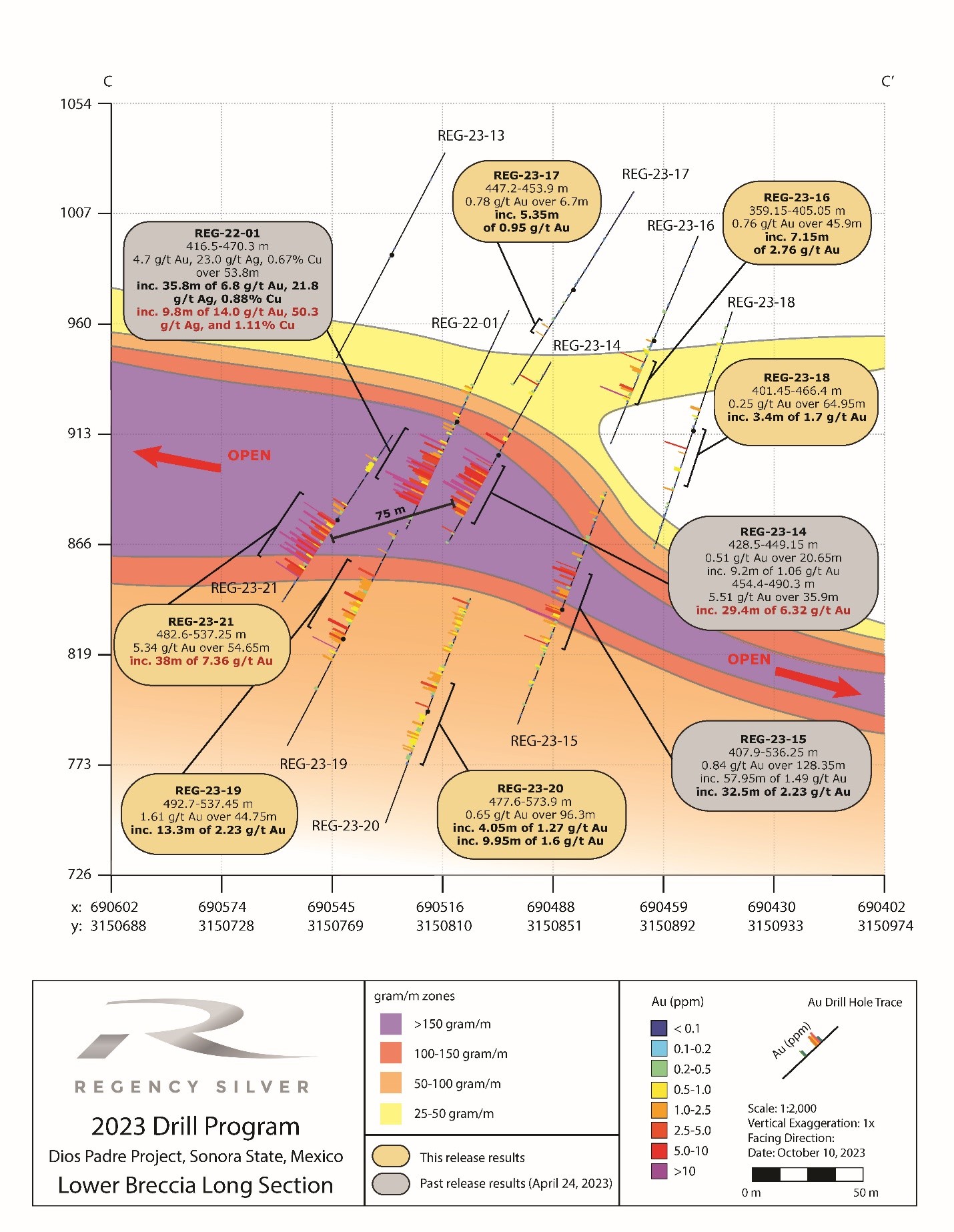

Vancouver, BC – November 2, 2023 – Regency Silver Corp. (OTCQB:RSMXF) (TSX-V:RSMX) (“Regency Silver” or the “Company”) is pleased to announce that hole REG-23-21 intersects 54.65m of 5.34 g/t gold including 7.36 g/t over 38m in a ~65 m step-out along strike to the southeast from the discovery hole REG-22-01 which returned (35.8m of 6.84 g/t gold, 0.88% copper and 21.82 g/t silver) and ~75m step-out from REG-23-14 (35.9m of 5.51 g/t Au including 29.4m of 6.32 g/t Au.

The Company will host a virtual investor webcast to discuss these drill results and to provide a corporate update to the investment community later today at 06:00 PDT / 09:00 EDT. Details are provided below.

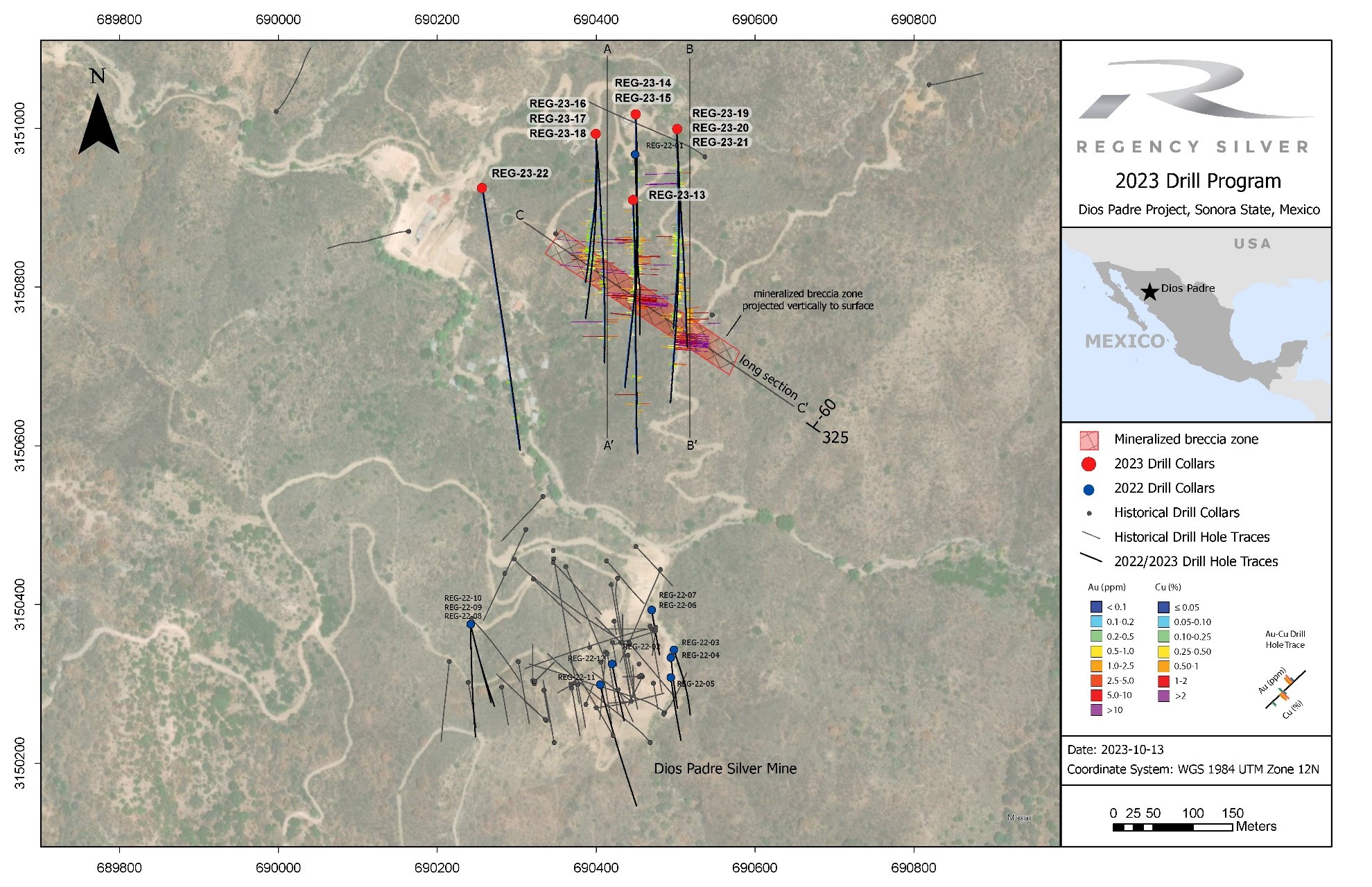

The 2023 drill campaign consisted of 6105.25m in 10 holes (Fig.1). 8 of the 9 holes targeting the lower Dios Padre breccia zone intersected mineralized pyrite-specularite breccia and confirm the mineralized breccia zone has a strike of at least 180m and depth extent of at least 150m while the breccia remains open both along strike, up-dip towards the old silver mine, and at depth.

Select Drilling Highlights:

- REG-23-21 intersects 65m of 5.34 g/t Au including 7.36 g/t over 38m and 8.7 g/t over 28.90m from 450.8m downhole in ~65 m step-out along strike to the southeast from hole REG-22-01 (Fig. 3).

- REG-23-19 intersects 44.75m of 1.61 g/t including 3m of 2.23 g/t Au from 492.7m downhole ~40 m down- dip from REG-23-20.

- REG-23-20 intersects 96.3m of 0.65 g/t Au including 95m of 1.6 g/t Au from 477.6m downhole ~45m down-dip from REG-23-19 and ~85m down-dip from REG-23-21.

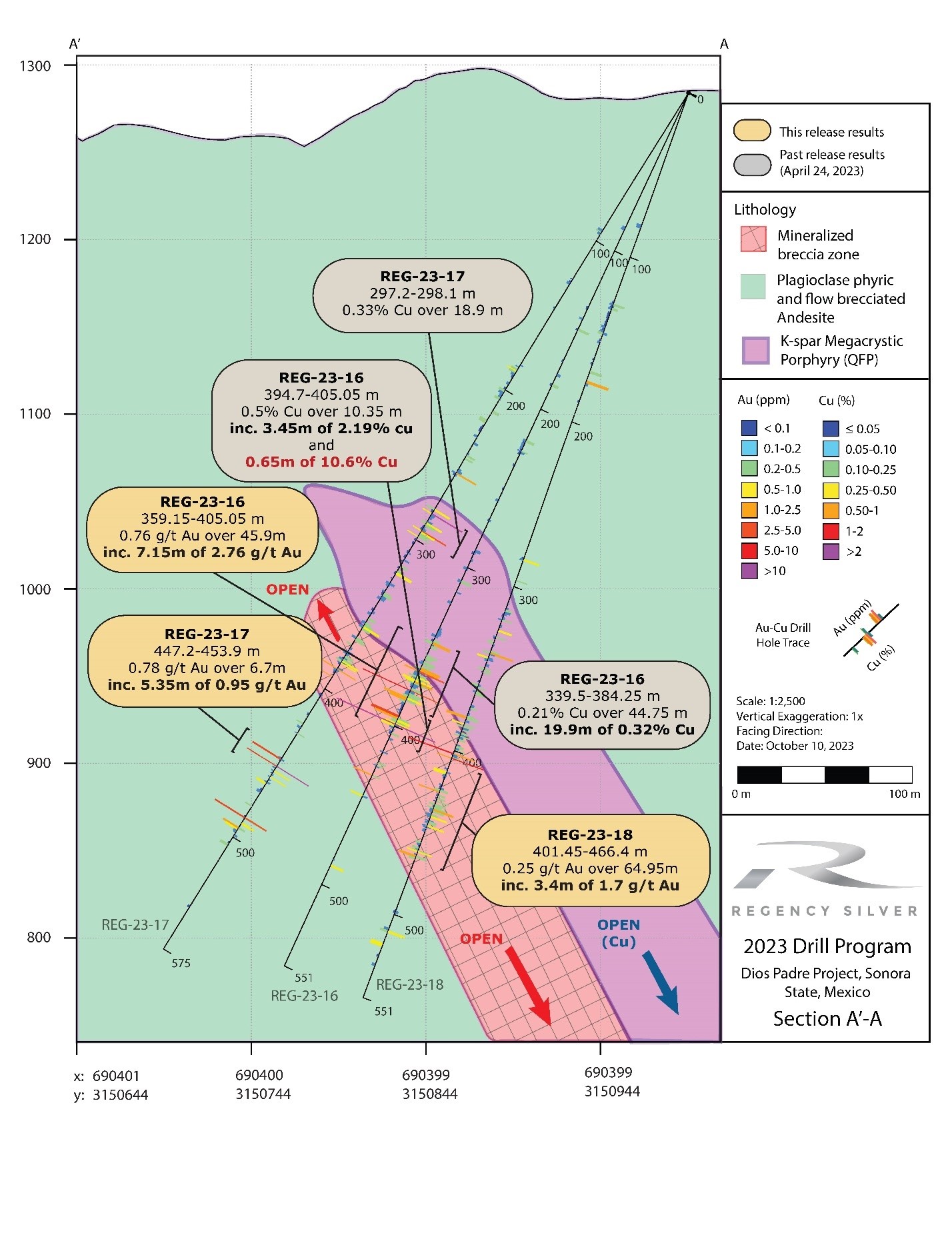

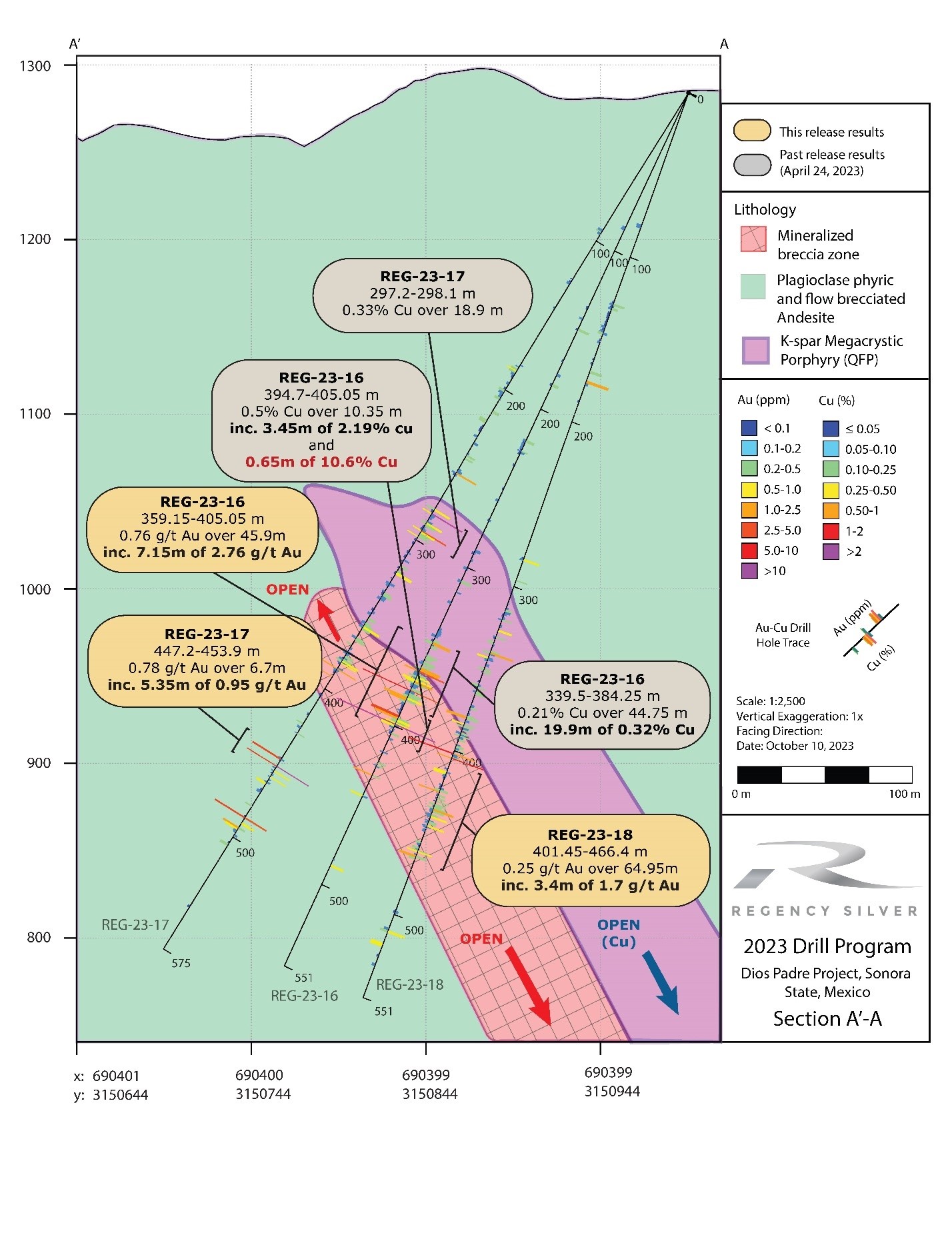

- REG-23-16 intersects 7.15m of 2.76 g/t Au from 393.3m downhole ~75m along strike to the NW from REG-23-14 (Fig. 2).

Michael Tucker, lead geologist and director states, “The continued ability of the lower breccia zone to produce highly elevated gold grades over significant widths is very compelling. The system has proven the ability to generate spectacular grades and thicknesses. The indications of a large magmatic-hydrothermal system are present, and we are excited to continue expanding on these exceptional results as they clearly demonstrate there is a big system to be explored.”

Discussion of results:

- The mineralized breccia zone now has a confirmed strike extent of at least 180m and depth extent of at least 150m, and the breccia remains open both along strike and at depth (Fig. 4).

- The shape and orientation of the breccia zone is now understood; trending NW-SE and dipping ~60˚ to the NE. The orientation of the breccia is unrelated to the orientation of the Quartz-feldspar porphyry (QFP) (Fig. 5).

- High grade Au mineralization is hosted within the larger pyrite-specularite breccia body. More Au-rich zones appear to be associated with areas of increased pyrite.

- High grade Au at this stage appears to be concentrated in the shallower (upper) portions of the breccia.

- The SE portion of the breccia body is trending upwards towards similar Au-Ag rich breccias encountered in shallow drilling at the Dios Padre mine site (REG-22-04 – 17.9m of 1.34 g/t Au. See news release of October 14, 2022). This suggests that similar high-grade sections as those in REG-22-01, REG-23-14 and REG-23-21 may exist at shallower levels as we approach the historic mine site, potentially transitioning to more of an Au-Ag assemblage.

- The breccia zone as well as the high-grade upper portion both are open along strike and at depth.

- Copper mineralization is more intimately associated with the QFP unit. Where the breccia and the QFP intersect, more Au-Cu mineralization is present although Cu mineralization is a later event which overprints the earlier Au mineralization.

- Cu and associated low-grade Au mineralization appears to be increasing with depth within the QFP unit, indicating a vector towards a higher-grade Cu core within the QFP at depth.

- REG-23-22 targeted the strongest IP (Chargeability) anomaly indicated by the 2023 survey. The hole intersected zones of significant pyrite, alunite, and sericite alteration, however, did not intersect and significant Au, Ag or Cu mineralization. The sulphide and broad alteration are clearly associated with the main hydrothermal system and provide important information on metal endowment variance with distance from the primary mineralized corridors.

Bruce Bragagnolo, Executive Chairman and Director states, “The gold breccia is a large, high grade gold zone. Consistently drilling into a mineralized zone as thick as an 18-story building builds our confidence that we can extend the high-grade core along strike with strong potential for continued high grade zones up-dip 400m toward the historic silver mine.”

Technical Prospectivity of the Dios Padre project:

The Dios Padre historic silver mine workings contain a NI 43-101 inferred resource of 11.375 million AgEq ounces (94% Ag) at an average grade of 255.64 g/t AgEq at a cutoff grade of 120 g/t AgEq. Dios Padre is a high-grade deposit as evidenced by its drill intercepts which include:

- Hole FMR 12-06 with 1.9m of 3220 g/t silver inside an intercept of 32.5m of 408 g/t silver.

- Hole FMR 17-06 with 5.2m of 1145 g/t silver

- Hole RDP 18-12 with 12.4m of 558 g/t silver

- Hole FMR 15-06 with 28.m of 467.8 silver

The newly discovered lower breccia Au-Cu zones are clearly part of a long lived, multi-phase magmatic hydrothermal Au-Cu-Ag event in the district. The current hypothesis is that this system is part of the late Cretaceous to early Paleogene Laramide magmatic arc and associated porphyry Cu-Au deposits that span from New Mexico southwards into Sinaloa, Mexico (e.g. Buenavista del Cobre, La Caridad).

Samples from the Cu-Au mineralized K-spar megacrystic QFP have been submitted for geochronological analysis to determine its age and confirm its association with this magmatic suite. The presence of a Laramide age Cu-Au porphyry system would be new to the Dios Padre region of Sonora and has property-scale, as well as regional-scale implications on the prospectivity of the district. Dios Padre has all the indications of the presence of a significant hydrothermal system including widespread alunite-sericite alteration, extensive specularite-pyrite halos around Au-Cu mineralization, large, well-developed, multi-phase breccias as well as Cu-Au mineralized porphyritic intrusive rocks.

The current hypothesis is that the Dios Padre silver mine and the lower Au breccia represent the thermal transition from a cooler Ag dominant upper assemblage to a warmer Au-Cu domain as the system approaches the magmatic source. The current complex is believed to represent a hypogene, high-sulphidation Au-Ag-Cu system proximal to the Cu-Au porphyry source likely to exist at depth at the northern part of the property.

Table 1: Gold (Au) results for holes REG-23-16 to REG-23-21

| Hole |

From (m) |

To (m) |

Length (m)1 |

Au (g/t)2 |

| REG-23-16 |

359.15 |

405.05 |

45.9 |

0.76 |

| Inc. |

377.4 |

384.25 |

6.85 |

1.31 |

| Inc. |

393.3 |

400.45 |

7.15 |

2.76 |

| Inc. |

398.6 |

399.25 |

0.65 |

17.5 |

| REG-23-17 |

447.2 |

453.9 |

6.7 |

0.78 |

| Inc. |

447.2 |

452.55 |

5.35 |

0.95 |

| REG-23-18 |

401.45 |

466.4 |

64.95 |

0.25 |

| Inc. |

401.45 |

404.85 |

3.4 |

1.7 |

| REG-23-19 |

142.2 |

155.3 |

13.1 |

0.47 |

| REG-23-19 |

492.7 |

537.45 |

44.75 |

1.61 |

| Inc. |

524.15 |

537.45 |

13.3 |

2.23 |

| REG-23-20 |

135.5 |

171.5 |

36 |

0.25 |

| Inc. |

146 |

149.85 |

3.85 |

1.22 |

| REG-23-20 |

354.14 |

391.45 |

37.31 |

0.24 |

| REG-23-20 |

477.6 |

573.9 |

96.3 |

0.65 |

| Inc. |

480.8 |

484.85 |

4.05 |

1.27 |

| Inc. |

522.4 |

532.35 |

9.95 |

1.6 |

| Inc. |

546.6 |

566.7 |

20.1 |

0.81 |

| REG-23-21 |

450.8 |

460.3 |

9.5 |

0.61 |

| REG-23-21 |

482.6 |

537.25 |

54.65 |

5.34 |

| Inc. |

494.65 |

532.65 |

38 |

7.36 |

| Inc. |

494.65 |

523.55 |

28.9 |

8.7 |

| REG-23-21 |

564 |

571.9 |

7.9 |

0.95 |

- It is estimated that the intervals are somewhere between 70-100% of true thickness since drilling is currently near perpendicular to the orientation of stratigraphy with mineralization appearing to loosely follow stratigraphy at this stage of exploration.

- Au composites are calculated using a 0.1 g/t Au cutoff, incorporating no more than 7.5 m downhole dilution. Higher-grade composite intervals are calculated using 0.3g/t, 1g/t, 3g/t, and 5 g/t cutoffs incorporating no more than 5 m downhole dilution.

Table 2: Copper (Cu) results for holes REG-23-16 to REG-23-21

| Hole |

From (m) |

To (m) |

Length (m)1 |

Cu (%)2 |

| REG-23-16 |

339.5 |

384.25 |

44.75 |

0.21 |

| Inc. |

363.1 |

383 |

19.9 |

0.32 |

| REG-23-16 |

394.7 |

405.05 |

10.35 |

0.5 |

| Inc. |

395.8 |

399.25 |

3.45 |

2.19 |

| Inc. |

398.6 |

399.25 |

0.65 |

10.6 |

| REG-23-17 |

279.2 |

298.1 |

18.9 |

0.33 |

| REG-23-18 |

373.45 |

408.85 |

35.4 |

0.15 |

| REG-23-18 |

423.6 |

446.35 |

22.75 |

0.16 |

| REG-23-19 |

142.2 |

147.5 |

5.3 |

1.88 |

| REG-23-19 |

440.85 |

461.5 |

20.65 |

0.16 |

| REG-23-20 |

346.05 |

394.05 |

48 |

0.21 |

| Inc. |

360.4 |

373.5 |

13.1 |

0.36 |

| REG-23-21 |

450.8 |

472.5 |

21.7 |

0.14 |

| REG-23-21 |

523.55 |

535.05 |

11.5 |

0.17 |

- It is estimated that the intervals are somewhere between 70-100% of true thickness since drilling is currently near perpendicular to the orientation of stratigraphy with mineralization appearing to loosely follow stratigraphy at this stage of exploration.

- Cu composites are calculated using a 0.1 % Cu cutoff, incorporating no more than 7.5 m downhole dilution. Higher-grade composite intervals are calculated using 0.25%, 0.5%, 0.75% cutoffs incorporating no more than 7.5 m downhole dilution.

Table 3: Silver (Ag) results for holes REG-23-16 to REG-23-22

| Hole |

From (m) |

To (m) |

Length (m)1 |

Ag (g/t)2 |

| REG-23-16 |

No Significant Results |

| REG-23-17 |

253.6 |

257.1 |

3.5 |

140.07 |

| REG-23-17 |

279.2 |

298.1 |

18.9 |

33.45 |

| REG-23-18 |

No Significant Results |

| REG-23-19 |

142.2 |

155.3 |

13.1 |

77.01 |

| Inc. |

142.2 |

147.5 |

5.3 |

180.43 |

| REG-23-19 |

305.5 |

311.5 |

6 |

60.91 |

| REG-23-20 |

142.7 |

152.5 |

9.8 |

78.23 |

| Inc. |

146 |

146.85 |

0.85 |

833 |

| REG-23-21 |

No Significant Results |

- It is estimated that the intervals are somewhere between 70-100% of true thickness since drilling is currently near perpendicular to the orientation of stratigraphy with mineralization appearing to loosely follow stratigraphy at this stage of exploration.

- Ag composites are calculated using a 10g/t cutoff, incorporating no more than 7.5 m downhole dilution. Higher-grade composite intervals are calculated using 25g/t and 50 g/t cutoffs incorporating no more than 5 m downhole dilution.

Table 4: Collar table containing the location and orientations of completed holes. Holes contained in this news release are in bold and the balance are holes that have been previously completed and the results released.

| Hold ID |

Easting |

Northing |

Elevation |

Hole Depth |

Azimuth |

Dip |

| REG-22-01 |

3150962 |

690443 |

1294 |

500.5 |

178.2 |

-60 |

| REG-23-13 |

3150907 |

690448 |

1300 |

670.05 |

180 |

-59.5 |

| REG-23-14 |

3151017 |

690450 |

1294 |

686.4 |

179.5 |

-60.2 |

| REG-23-15 |

3151017 |

690450 |

1294 |

617.5 |

179.6 |

-66.5 |

| REG-23-16 |

3150995 |

690398 |

1284 |

551.4 |

180 |

-65 |

| REG-23-17 |

3150995 |

690398 |

1284 |

575.4 |

178 |

-58.2 |

| REG-23-18 |

3150995 |

690398 |

1284 |

550.9 |

178 |

-70.6 |

| REG-23-19 |

3150994 |

690500 |

1299 |

599.2 |

178 |

-62 |

| REG-23-20 |

3150994 |

690500 |

1299 |

666 |

178 |

-67.5 |

| REG-23-21 |

3150994 |

690500 |

1299 |

651.3 |

179.9 |

-58.9 |

| REG-23-22 |

3150925 |

690257 |

1234 |

536.3 |

172.3 |

-51.1 |

QA/QC

Once the drill core was received from the drill site, individual samples were determined, logged for geological attributes, sawn in half, labelled, and bagged for assay submittal. The remaining drill core was then stored at a secure site in the buildings surrounding the old milling site for the Dios Padre silver mine. The Company inserted quality control samples at regular intervals within the sample stream which included blanks, preparation duplicates, and standard reference materials with all sample shipments intended to monitor laboratory performance. Sample shipment was conducted under a chain of custody procedure.

Drill core samples were submitted to ALS Global’s analytical facility in Hermosillo, Mexico for preparation and analysis. Sample preparation included drying and weighing the samples, crushing the entire sample, and pulverizing 250 grams (“g”). Analysis for gold was by method Au-AA23: 30g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.005 ppm and upper limit of 10 ppm. Gold assays greater than 10ppm are automatically analyzed by method Au-GRA21: 30g fire assay fusion with a gravimetric fusion. Analysis for silver and base metals was by method ME-ICP61m: 0.75 g is dissolved via four acid digest and analyzed with ICP-AES finish. Detection limits for Ag are 0.5-100ppm, 1-10 000ppm for Cu, 2-10 000ppm for Zn and 2-10 000ppm for Pb. Silver assays greater than 100ppm are automatically analyzed by method Ag-OG62: 0.4g sample by Ag by HF-HNO3-HClO4 digestion with HCl leach, ICP-AES or AAS finish. Samples with Ag>1500ppm are automatically analyzed by Ag-GRA21: 30g sample Ag by fire assay and gravimetric finish. Cu, Pb and Zn >10 000ppm are automatically analyzed by Cu-OG62, Pb-OG62 and Zn-OG62 respectively: 0.4g sample by Four acid digestion and ICP finish.

ALS Global is ISO 9001 and ISO/IEC 17025 certified and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. Parameters for ALS’ internal and Regency Silver’s external blind quality control samples were acceptable for the analyzes returned.

Technical Information

The technical information contained in this news release has been reviewed by Company director Michael Tucker, P.Geo, who is recognized as a Qualified Person under the guidelines of National Instrument 43-101. Mr. Tucker is a director of the Company and for that reason is not considered independent. Mr. Tucker has read and approved the technical contents of this news release.

Webcast Details

Topic: Regency Silver Investor Update

Date: November 2, 2023

Time: 06:00 PDT / 09:00 EDT

Speaker(s): Bruce Bragagnolo, Executive Chairman

Webcast URL: https://us06web.zoom.us/webinar/register/2316987678980/WN_FX7LEDxcQ6-WNzbbU-hf2g

ABOUT REGENCY SILVER CORP.

Regency Silver is a gold-copper-silver exploration company focused on the Americas. Regency Silver is led by a team of experienced professionals with expertise in both exploration and production. Regency Silver’s flagship project is the Dios Padre gold-copper-silver project in Sonora, Mexico.

Regency Silver has received a Technical Report entitled “Geological Report and Resource Estimate, Dios Padre Property, Municipality of Yecora, Sonora State, Mexico”, dated March 02, 2023 prepared by Gordon Gibson, B.Sc., P. Geo in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). Mr. Gibson is an independent Qualified Person pursuant to NI 43-101. The Technical Report contains a resource estimate which estimates an inferred resource of 11.375 million ounces of silver equivalent represented by 1.384 million tonnes at 255.64 g/t silver equivalent.

Contact Information

Regency Silver Corp.

Kin Communications Inc.

Phone: 1-604-684-6730

Email: RSMX@kincommunications.com

Bruce Bragagnolo, Executive Chairman

(604) 417-9517

Email: bruce@regency-silver.com

Gijsbert Groenewegen, Chief Executive Officer

Phone: 1-646-247-1000

Email: gijs@regency-silver.com

Information Concerning Estimates of Mineral Resources

The scientific and technical information in this news release was prepared in accordance with NI 43-101 which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the “SEC”). The terms “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” used herein are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the “CIM Definition Standards”), which definitions have been adopted by NI 43-101. Accordingly, information contained herein providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

You are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, “inferred mineral resources” are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. Information regarding mineral resources contained or referenced herein may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be “substantially similar” to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Definitions Standards. Accordingly, there is no assurance any mineral resources that the Company may report as “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements: This news release includes certain forward-looking statements and forward-looking information (together, “forward-looking statements”). All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the optioning of the Project by the Company. There can be no assurance that such statements will prove to be accurate and actual results and future events may vary from those anticipated in such statements. Important risk factors that could cause actual results to differ materially from the Company’s plans or expectations include the risk that regulatory changes, fundraising, and risk associated with mineral exploration, including the risk that actual results of exploration will be different from those expected by management. The forward-looking statements in this news release were developed based on the expectations of management, including that Exchange acceptance for the proposed transaction will be obtained, conditions will be satisfied, required fundraising will be completed and the other risks described above will not materialize. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as otherwise required by applicable securities legislation.

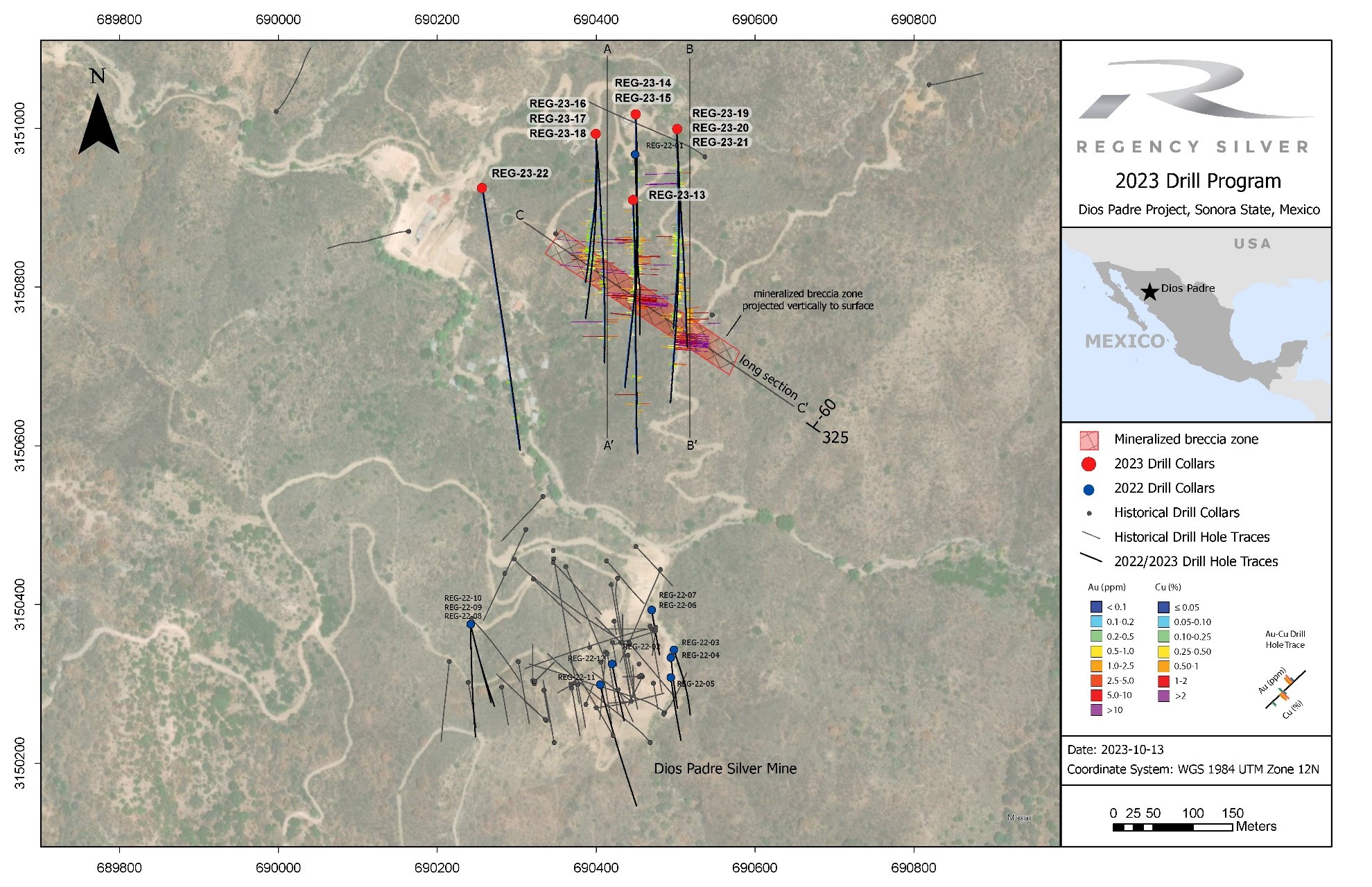

Figure 1: Plan map showing hole locations, section locations, traces as well as the projection of the mineralized breccia to surface.

Figure 2: Cross section with holes REG-23-16, REG-23-17 and REG-23-18.

Figure 3: Cross section with holes REG-23-19, REG-23-20 and REG-23-21.

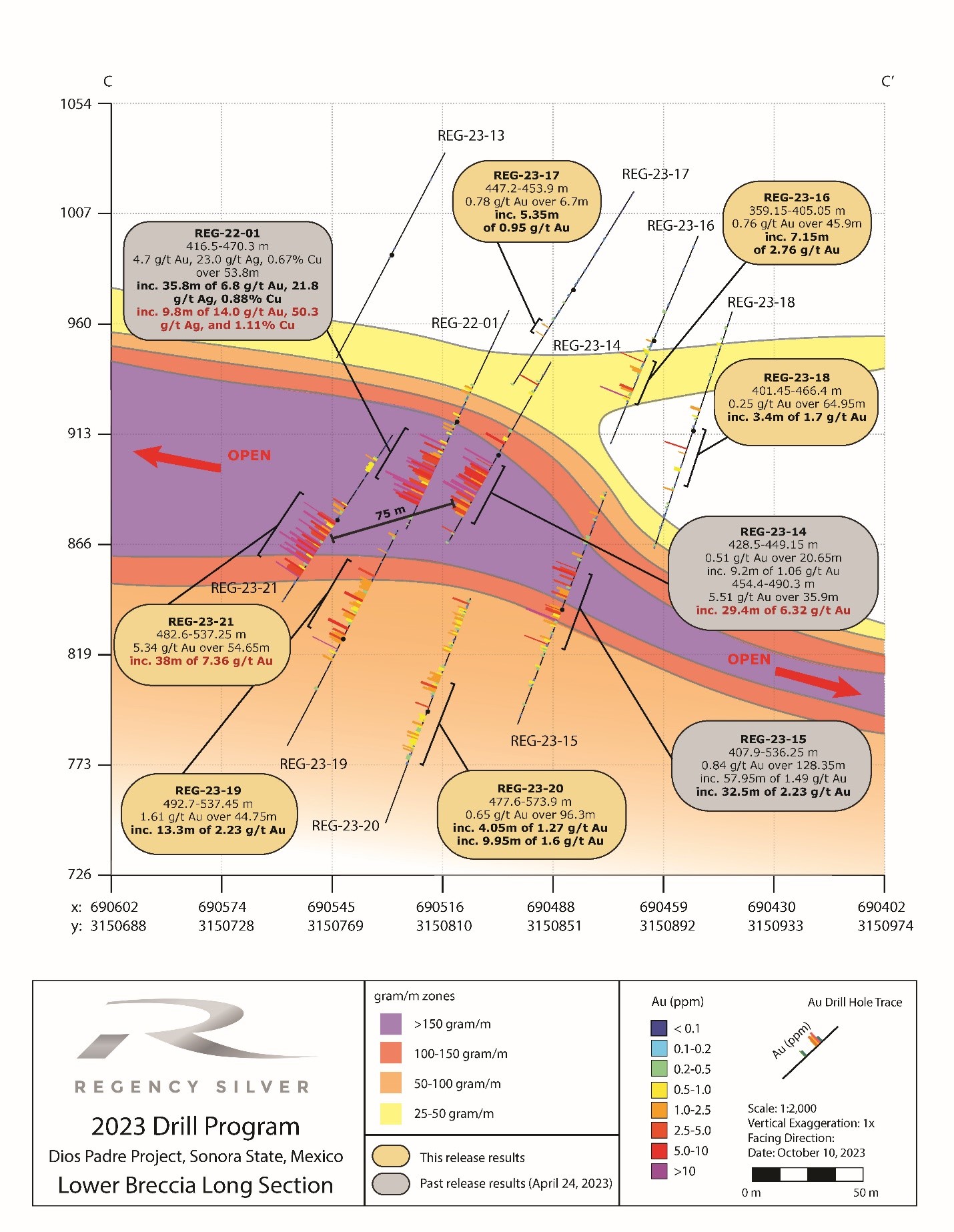

Figure 4: Long section for 2022 and 2023 drill holes. Contours are based on the grade x thickness values for the drill hole composites.

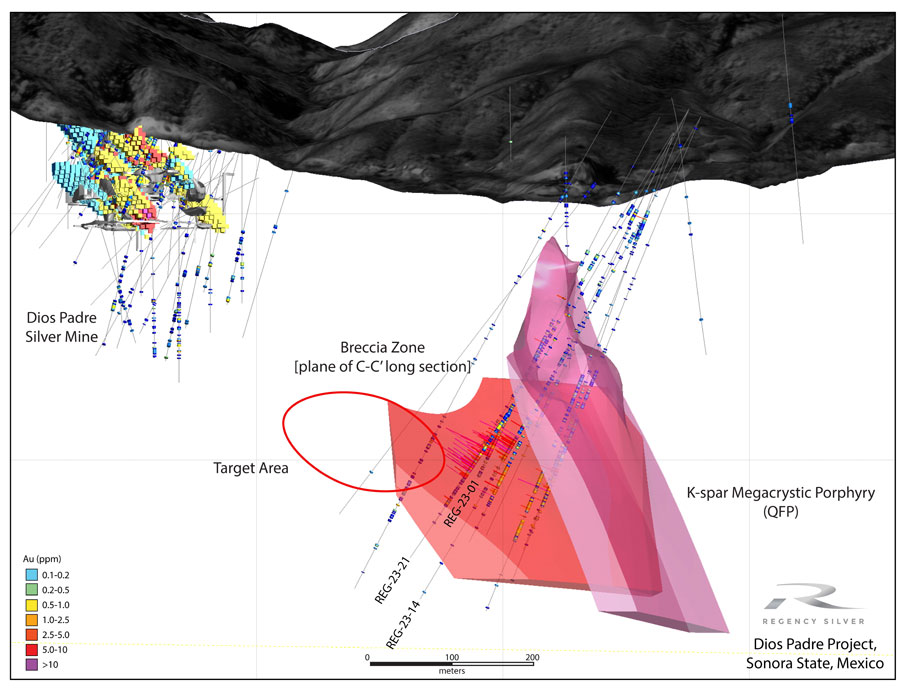

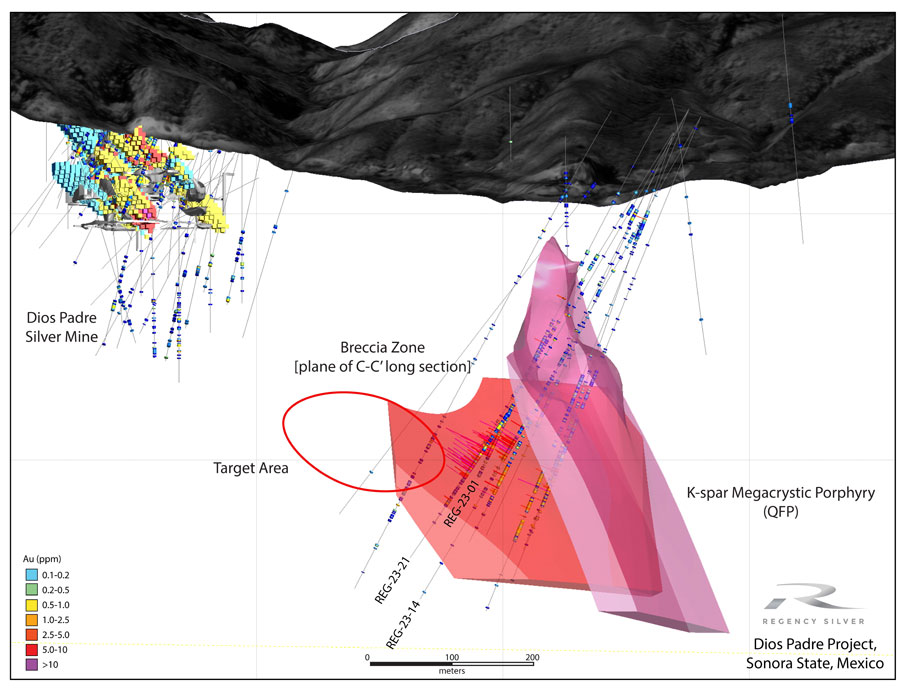

Figure 5: Three-dimensional image showing the orientation of the breccia zone, the intersecting drill holes, the QFP unit as well as the identified target area for immediate follow up.