GET TOP RATED STOCK ALERTS ACTIVE TRADERS DEPEND ON

SIGN UP TODAY FOR FREE NEWS DRIVEN ALERTS

Vancouver, BC – January 11, 2024 – American Pacific Mining Corp (CSE: USGD) (OTCQX: USGDF) (FWB: 1QC) (“American Pacific” or the “Company”) is pleased to report the third and final batch of assay results from the 2023 resource definition and geotechnical drill programs at the Palmer Project (“ Palmer ” or the “ Project ”). Palmer is an advanced-stage, high-grade volcanogenic massive sulphide-sulphate deposit (“ VMS ”) located in the Porcupine Mining District of the Haines Borough, Alaska, USA. Constantine North Inc., a subsidiary of American Pacific, is the operator for the Project and the ~US$20 million 2023 program was funded by joint venture (“ JV ”) partner Dowa Metals & Mining Co., Ltd (“ Dowa ”).

The final batch of 2023 assay results include the four (4) most significant copper (“Cu”) drill intersections (grade x thickness) reported to-date at Palmer , with significant zinc (“Zn”), gold (“Au”) and silver (“Ag”) results, as well as extending Cu-Zn mineralization beyond the current mineral resource estimate (“MRE”).

Highlights include :

- CMR23-172 Zone 1: 43.8 m grading 6.54% Cu, 3.15% Zn, 0.42 g/t Au and 27.97 g/t Ag (8.22% CuEq)

- CMR23-167 Zone 1: 37.1 m grading 4.57% Cu, 8.44% Zn, 0.50 g/t Au and 29.33 g/t Ag (8.40% CuEq)

- CMR23-169 Zone 1: 33.2 m grading 5.48% Cu, 7.22% Zn, 0.64 g/t Au and 36.78 g/t Ag (8.95% CuEq)

- CMR23-171 Zone 1: 23.9 m grading 9.03% Cu, 3.49% Zn, 0.83 g/t Au and 41.75 g/t Ag (11.15% CuEq)

- CMR23-168 Zone 1: 28.4 m grading 2.29% Cu, 4.01% Zn, 0.21 g/t Au and 26.61 g/t Ag (4.20% CuEq)

- CMR23-174 Zone 2-3: 39.8 m grading 1.11% Cu, 4.34% Zn, 0.45 g/t Au and 32.45 g/t Ag (3.31% CuEq) , including 17.8 m grading 1.05% Cu, 8.86% Zn, 0.94 g/t Au and 66.24 g/t Ag (5.54% CuEq)

Notes: Copper equivalents (“CuEq”) calculated using the same metal prices and recovery assumptions as the Company’s NI 43-101 Technical Report (JDS 2022). See Tables 1-3 for all new assay results and corresponding disclosure notes (metres = m).

“The final assay results from Palmer’s 2023 resource definition drilling have exceeded expectations with tremendous copper grades and aggregate metals values over significant widths,” commented Peter Mercer, Senior Vice President, Advanced Projects. “ Last year’s drilling has extended the mineralized envelope beyond the current MRE and our team is updating our 3D geological model. Preliminary interpretations have highlighted several priority target areas for follow-up drilling in 2024. In addition, the knowledge gained from this year’s drilling will provide valuable insights as we re-evaluate and rank the numerous VMS showings throughout the mineralized district.”

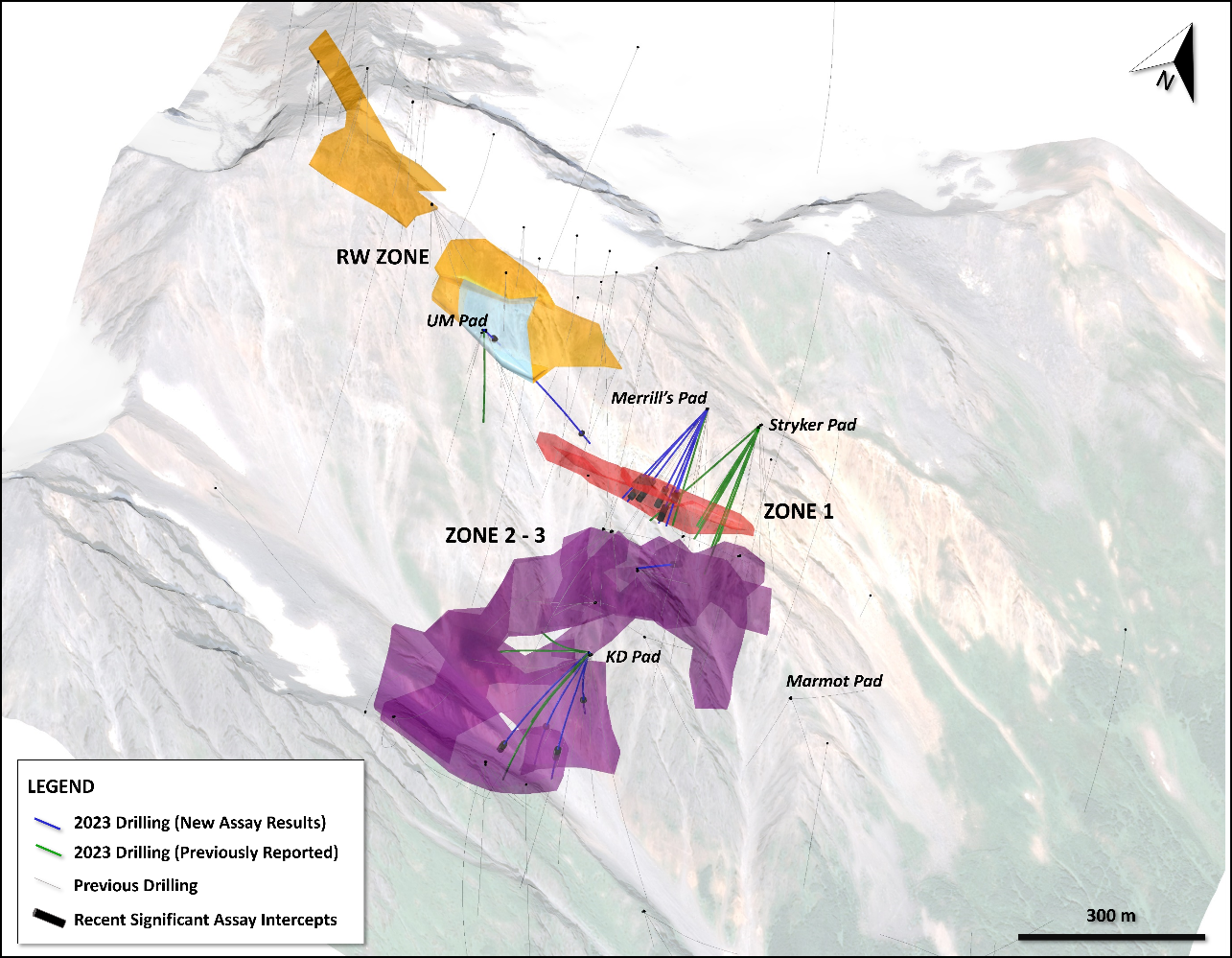

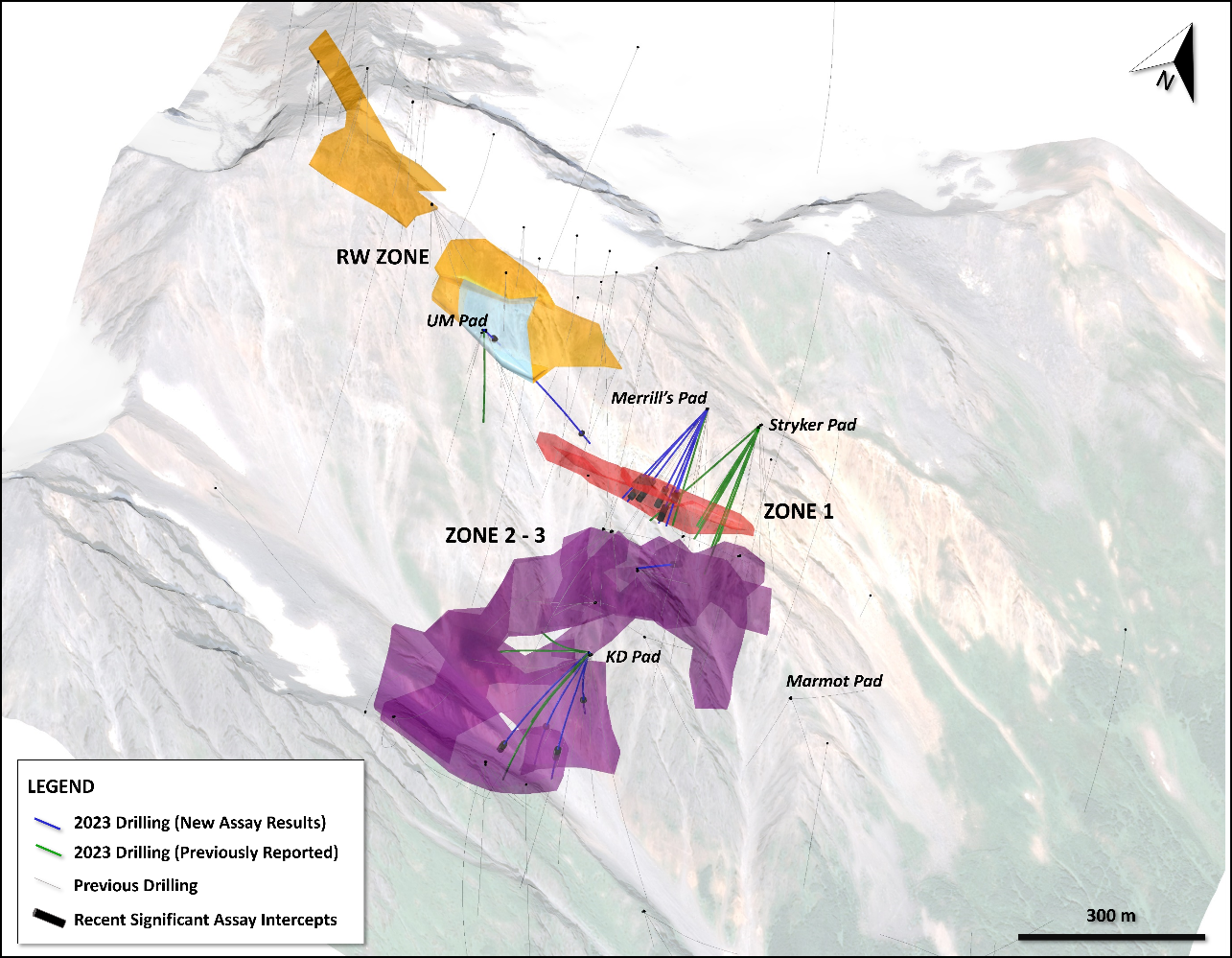

The 2023 diamond drill program successfully targeted high-priority areas in two unique mineralized lenses, Zone 1 and Zone 2-3, which together make up the South Wall Zone of the Palmer deposit (see Figure 1). The Company is incorporating all 2023 results into its 3D geological model to complete interpretation/analysis and target rank drill locations for the 2024 program.

The third and final batch of assay results reported in this release consists of 13 drillholes (seven at Zone 1, five at Zone 2-3, and one geotechnical drill hole at the RW Oxide Zone – see Figures 1-3 and Tables 1-3). See Company news releases dated October 18 and November 14, 2023, for previous 2023 assay results.

Key Takeaways from Latest Assay Results:

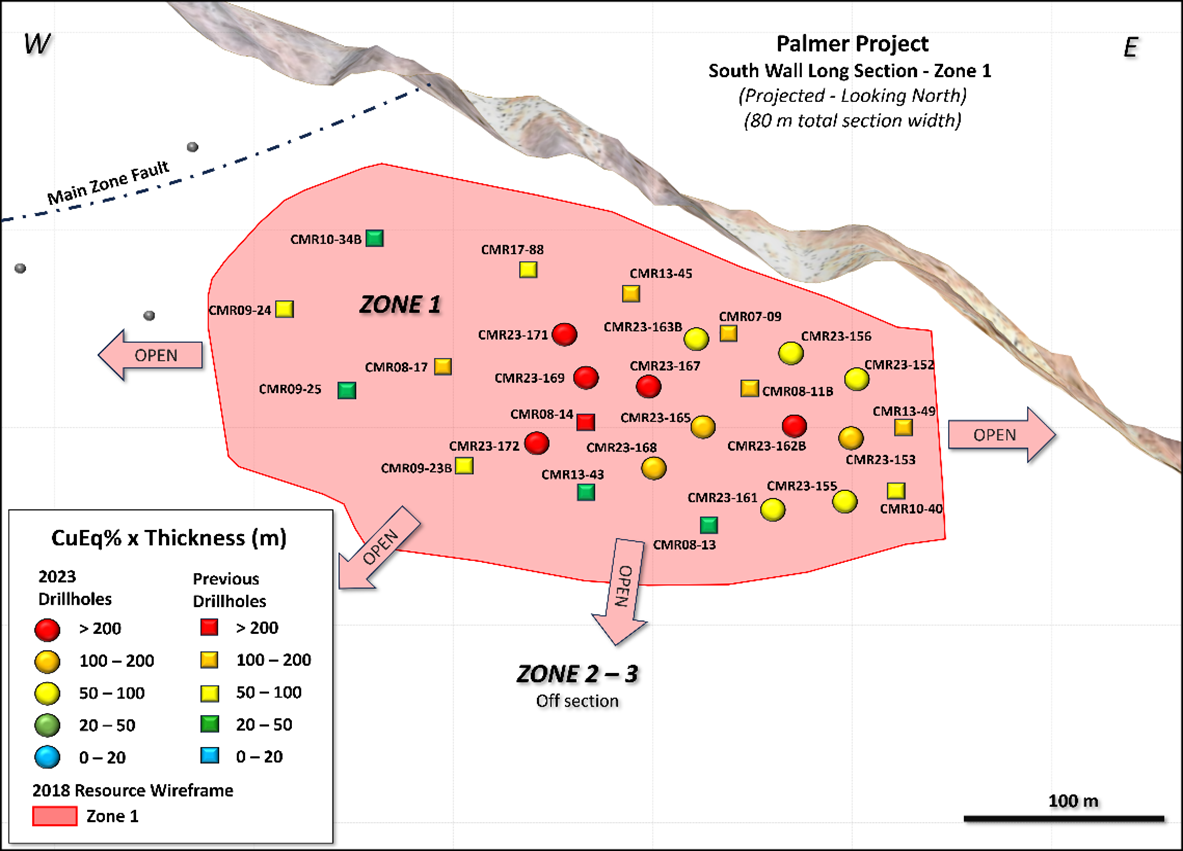

- High-grade copper mineralization with strong metal zoning demonstrated in the core of Zone 1 (see Figure 2 and 3 and Photo 1).

- Cu-Zn mineralization extends beyond the limits of the MRE in Zone 1 highlighting the potential for mineral resource expansion and the discovery of additional lenses downdip and along strike.

- Increased confidence in the current MRE and the 2023 infill drilling provides better methodology for assessing feasibility-level drill space requirements.

Figure 1: Oblique plan view highlighting South Wall Zone 1, South Wall Zone 2-3 and RW Zone

with 2023 drill traces (blue corresponding to newly reported assays).

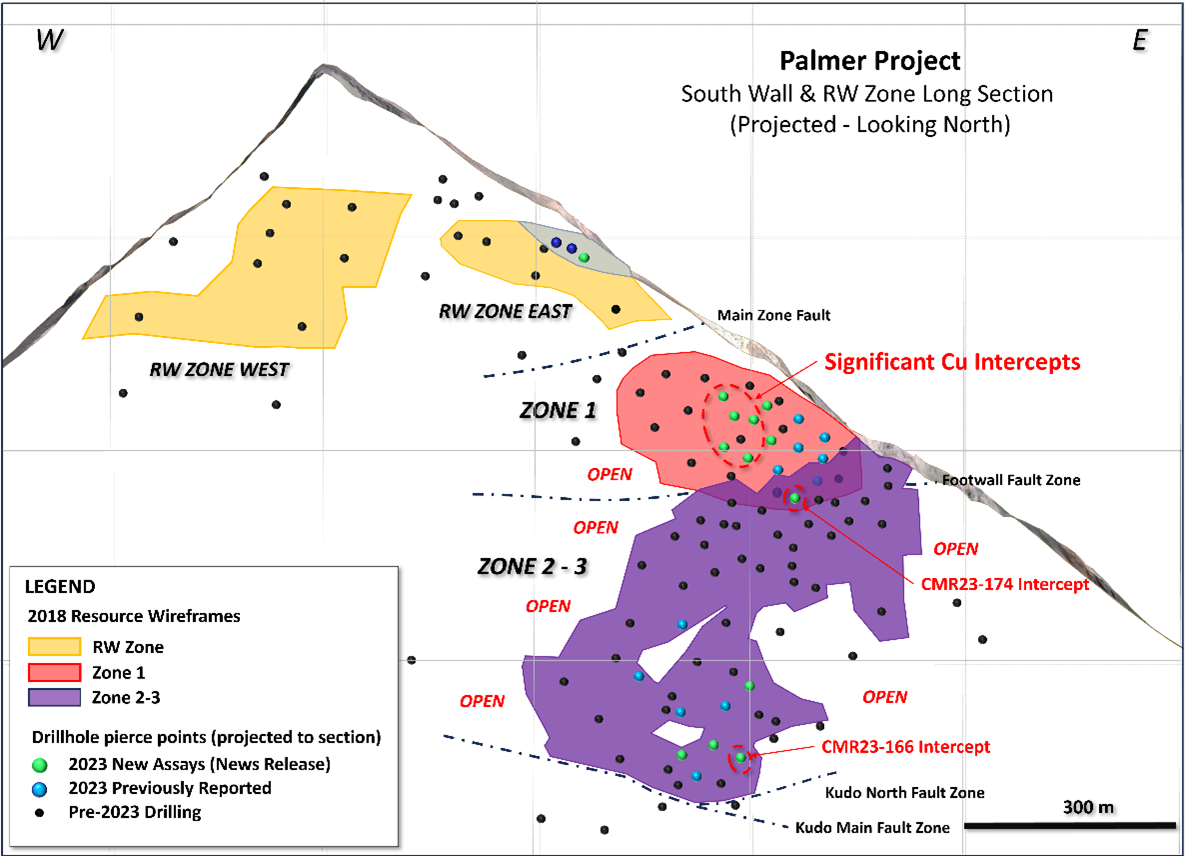

Figure 2: Longitudinal projection of South Wall and RW Zone (looking North) with drillhole pierce points.

Figure 3: Longitudinal projection of Zone 1 (looking north) with 2023 drillhole pierce points (circles) and previous drillhole pierce points (squares) showing Copper Equivalent grade thickness intersections. Note the four new copper-rich drill intersections (red circles) in the core of Zone 1.

Summary of Results and Initial Observations:

- Zone 1: Drill holes CMR23-167, CMR23-169 and CMR23-171/172 stand out for their exceptional copper grades and thicknesses and support an emerging copper-rich core to Zone 1 (see Figures 2 and 3 above).

- Zone 1 : CMR23-172 intersected 43.8 m of 6.54% Cu and 3.15% Zn, extending below the MRE wireframe in an area correlating to the emerging Cu-rich core and that remains open to the west and downdip.

- Zone 1: CMR23-168 (28.4 m of 2.29% Cu and 4.01% Zn) representing a priority step-out target for future drilling as there is limited drilling at >100 m spacing downdip.

- Zone 1: CMR23-161 intersected 18.4 m of 1.6% Cu and 14.7 m of 2.66% Cu and 2.93% Zn, with the bottom of the last intercept extending approximately 20.6 m below the limits of the Zone 1 MRE in an area that remains open to the NE and downdip.

- Zone 2-3: Two distinct sphalerite-chalcopyrite-pyrrhotite-barite massive sulphide horizons have been identified in the drill core. Zone 2-3 remains open for expansion along strike and within the current resource model. The Zone 2-3 mineralization is cut off by the Kudo fault at depth; the interpreted fault offset of the mineralization remains a compelling exploration target.

- RW Oxide Zone: Geotechnical drill hole GT23-025 intersected 1.88% lead, 0.94 g/t Au and 137.4 g/t Ag over 8.1 m. The RW Oxide Zone has limited drilling and is not included in the current MRE. GT23-25 also bottomed in copper mineralization (0.9 m of 2.27% Cu) in an area with limited drilling. This mineralization represents a proximal exploration target for future drill campaigns.

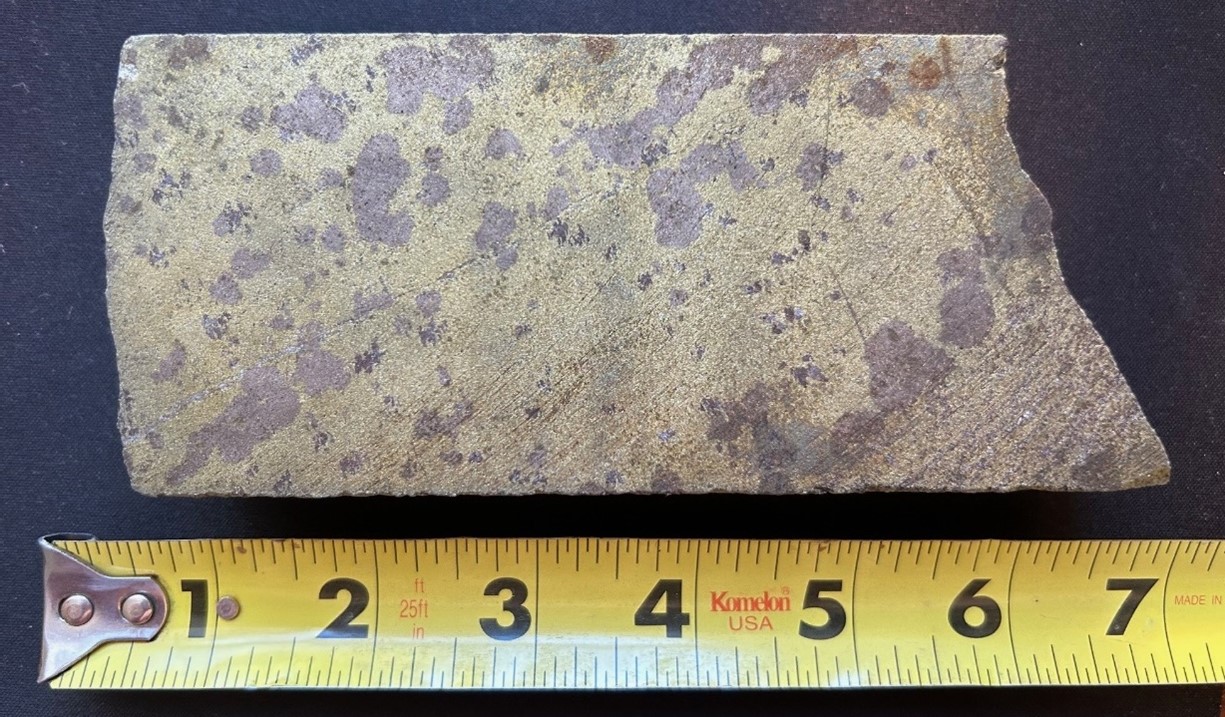

Photo 1: Piece of CMR23-171 split drill core pictured from 15.4 m interval starting from 160.6 m that returned 9.12% Cu, 5.21% Zn, 0.87 g/t Au and 41.93 g/t Ag (11.94% CuEq).

Table 1. Significant Assay Results – South Wall Zone 1

| Zone 1 | From (m) |

To (m) |

Interval (m) |

Cu % |

Zn % |

Pb % |

Au g/t |

Ag g/t |

BaSO 4 % |

CuEQ % |

ZnEQ % |

| CMR23-163 | 154.8 | 158.5 | 3.7 | 1.33 | 18.46 | 0.45 | 0.44 | 50.95 | 32.26 | 9.29 | 23.33 |

| CMR23-163B | 150.9 | 168.2 | 17.3 | 0.49 | 9.40 | 0.15 | 0.32 | 27.18 | 40.02 | 4.60 | 11.56 |

| includes | 150.9 | 158.5 | 7.6 | 0.82 | 14.78 | 0.10 | 0.33 | 25.36 | 49.23 | 7.06 | 17.74 |

| includes | 163.3 | 168.2 | 4.9 | 0.47 | 10.25 | 0.37 | 0.62 | 56.61 | 64.96 | 5.29 | 13.29 |

| CMR23-167 | 161.0 | 198.1 | 37.1 | 4.57 | 8.44 | 0.11 | 0.50 | 29.33 | 8.57 | 8.40 | 21.10 |

| includes | 161.0 | 189.0 | 28.0 | 5.84 | 9.70 | 0.13 | 0.65 | 36.20 | 11.35 | 10.30 | 25.86 |

| includes | 189.0 | 198.1 | 9.1 | 0.66 | 4.58 | 0.04 | 0.05 | 8.21 | 0.00 | 2.57 | 6.45 |

| CMR23-168 | 208.3 | 236.7 | 28.4 | 2.29 | 4.01 | 0.08 | 0.21 | 26.61 | 12.71 | 4.20 | 10.54 |

| includes | 208.3 | 220.2 | 11.9 | 3.31 | 1.08 | 0.01 | 0.22 | 21.57 | 1.57 | 4.02 | 10.08 |

| includes | 220.2 | 236.7 | 16.5 | 1.56 | 6.13 | 0.12 | 0.20 | 30.24 | 20.75 | 4.33 | 10.88 |

| CMR23-169 | 159.4 | 192.6 | 33.2 | 5.48 | 7.22 | 0.13 | 0.64 | 36.78 | 14.77 | 8.95 | 22.47 |

| includes | 159.4 | 168.1 | 8.7 | 1.36 | 12.27 | 0.06 | 0.15 | 12.03 | 22.52 | 6.41 | 16.10 |

| includes | 168.1 | 186.4 | 18.3 | 8.98 | 1.80 | 0.02 | 0.83 | 37.22 | 1.70 | 10.38 | 26.05 |

| includes | 186.4 | 192.6 | 6.2 | 0.94 | 16.41 | 0.55 | 0.78 | 70.21 | 42.46 | 8.29 | 20.81 |

| and | 192.6 | 204.2 | 11.6 | 0.40 | 9.72 | 0.04 | 0.10 | 10.36 | 3.76 | 4.40 | 11.04 |

| includes | 198.9 | 204.2 | 5.3 | 0.38 | 16.03 | 0.03 | 0.06 | 8.01 | 3.60 | 6.86 | 17.22 |

| CMR23-171 | 160.6 | 184.5 | 23.9 | 9.03 | 3.49 | 0.01 | 0.83 | 41.75 | 1.94 | 11.15 | 27.98 |

| includes | 160.6 | 176.0 | 15.4 | 9.12 | 5.21 | 0.01 | 0.87 | 41.93 | 2.91 | 11.94 | 29.97 |

| includes | 176.0 | 184.5 | 8.5 | 8.87 | 0.38 | 0.01 | 0.77 | 41.42 | 0.19 | 9.71 | 24.38 |

| CMR23-172 | 169.6 | 213.4 | 43.8 | 6.54 | 3.15 | 0.01 | 0.42 | 27.97 | 3.72 | 8.22 | 20.63 |

| includes | 175.2 | 181.7 | 6.5 | 6.70 | 5.89 | 0.01 | 0.36 | 32.37 | 0.00 | 9.47 | 23.77 |

| includes | 184.6 | 194.0 | 9.4 | 12.61 | 0.78 | 0.00 | 0.66 | 44.39 | 0.00 | 13.58 | 34.10 |

| includes | 194.0 | 213.4 | 19.4 | 5.73 | 2.18 | 0.01 | 0.46 | 25.53 | 8.40 | 7.01 | 17.61 |

| and | 216.4 | 219.5 | 3.1 | 0.23 | 6.29 | 2.12 | 0.58 | 109.97 | 75.24 | 3.87 | 9.72 |

CMR23-163 abandoned (lost hole) at top of Zone 1; Reported drill intercepts are downhole core lengths with true thickness estimated to be approximately 65-85% of downhole core length.

Copper and Zinc Equivalent Notes:

1. ZnEQ = (Cu/100*2204.6*$lbCu*CuREC) + (Zn/100*2204.6*$lbZn*ZnREC) + (Au/31.1035*$ozAu*AuREC) + (Ag/31.1035*$ozAg*AgREC) / (2204.6/100*$lbZn*ZnREC)

2. CuEQ = (Cu/100*2204.6*$lbCu*CuREC) + (Zn/100*2204.6*$lbZn*ZnREC) + (Au/31.1035*$ozAu*AuREC) + (Ag/31.1035*$ozAg*AgREC) / (2204.6/100*$lbCu*CuREC)

3. Lead and Barite are not included in the CuEq and ZnEq values.

4. Assumed metal prices are US$1.15/lb for zinc (Zn), US$3.00/lb for copper (Cu), US$1250/oz for gold (Au), US$16/oz for silver (Ag) (JDS 2022).

5. Estimated metal recoveries (REC) are 93.1% for zinc, 89.6% for copper, 90.9% for silver and 69.6% for gold as determined from metallurgical locked cycle flotation tests completed in 2018 (JDS 2022).

Table 2. Significant Assay Results – South Wall Zone 2-3

| Zone 2-3 | From | To | Interval | Cu | Zn | Pb | Au | Ag | BaSO 4 | CuEQ | ZnEQ |

| (m) | (m) | (m) | % | % | % | g/t | g/t | % | % | % | |

| CMR23-164 | 417.7 | 421.0 | 3.3 | 1.79 | 3.32 | 0.05 | 0.47 | 44.62 | 8.15 | 3.69 | 9.26 |

| CMR23-166 | 401.1 | 435.9 | 29.5 | 0.07 | 4.09 | 0.10 | 0.05 | 11.41 | 6.92 | 1.82 | 4.56 |

| includes | 410.0 | 425.0 | 15.0 | 0.07 | 5.77 | 0.04 | 0.06 | 12.63 | 6.97 | 2.49 | 6.26 |

| includes | 410.7 | 419.0 | 8.3 | 0.06 | 6.93 | 0.04 | 0.03 | 7.63 | 4.78 | 2.90 | 7.27 |

| CMR23-170 | 483.0 | 485.1 | 2.1 | 0.14 | 2.23 | 1.06 | 0.54 | 107.95 | 0.00 | 2.14 | 5.36 |

| and | 490.6 | 495.9 | 5.3 | 0.24 | 4.72 | 0.43 | 0.17 | 46.20 | 0.00 | 2.57 | 6.45 |

| and | 500.9 | 509.6 | 8.7 | 0.79 | 6.46 | 0.16 | 0.27 | 37.24 | 26.04 | 3.79 | 9.51 |

| includes | 502.9 | 509.6 | 6.7 | 1.01 | 7.88 | 0.19 | 0.31 | 42.47 | 33.82 | 4.63 | 11.62 |

| CMR23-174 | 187.7 | 227.5 | 39.8 | 1.11 | 4.34 | 0.18 | 0.45 | 32.45 | 17.58 | 3.31 | 8.30 |

| includes | 187.7 | 204.9 | 17.2 | 1.05 | 8.86 | 0.39 | 0.94 | 66.24 | 39.13 | 5.54 | 13.91 |

| includes | 188.8 | 196.0 | 7.2 | 0.18 | 8.40 | 0.28 | 0.49 | 81.06 | 50.20 | 4.40 | 11.04 |

| includes | 197.1 | 204.0 | 6.9 | 1.30 | 12.86 | 0.68 | 1.75 | 67.19 | 43.97 | 7.78 | 19.53 |

| includes | 204.9 | 227.5 | 22.6 | 1.15 | 0.90 | 0.01 | 0.09 | 6.73 | 1.17 | 1.60 | 4.03 |

| CMR23-175 | 362.2 | 364.0 | 1.8 | 0.03 | 5.17 | 0.09 | 0.15 | 27.43 | 43.40 | 2.38 | 5.97 |

Drill Intercepts are downhole core lengths. True thickness estimated to be approximately 65-95% of downhole core length.

Table 3. Significant Assay Results – RW Zone

| RW Zone | From (m) |

To (m) |

Interval (m) |

Cu % |

Zn % |

Pb % |

Au g/t |

Ag g/t |

BaSO 4 % |

CuEQ % |

ZnEQ % |

| GT23-025 | 30.5 | 38.6 | 8.1 | 0.06 | 0.04 | 1.88 | 0.94 | 137.42 | 76.35 | 1.60 | 4.02 |

| includes | 33.5 | 38.6 | 5.1 | 0.08 | 0.04 | 2.85 | 1.06 | 162.08 | 76.35 | 1.87 | 4.70 |

| and | 359.9 | 360.8 | 0.9 | 2.27 | 0.04 | 0.00 | 0.21 | 7.40 | 0.00 | 2.44 | 6.14 |

Drill Intercepts are downhole core lengths. True thickness is estimated to be near core length.

Quality Assurance (QA) and Quality Control (QC)

There are strict Quality Assurance and Quality Control (QA/QC) protocols at Palmer covering the planning and placing of drill holes in the field; drilling and retrieving drill core; drill hole surveying; core transport to the Palmer Camp; core logging, sampling and bagging of core for analysis; transport of core from site to ALS Laboratory in North Vancouver, BC for sample preparation and analysis; recording and final statistical vetting of results.

Sampling Procedures – The Company’s QA/QC drill core sample protocol consists of collection of samples over a minimum 0.3 m interval to a maximum 1.5 m interval (depending on the lithology and style of mineralization) over the mineralized portions of the drillhole. The drill core sample is cut in half with a diamond saw, with half of the core placed in individual sealed polyurethane bags and the remaining half securely retained in the original core box for permanent storage. Drill core samples are shipped by transport truck in sealed woven plastic bags to ALS Geochemistry Analytical Lab facility in North Vancouver, BC for sample preparation and analysis. ALS Geochemistry meets all requirements of International Standards ISO/IEC 17025:2017 and ISO 9001:2015. ALS Global operates according to the guidelines set out in ISO/IEC Guide 25.

Gold was determined by fire-assay fusion of a 30 g sub-sample with atomic absorption spectroscopy (AAS). Various metals including silver, gold, copper, lead and zinc were analyzed by inductively-coupled plasma (ICP) atomic emission spectroscopy, following multi-acid digestion. The elements copper, lead and zinc are determined by ore grade assay for samples that return values >10,000 ppm by ICP analysis. Silver is determined by ore-grade assay for samples that return >100 ppm by ICP analysis. Barium (BaO) analysis utilized lithium borate fusion into fused discs for XRF analyses, with BaO converted to BaSO4 (barite) using a conversion factor of BaO x 1.52217. Density measurements were determined at the project site by Constantine personnel on cut core for each assay sample.

The Company maintains a robust QA/QC program that includes the collection and analysis of duplicate samples and the insertion of blanks and standards (certified reference material). In addition, prepared samples, sample replicates, duplicates and internal reference materials are routinely used as part of ALS Geochemistry’s internal quality assurance program.

Qualified Person Statement

The technical information in this news release regarding the Palmer Project has been reviewed and approved by Michael Vande Guchte, P.Geo., VP Exploration for the Palmer Project and a Qualified Person (QP) as defined by National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About American Pacific Mining Corp.

American Pacific Mining Corp. is a precious and base metals explorer and developer focused on opportunities in the Western United States. The Company has two flagship assets: the Palmer Project, a Volcanic Massive Sulphide-Sulphate (VMS) project in Alaska, under joint-venture partnership with Dowa Metals & Mining, owner of Japan’s largest zinc smelter; and the Madison Project, a past-producing copper-gold project in Montana partnered with Kennecott Exploration, a division of the Rio Tinto Group. For the Madison transaction, American Pacific was selected as a finalist in both 2021 and 2022 for ‘Deal of the Year’ at the S&P Global Platts Global Metals Awards, an annual program that recognizes exemplary accomplishments in 16 performance categories. Also, in American Pacific’s asset portfolio are three high-grade, precious metals projects located in key mining districts of Nevada, USA: the Ziggerat Gold project, partnered with Centerra Gold; the Gooseberry Silver-Gold project; and the Tuscarora Gold-Silver project. The Company’s mission is to grow by the drill bit and by acquisition.

On Behalf of the Board of American Pacific Mining Corp.

“Warwick Smith”

CEO & Director

Corporate Office: Suite 910 – 510 Burrard Street Vancouver, BC, V6C 3A8 Canada

Investor Relations Contact:

Kristina Pillon, High Tide Consulting Corp.,

604.908.1695 / Kristina@americanpacific.ca

Media Relations Contact:

Adam Bello, Primoris Group Inc.,

416.489.0092 / media@primorisgroup.com

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

JDS (2022 ): 2022 Amended NI 43-101 Technical Report for the Palmer Project prepared by JDS Energy & Mining Inc for Constantine Metal Resources Ltd. The Technical Report is available on the Company’s issuer profile on SEDAR at www.sedar.com

Source: American Pacific Mining Corp.

Vancouver, BC – December 20, 2023 – American Pacific Mining Corp (CSE: USGD) (OTCQX: USGDF) (FWB: 1QC) (“American Pacific” or the “Company”) is pleased to announce that it has received the permits necessary to commence drilling at the Madison Copper-Gold Project (“ Madison ” or the “ Project ”) in Montana, USA.

The five-hole diamond drill campaign, which is expected to commence in Q1, 2024, is designed to further define and expand on known near-surface, high-grade copper and gold mineralization, while extending beneath known mineralization to provide a foundation for deeper exploration in areas which have seen limited historical drilling.

The programs sets out to achieve three key objectives: test shallow gap areas; tighten drill spacing at moderate depth within the skarn to support a future mineral resource estimate; and extend below known mineralization to provide valuable information for deeper exploration in subsequent campaigns.

Previous drilling in this area returned drill intersections of 14.44 grams per tonne (“g/t”) gold (“Au”) over 6.53 metres (“m”) (see news release dated January 22, 2022) and 6.97% copper (“Cu”) over 61.63 m 1 . This program is, in part, a follow-up to the work done during previous partner-funded campaigns.

“The Madison Project has always been of keen interest to our team, given its historical high-grades and still limited exploration,” commented CEO Warwick Smith. “Madison has been shown to carry significant grades, particularly in the skarn and we look forward to extending skarn mineralization, as we prepare to conduct more comprehensive exploration into the porphyry-style mineralization beneath.”

Qualified Persons

Technical aspects of this press release have been reviewed and approved by Eric Saderholm, P.Geo., the designated Qualified Persons (QP) under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

About American Pacific Mining Corp.

American Pacific Mining Corp. is a precious and base metals explorer and developer focused on opportunities in the Western United States. The Company has two flagship assets: the Palmer Project, a Volcanic Massive Sulfide (VMS) project in Alaska, under joint-venture partnership with Dowa Metals & Mining, owner of Japan’s largest zinc smelter; and the Madison Project, a past-producing copper-gold project in Montana partnered with Kennecott Exploration Company, a division of the Rio Tinto Group. For the Madison transaction, American Pacific was selected as a finalist in both 2021 and 2022 for ‘Deal of the Year’ at the S&P Global Platts Global Metals Awards, an annual program that recognizes exemplary accomplishments in 16 performance categories. Also, in American Pacific’s asset portfolio are high-grade, precious metals projects located in key mining districts of Nevada, USA: the Ziggurat Gold project, partnered with Centerra Gold; and the Tuscarora Gold-Silver project. The Company’s mission is to grow by the drill bit and by acquisition.

On Behalf of the Board of American Pacific Mining Corp.

“Warwick Smith”

CEO & Director

Corporate Office: Suite 910 – 510 Burrard Street Vancouver, BC, V6C 3A8 Canada

Investor Relations Contact:

Kristina Pillon, High Tide Consulting Corp.,

604.908.1695 / Kristina@americanpacific.ca

Media Relations Contact:

Adam Bello, Primoris Group Inc.,

416.489.0092 / media@primorisgroup.com

Notes:

Quality Assurance and Procedures of Madison Drilling Data

Both Broadway and Rio Tinto employed ALS Global during their drilling programs, an ISO 9001:2008 certified Assay Laboratory. Analysis and assay quality were deemed sufficient by the company geologists. Use of blanks, checks and standards ensured that all QA/QC measures were in place during these programs as assurance of lab accuracy and no issues were detected during the respective programs. Exact procedures are documented in the updated Madison 43-101 found on the APM website. Both companies used the same assay codes and procedures:

ME-MS61L (Super trace lowest DL 4 acid by ICP-MS)

Au-ICP21 (Au 30g fire assay with ICP-AES finish)

ME-OG62 for elements above detection limit (Cu-OG62 for Cu>7000 ppm)

The CSE has neither approved nor disapproved the contents of this news release. Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Source: American Pacific Mining Corp.

Sign Up for FREE

Stock Alerts from

to be the first to know when this emerging company issues Breaking News!

THREE WORLD-CLASS PARTNERS ON WESTERN US PROJECTS

American Pacific Mining Corp. is a precious and base metals explorer with a core focus on opportunities in the Western United States. American Pacific was recently selected as a ‘Deal of the Year’ finalist for its Madison transaction and nominated for the ‘Rising Star Company Award’ in the S&P Global Platts Metals Awards, an annual program that recognizes exemplary accomplishments in 17 performance categories.

PROJECTS:

Palmer VMS Project Project Overview

Advancing a high-grade copper-zinc resource to feasibility with PEA Completed in June 2019

* 2019 PEA post-tax NPV@7% US$266M (US$505M) August 2022 spot prices)

* ~C$30M transaction vs ~C$230M attributable NPV

Defining a multi-deposit district with exceptional exploration upside

Total project expenditures of ~US$78 million through to end of 2022

JV partnership with Dowa Metals & Mining Alaska Ltd and a 5 year plan to feasibility

* An anticipated exploration and development budget of US $25.5M+ for 2023

Defining high-grade, low-capex type targets within a multi-deposit, district-scale environment

The Palmer VMS Project is an advanced stage Cu-Zn-Au-Ag exploration project in Southeast Alaska with road access and located only 60 km (37 miles) from the deep sea port at Haines, Alaska.

The project hosts two NI 43-101 compliant resources, the Palmer Deposit and AG Zone Deposit, with a total consolidated mineral resource of 4.68 million tonnes of 10.2% zinc equivalent in the indicated category and 9.59 million tonnes of 8.9% zinc equivalent in the inferred category.

A Preliminary Economic Assessment (“PEA”) was completed in June 2019 (filed July 18, 2019, amended March 7, 2022; filed on www.sedar.com), which presents a low capex, low operating cost, high margin underground mining operation with attractive environmental attributes.

The Palmer project includes numerous drill-ready high-grade prospects that define more than 15 kilometers of favorable mineral trends, all hallmarks of a significant massive sulphide system and opportunity for the discovery of multiple deposits.

Madison Mine Project Overview

USGD acquired the permitted Madison Copper Gold Mine from Madison Metals June 2020

Rio Tinto may earn 70% by spending US$30M with USGD free carried

Past production 2008 – 2012 of 2.7M lbs of copper with grades ranging from ~20% to over 35% copper and 7,570 ounces of gold at 16.1 g/t

Analogous to and just 48 km from the Butte mine, which churned out 21 billion lb. copper, 715 million oz. silver, 2.9 million oz. gold

Copper-Gold in Montana, USA –

American Pacific’s Madison Mine is a high-grade, past-producing Madison Copper-Gold project in Montana, under option to joint venture with Kennecott Exploration Company, a division of the Rio Tinto Group, which the Company acquired in 2020.

For this transaction, American Pacific was selected as a finalist in the ‘Deal of the Year’ category in both 2021 and 2022 at the S&P Global Platts Global Metals Awards, an annual program that recognizes exemplary accomplishments in 16 performance categories.

Ziggurat Project Project Overview

USGD acquired the Ziggurat Project via the acquisition of Clearview Gold in May 2023

Located at the northern end of Round Mountain Trend – an active mining region in Nevada with several multi-million-ounce gold projects

Excellent infrastructure with year-round, cost-effective exploration

USD $1.3M budget funded by Centerra for 2023

100% owned and under a JV option agreement with Centerra Gold Inc.

An active district being developed and explored by Majors

* 20 km from Kinross’ Round Mountain Mine (>15 Moz Au produced) Adjacent to Newmont’s Northumberland Mine (3.5 Moz Au, 11 Moz Ag production + M&I)

Gooseberry Mine Project Overview

High-grade, low sulphidation, epithermal vein system encompassing the historical Gooseberry silver-gold mine which operated between 1900 and 1990

Assay results pending from ongoing up to 17,000 metre drill program

2021 drilling identified multiple additional veins where only one was previously known to exist

Similar geology and just 15 miles from 8.6M oz gold and 270M oz silver Comstock Lode

Tuscarora District Project Overview

The Tuscarora volcanic field is the largest example of Eocene age magmatism in Nevada

The field formed between 39.9 and 39.3 Ma, which corresponds to the 40-37 Ma age of gold mineralization in the Carlin Trend

This represents the strongest period of gold mineralization known in the Basin and Range Province

Production from quartz veins and stockwork

* >500,000 oz Gold (Au)

* 7.5 million oz Silver (Ag)

Red Hill Project Project Overview

80 claims covering 1,500 acres 24 km SE of the 12M oz Cortez Hills gold deposit within the prolific Cortez trend in Eureka County, Nevada

Previous drilling by Barrick returned high-grade results, including:

* 24.4m of 4.99 g/t Au, including 13.7m of 8.11 g/t Au confirming sediment-hosted gold system is present

Property not adequately tested for deep potential given Barrick’s nearby multi-million ounce Goldrush discovery 12 km northwest of Red Hill along the Cortez trend

Property acquired for an initial $25,000 payment with subsequent payments spread over 10 years and annual claim maintenance fees of $13,244

Disclaimer

FN Media Group LLC (FNMG) owns and operates FinancialNewsMedia.com (FNM) which is a third party publisher that disseminates electronic information through multiple online media channels. FNMG’s intended purposes are to deliver market updates and news alerts issued from private and publicly trading companies as well as providing coverage and increased awareness for companies that issue press to the public via online newswires. FNMG and its affiliated companies are a news dissemination and financial marketing solutions provider and are NOT a registered broker/dealer/analyst/adviser, holds no investment licenses and may NOT sell, offer to sell or offer to buy any security. FNMG’s market updates, news alerts and corporate profiles are NOT a solicitation or recommendation to buy, sell or hold securities. The material in this release is intended to be strictly informational and is NEVER to be construed or interpreted as research material. All readers are strongly urged to perform research and due diligence on their own and consult a licensed financial professional before considering any level of investing in stocks. The companies that are discussed in this release may or may not have approved the statements made in this release. Information in this release is derived from a variety of sources that may or may not include the referenced company’s publicly disseminated information. The accuracy or completeness of the information is not warranted and is only as reliable as the sources from which it was obtained. While this information is believed to be reliable, such reliability cannot be guaranteed. FNMG disclaims any and all liability as to the completeness or accuracy of the information contained and any omissions of material fact in this release. This release may contain technical inaccuracies or typographical errors. It is strongly recommended that any purchase or sale decision be discussed with a financial adviser, or a broker-dealer, or a member of any financial regulatory bodies. Investment in the securities of the companies discussed in this release is highly speculative and carries a high degree of risk. FNMG is not liable for any investment decisions by its readers or subscribers. Investors are cautioned that they may lose all or a portion of their investment when investing in stocks. This release is not without bias, and is considered a conflict of interest if compensation has been received by FNMG for its dissemination. To comply with Section 17(b) of the Securities Act of 1933, FNMG shall always disclose any compensation it has received, or expects to receive in the future, for the dissemination of the information found herein on behalf of one or more of the companies mentioned in this release. For current services performed FNMG has been compensated forty five hundred dollars for American Pacific Mining Corp. current news coverage by a non-affiliated third party. FNMG HOLDS NO SHARES OF American Pacific Mining Corp.

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. “Forward-looking statements” describe future expectations, plans, results, or strategies and are generally preceded by words such as “may”, “future”, “plan” or “planned”, “will” or “should”, “expected,” “anticipates”, “draft”, “eventually” or “projected”. You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company’s annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and FNMG undertakes no obligation to update such statements.